What Brickflow’s bridging loan calculator does

Brickflow’s bridging loan calculator is more than a quick estimate of loan costs; it’s a comprehensive search of the live lending market, delivering detailed and accurate loan options based on your input and criteria.

Our market-wide search covers mainstream banks, challenger and non-banks, and specialist lenders, comparing 200,000+ lender data points weekly to search and filter loans.

Your results page shows real-time borrowing options for your property and borrower profile, so you can see how much you can borrow and if your deal stacks. Unlike other UK bridging loan calculators, where you input vague values for rates and loan sizes, Brickflow gives you the information, with like-for-like details on rates, fees, net & gross loans and more.

Final terms will always depend on valuation, legal due diligence and credit approval, but with Brickflow, you can secure a DIP (Decision in Principle) and lock in your deal in minutes.

Using Brickflow’s bridging finance calculator couldn’t be simpler.

1. SEARCH & COMPARE live loans, instantly

- Select the type of bridging finance you need, enter the details of your property, click SEARCH

- Compare loans from 80+ bridging lenders and shortlist up to 5 of your favourites

2. SECURE a same-day DIP (our record is 4 minutes)

- Using our digital loan application, submit to lenders directly from the platform, eliminating repetitive form-filling

- Receive multiple DIPs back within minutes

3. APPLY for a loan

- Choose your preferred loan and apply with your broker or a Brickflow partner - they'll manage your entire application and ensure you're happy with the terms.

- Our lender-favoured online application covers everything they need to make fast, reliable credit decisions.

*If you don’t get back any results, try altering your search criteria. The minimum loan size for bridging finance on Brickflow is £25,000.

Interpreting the results

Brickflow’s bridging finance calculator is an incredibly useful tool, and should be the first port of call for every property professional before committing to a purchase.

To use the bridging calculator to your full advantage, the below will help you to better interpret and understand what is shown in the results:

- Maximum Loan to Value (LTV) ratios for your project: Lenders all have different caps on what they’ll lend against the land/property cost and build costs (if applicable).

- Monthly and annual interest charges: Interest can be serviced (paid monthly) or rolled up, and some lenders charge interest monthly rather than daily. This means you pay an entire month’s interest even if exiting part-way through the month, so always ascertain how its charged from the outset.

- Arrangement and exit fees: Exit fees are pretty uncommon, with almost none of the Brickflow lenders charging exit fees. Typical arrangement fees are up to 2% of the gross loan.

- True monthly costs (TMC): Brickflow uses a calculation of (Interest Rate / 12) + (arrangement fee + exit fee) / number of months = TMC to help you better understand the cost of your loan.

- Deposit requirements: Materially affected by the LTV ratios.

Your final redemption payment (to pay off the loan) will include the original amount of capital borrowed plus the accrued interest.

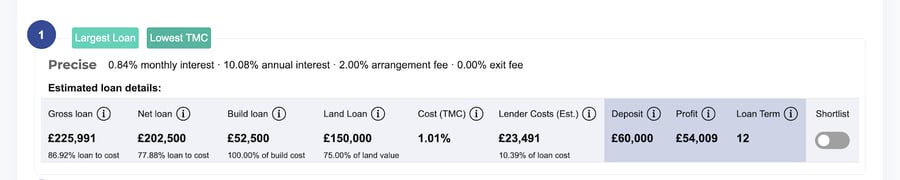

The below example shows these numbers in practice.

Bridging loan example

Let’s use a property purchase with refurbishment bridging finance over 12 months:

- Purchase price: £200,000

- Purchase costs: £10,000 (usually 5% of the purchase price)

- Costs of works: £50,000

- Gross development value (GDV): £340,000

The lender offering the largest loan with the lowest true monthly costs has an interest rate of 10.08% annually and a 2% arrangement fee, equalling an estimated total lender cost of £23,491.

Additional bridging loan costs to be aware of that are not shown in the calculator:

- Legal fees: you’ll have to pay your own legal fees as well as the lenders

- Broker fees: typically paid by the lender

- Valuation or survey fees

Bridging loan criteria

As with all specialist finance, every lender will have different eligibility criteria, but the bridging market has grown substantially in recent years and covers a vast array of borrowing requirements.

Brickflow's bridging loan calculator lets you filter your search results by different criteria; for example, first-time investor, based overseas, serviced interest, property type, etc. However, there are some minimal input requirements to use the calculator such as property details, required loan term, refurb costs, and any applicant has to meet basic requirements:

-

Aged 18 or over (some lenders may have an upper age limit)

-

UK resident or UK national living abroad

-

Employed, self-employed or retired

-

An individual, Limited Company, LLP or partnership

-

Short-term loan only, typically up to 24 months

Then it comes down to the property, experience, credit history and more. We cover criteria this in-depth in Who can get a bridging loan? Eligibility and Criteria.

Want to know more about bridging loans?

We cover everything you need to know about bridging loans, including:

Compare loans from 80+ bridging finance lenders

See how much you could borrow against a specific project & at what rate

Check detailed eligibility criteria to avoid wasting time & money

Ensure your deal stacks & make smarter investment decisions

How much can I borrow?

How much you can borrow depends on various factors, but it’s a vast scale ranging from £25,000 - £350 million. Typically, lenders will offer up to 75% LTV on a gross loan basis and 100% of build costs.

To determine their lending limits, they will consider:

- The property or site, it’s location & condition, your plans for the property

- You as a borrower, including credit file, experience in property investment, employment status

- Your exit strategy

- The value of your assets used to secure the loan

How much do you need to put down for a bridging loan?

This depends on the value of the property or site you want to fund with the bridging loan and the lender's lending limits.

For example, on a £200,000 purchase with £10,000 purchase costs + £52,500 total build costs, if the lender funds 100% of the build costs (£52,500) and 75% of the purchase costs (£150,000), you will need a deposit of £60,000.

What is the typical interest on a bridging loan?

Currently, bridging loan rates are around 8% - 12% annually.

Do you pay a bridging loan monthly?

Bridging loans are typically repaid in one lump sum at the end of the term. The final payment includes the initial capital borrowed plus interest charges.

Can I get a bridging loan with no money?

Bridging loans are secured against your property, so monthly income is not essential to securing a bridging loan. However you will still need an amount of money for the deposit – how much depends on the value of the property you intend to fund.

In some circumstances, you can get a 100% bridging loan, but you would need additional assets as security. Rather than 100% finance, it is more of a ‘cashless deal’. It can be difficult to meet the criteria, but some lenders in specific arrangements can offer this type of funding.

How is bridging loan interest calculated?

Interest is calculated on a monthly gross loan basis, so whatever the interest charges are, they are applied to the purchase loan, build loan, interest, and arrangement fee.

You will only pay interest for the duration of your loan, even if you exit the loan earlier than the originally agreed term.

How does a bridging loan calculator work?

A bridging loan calculator works by using the property, loan and borrower details you enter to search the market and estimate how a bridging loan could be structured.

Brickflow’s bridging loan calculator goes a step further by comparing your inputs against live lender criteria and pricing data, returning accurate borrowing options that show loan size, interest, fees, profit outcome and more. The results help you assess whether a deal is viable before progressing to a formal application.

What inputs do I need to calculate bridging loan costs?

To calculate bridging loan costs, you’ll need to provide key details about the transaction, such as the property type, purchase price, expected works (if applicable), loan term and your intended exit strategy. These inputs allow the calculator to assess loan-to-value limits, interest structure and fees that apply to your scenario.

Does the calculator include interest and fees?

Yes. Brickflow’s bridging loan calculator includes interest charges and typical lender fees, such as arrangement fees, and shows estimated total lender costs. Some costs associated with completing a loan (such as legal fees, valuation fees and broker fees) are not shown in the calculator and should be factored in separately.

Are the results an exact quote or an estimate?

The results shown by a bridging loan calculator are indicative, not a binding offer. Final pricing and terms are always subject to valuation, legal due diligence and lender credit approval.

However, Brickflow examines over 200,000 lender data points weekly, delivering actual real-time loan options. You can progress from indicative results to a Decision in Principle to lock in the rates shown - our fastest DIP took just 4 minutes.

How is bridging loan interest calculated?

Interest is calculated on a monthly gross loan basis so whatever the interest charges are is applied to the purchase loan + build loan + interest + arrangement fee.

You will only pay interest for the duration of your loan, even if you exit the loan earlier than the originally agreed term.