What is a Peak Debt Facility?

Jargon-free advice on peak debt facility, also known as a revolving loan. Find out what it is, how it works, how it differs from a development loan...

We explain how bridging loans work, when to use them and how to apply. Read our market insights, need-to-know tips and pros & cons of different lenders.

How Bridging Loans Work

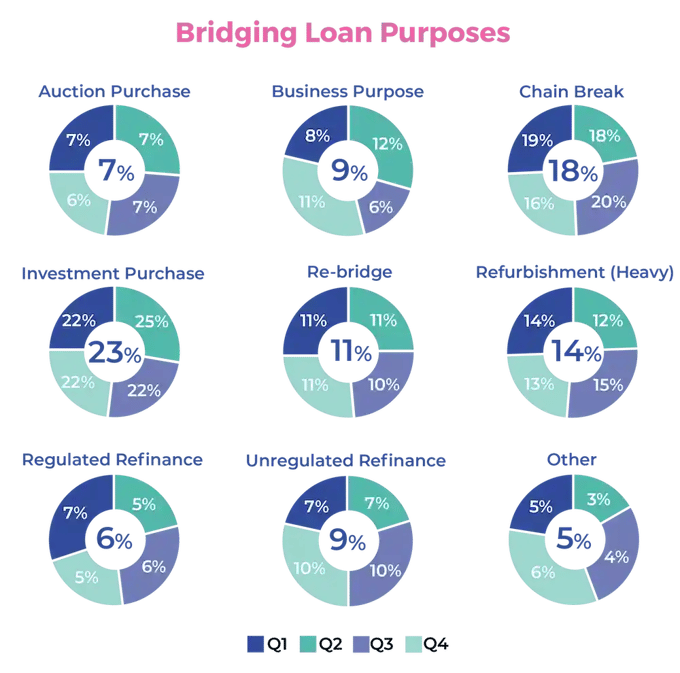

As the name suggests, Bridging Loans are designed to bridge the gap between buying and selling, when the scenario isn’t fundable through more traditional finance methods. In the past, they were typically considered a last resort, secured if people were let down by an alternative source or had no alternative option. Now, Bridging Loans are used by successful property entrepreneurs as a powerful tool to facilitate both simple and complex transactions, quickly.

Amongst other benefits, they can allow a property purchase to go ahead before selling an existing one, buy an uninhabitable place in need of refurbishment, or facilitate a quick move when speed is a priority. Interest rates are higher than traditional mortgage options but cheaper than they used to be, and the potential upsides for the borrower can significantly outweigh the increased costs of funding.

Market Overview

Since the financial crash, the bridging market has grown at an explosive rate, with more than 100 lenders now competing for their share, contributing to a huge increase in popularity among property investors. In 2012, UK bridging completions stood at £885m, and in 2019, totalled more than £4bn, representing 352% growth in just seven years.

Whilst the benefit to the borrower of market growth is more choice, the fragmented nature of the market and lack of true comparison technology makes it more difficult to secure the best possible deal. Pricing and leverage are normally key drivers for borrowers, but it is also also important to understand how a lender is funded, as delays and reversed approvals are costly. Unbeknownst to many borrowers they could still be borrowing from a mainstream bank. Some of the bigger, well-known household names provide wholesale funding lines to the smaller boutique lenders, which means they underwrite the loan a second time (after the bridging lender has completed its initial underwrite).

It’s an important nuance to understand as problems can arise with changed pricing, reduced leverage or declined applications when the borrower is already a long way along through the process.

The difference is, the better bridging lenders will still have enough of their own money to execute on deals where the funding line is not available, or have multiple funding lines where risk appetite is diversified. The thin equity bridging lenders are essentially mainstream lenders under a different guise and will provide little deviation from their High Street sponsor’s standard criteria.

To fully understand the bridging market, you need to drill down to the lenders and how they are individually funded. Each lender has their pros and cons, so the key is having an in-depth understanding of the market, and the know-how to select the best lender for each individual scenario.

Types of Bridging Loan Lenders

Mainstream lenders & private banks

Specialist lenders / funds

Challenger banks

Individuals/family offices (not funded by wholesale)

Four Key Bridging Loans and Ways to Use Them

1. Development Entry (Planning Bridging)

Planning bridging loans can make development sites that seem unattainable, a reality. If a developer needs to apply for full planning or revise existing planning, then a Pre-construction Bridging Loan is a perfect way to secure the site before the purchase price increases once planning is granted. Once the site has been fully prepped, developers can then switch to a development loan. Borrowers can use a bridge loan to purchase sites with no planning (least number of lenders available), outline planning or detailed planning, but are not yet ready to start developing.

It could be that the borrower wants to vary the existing planning, or there are pre-commencement conditions that will take some time to discharge.

Most development loans will stipulate that the development starts within 3 to 4 months of any land loan being drawn down. Therefore, even with detailed planning, if its going to take longer than a few months to start building then it may be more appropriate to start with a bridging loan.

2. Development Exit

Development Exit Finance is a short-term Bridging Loan, used to repay outstanding finance against a property development once the project has reached practical completion. It’s a great tool to use when existing finance is coming to an end and sales won’t be completed in time. Reduced risk for the lender (the properties are now built) means it can cost less than Development Finance. It also buys a borrower time and reduces the need for lowering prices for quick sales, and can free up equity to fund the next project, potentially making it a win-win for developers.

3. Refurbishment

Whether investing in a refurbishment property to sell, or ‘flip’, or as your next home, refurbishment finance can be used towards the purchase and cost of the works.

In the case of buying a new home that requires building / improvement work before moving in, a refurbishment bridging loan allows the works to be carried out, whilst you remain where you are, and move when the works are complete.

4. Purchase / Refinance

For purchasing or refinancing residential, commercial and mixed-use properties.

If a homeowner is considering upgrading or downsizing and have a large amount of equity in their home, a Bridging Loan enables them to borrow to buy a new property, before selling their existing one. When someone looking for a new home genuinely thinks they have found ‘the one’, they don't want to miss out, and the set-up fees and interest are worthwhile in the long-term if it means securing that once in a lifetime property.

It can also mean that any agent and / or vendor sees that you're in a stronger buying position as you're chain free and essentially, achieved the holy grail status of being a 'cash-buyer'.

Being a cash-buyer can lead to you being seen as a preferred bidder on properties, where there is a lot of interest. It can also mean that you can negotiate a better price, especially in falling markets, or where mortgages are harder to come by, as your fortunate position offers both speed and certainty.

Read more in our dedicated Bridging Finance page.

More Smart Ways to Use Bridging Loans

As a second charge to fund other assets

Second charge Bridging Loans are a great way to access equity in a property without having to fully replace the first charge. This can be particularly useful for someone looking to pay a deposit for a new development site funded by equity in lieu of cash.

It's also useful for borrowers that have cheap, first charge debt (especially if the existing rates are from a time when borrowing was cheaper), as it provides access to equity at potentially an overall cheaper, blended rate (the blended cost of the first charge plus the second charge) than if you replace the entire first charge.

Some lenders will allow a 2nd charge across multiple properties, rather like an overdraft facility. Allowing investors to draw against the equity value, to make further acquisitions.

It's important to remember that any second charge will require consent from the first charge lender, before it can be put in place. Whilst it should be a formality, the first charge lender can refuse. Therefore, if its possible, then check with your existing lender before you start an application, and / or ask your broker of their experiences.

First charge lenders are more likely to say no, if the second charge is being requested, within a short time frame of the first charge loan being completed (perhaps, within the first 6 months).

To secure finance against mixed asset types

Most lenders will have an asset type they prefer, be it residential, BTL or commercial. Securing a Bridging Loan for a development with mixed assets can be complicated if you start involving multiple lenders with multiple rates, and it just takes one to derail the entire deal. Even larger lenders who can finance different asset types will split the loans across different departments, making communication slow and the process disjointed. With the right contacts however, it is possible to secure one loan against multiple and mixed asset types.

Difficulties can however arise, if part of the asset mix is to be developed and part isn't. Some lenders are better than others with refurbishment and development, so make sure you discuss any future plans (even if they are not yet certain) with your broker and / or lender before you enter into the loan

For people who are asset rich but cash poor

For anyone with a strong asset base but lacking in liquidity, a Bridging Loan can be a great option to provide some breathing space whilst organising assets and completing on a sale. Assets might be in transition and require work before they can be let, so they can be considered by traditional funders and create an income stream. Or, simply to be renovated to add value before selling in order to achieve the best possible price. A lack of liquidity normally rules out mainstream lenders, despite the fact there is still plenty of value on the owner’s balance sheet, and a bridging lender can have the flexibility and foresight to recognise this.

To purchase property at auction

Purchases at auction require the buyer to pay a 10% deposit and exchange on the purchase on the day of the auction. Afterwards, there is normally just four weeks to complete, ruling out traditional lenders who cannot operate this quickly. When buying a property to live in, traditional lenders also require it to be in a habitable condition (connected to the mains with a working kitchen and bathroom), or in a lettable condition, if buying to let. The nature of auction properties means they are often neither. Properties are often priced lower, due to the increased risk and lack of traditional funding options available, but for savvy buyers that have cash or understand how to arrange funding it's an opportunity to add value and make a decent profit. buyers to add value and make a larger profit. A Bridging Loan provides the speed required for auction transactions, as well as the flexibility to lend against properties, whatever their condition.

To resolve short-term illiquidity

Anyone can face short-term liquidity issues and for anyone waiting on a property, business or other asset to sell, a Bridging Loan can help provide a solution quickly. With a clearly defined exit strategy, i.e. the asset is being sold and contracts have been exchanged, although completion could still be months or weeks away, a lender will normally provide a better rate as they are confident the loan can be redeemed.

Need-To-Know

Bridging Loans aren’t as expensive as you might think

There’s a common misconception, even among experienced property developers, that Bridging Loans are an expensive form of finance. Whilst they are more expensive than traditional mortgages, their increase in popularity means there’s more choice of lenders in the market, which ultimately leads to better pricing. And if securing a Bridging Loan means an investor can buy the property that’s right for their portfolio at a good price and relatively quickly, it can prove good value in the long-term.

There’s more to consider than pricing and leverage

Whilst pricing and leverage are key, looking deeper is the way to secure the best deals. For larger, and more complex loans, or loans against commercial or transitional properties, the contractual Ts & Cs and loan covenants are just as important. They can be complicated and onerous, hence developers need to make sure they use a solicitor and broker that knows their way around a Bridging loan offer.

All large Bridging Loans (at least the good ones) are bespoke

When looking to secure a large Bridging Loan, chances are the developer's financial needs and situation are unique. This means the standard finance options offered by the High Street banks aren’t an option, so it's important to explore the specialist lenders who will take the time to understand individual circumstances properly and have the flexibility and experience to adapt. If a lender isn’t willing to do this, move on. Specialist brokers should be able to pre-empt lender concerns and present their client's borrowing needs and development plans in the most compelling way possible. Like anything else, the narrative around the deal is key.

Applying for a Bridging Loan

Preparation

Presentation

Create a short-form presentation in the style of a lender credit paper. Accentuate the positives but address the negatives upfront.

The presentation should include all of these:

Communication

Jargon-free advice on peak debt facility, also known as a revolving loan. Find out what it is, how it works, how it differs from a development loan...

A personal guarantee is your legal promise to repay a business loan where you are a beneficial owner. Find out how it works and read our need-to-know...

We explain the benefits of phasing, what phasing means, how it helps preserve equity and enables you to scale-up to bigger developments sooner.