Commercial Bridging Loan

Secure the best commercial bridging loan on the market and quickly, with Brickflow.

Secure a Commercial Bridging Loan Fast Using Brickflow

Brickflow is the fastest way to secure the best value commercial bridging loan, and it takes just a few simple steps:

- ENTER your project criteria and model deals

- COMPARE loans from 100+ lenders

- APPLY for a loan with your intermediary

Our live market search lets you explore the breadth of the commercial bridging loan market in seconds, and compare real-time borrowing options from over 50 bridging lenders. You can then shortlist your preferred lenders and have multiple DIPs back within the hour – for a commercial property bridging loan, it doesn’t get much faster than that!

As well as our ultra-fast search process, other benefits of using Brickflow to secure your commercial bridging loan include:

- Instant access to today’s bridging market enabling you to compare current lender rates, fees, maximum LTVs and more

- Borrow up to £100 million

- Find out exactly how much you can borrow and how much it will cost you

- Filter and choose lenders who match your specific criteria

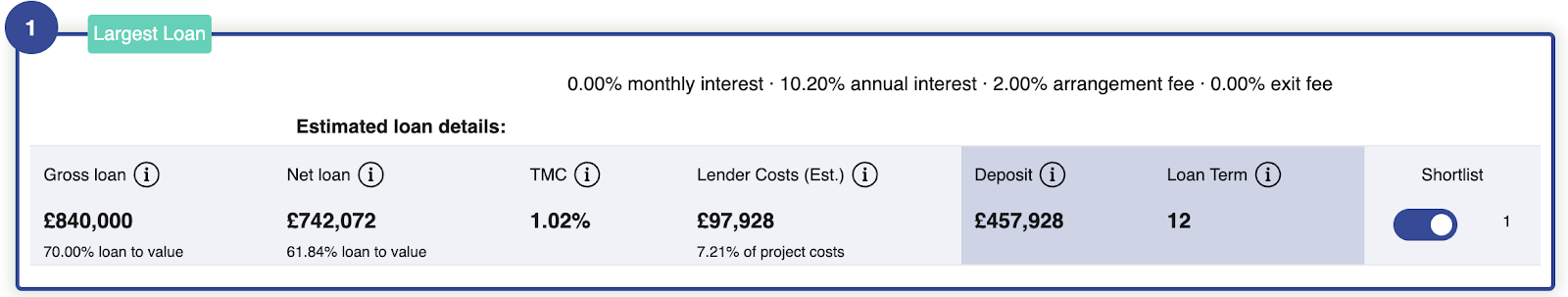

- Sort your results based on what’s most important to you (e.g. largest loan, best ROCE, lowest rates)

- With your intermediary, or we’ll connect you with an intermediary through the platform, you can apply to multiple lenders using a single online application. If one lender turns you down, with your intermediary you can simply apply again in one click.

- Our digital application covers everything lenders need to know to make quick, reliable credit decisions, helping to speed up completion times.

Compare loans from 50+ commercial bridging lenders

See how much you could borrow against a specific project & at what rate

Check detailed eligibility criteria to avoid wasting time & money

Ensure your deal stacks & make smarter investment decisions

What Is a Commercial Bridging Loan and How Does It Work?

A commercial bridging loan is, as you might have guessed, a bridging loan that is secured against a commercial property. It is a short-term finance arrangement that can be secured quickly to fund a commercial property purchase or release funds from a commercial property.

| Key Features | Key Details |

| Loan Term | 1 - 24 months |

| Borrow | £25,000 - £100 million |

| Rates | Currently 0.75% - 1.4% per month |

| Arrangement Time | 3 days - 6 weeks |

Interest: Interest is typically charged monthly but rolled up and repaid with the loan at the end of the term, meaning there are no monthly repayments. Interest is only charged for the time that you have the loan – so if it is repaid early, you will pay less in interest charges (subject to a minimum term). The rate you secure will depend on:

- LTV

- The property, its condition, location and desirability

- Your exit strategy

- The loan term

- You as a borrower, including yours and your business credit file and experience in commercial property investment

Repaying the loan: As with all bridging loans, a strong exit strategy is essential for approval. Commercial bridging loans will typically be repaid by:

- Selling the property after completing value-add work

- Refinancing onto a commercial mortgage or development finance

- Selling another property or liquidating other assets

Residential vs Commercial Bridging Loans: What’s The Difference?

Residential bridging loans are for purchasing residential properties, including commercial buildings that will be converted to flats or housing. Where the property being purchased will be used as a home by the borrower or their immediate family, the bridging loan will be regulated.

Commercial bridging loans tend to be more expensive than residential due to the higher risk to lenders – higher risk of vacancy and more difficulty in liquidating the asset (in comparison to residential assets) in the event of a default on the debt.

Where the property / properties are mixed use, with both residential and commercial, the overall use has to be more than 40% commercial to secure a commercial bridging loan. Otherwise, a semi-commercial bridging loan would be more apt.

Criteria for Commercial Bridging Loans

The key criterion for securing a commercial bridging loan is having a solid exit strategy – after all, the lender's primary concern is how they will get their money back. Demonstrate in detail the due diligence you have given to the property or site you intend to purchase and why your exit strategy will be successful.

Then it comes down to some standard eligibility requirements, you as a borrower and your requirements from the loan:

| The Borrower |

|

| Employment Status |

|

| Income |

|

| Credit History |

|

| Loan Amount |

|

| Loan Term |

|

| Property Type |

|

| Security |

|

| Loan to Value (LTV) |

|

Advantages of Commercial Bridging Loans?

Commercial bridging loans are a fast, flexible finance that can open up more market opportunities to you. Some of the advantages of commercial bridging loans include:

- Fast: Can complete in a matter of days, if both lender and borrower accept a desktop survey and determine that no further professional reports are required. The most typical arrangement time is around 14 days, however, which is still far quicker than a commercial mortgage which can take up to 10 weeks to complete. Take a look at our fast bridging loan page to find out more.

- Expands market opportunities: The speed at which a bridging loan can be arranged enables auction purchases, which usually have a short timeframe to complete the sale, typically 28 days. Commercial bridging loans can also facilitate purchases where a commercial mortgage wouldn’t be available, such as buildings in a poor state of disrepair and deemed uninhabitable or properties of non-standard construction.

- Flexible: Often ‘open-ended’, meaning there is no set date to repay the loan, though there will be a maximum loan term. Also, most bridging loan lenders don’t charge exit fees or early repayment charges after a minimum term has passed – this is usually three months.

- More accessible: Commercial bridging loans are unregulated and require a fraction of the paperwork compared to that of a traditional mortgage. This is because they are based on the property rather than the borrower’s ability to meet payments. Borrowers with adverse credit can still potentially secure a loan.

- Provides a quick cash injection: Businesses can use a commercial bridging loan to release equity from their premises which can then be used to upgrade machinery, or expand operations.

To learn more, take a look at our article the pros and cons of bridging loans.

Associated Interest Rates, Costs and Fees

A commercial bridging loan will typically involve the following costs and fees:

- Interest charges: The interest rate you pay will depend on the property, its location, condition and desirability, your loan term, your exit strategy and you as a borrower, including your credit file, asset net worth and experience in investing in similar properties. Lower interest rates can be secured with higher deposits (usually 40% or more) and stronger exit strategies, such as a set date for a property sale.

- Valuation or survey fees: A surveyor will assess the property, with costs depending on the property value, type and location. Lenders should provide quotes from more than one firm and let you decide – your broker or advisor should have some knowledge of each of the firms and help you choose the most suited to your property. As a guide, budget 0.1% of the property value.

- Legal fees: The lender’s legal fees, as well as your own.

- Arrangement fees: Up to 2% of the net or gross loan.

- Broker fees: Normally paid by the lender. For example, the lender will charge a 2% arrangement fee, and give 1% of that to the broker. Some brokers might add an engagement fee when they start the application.

- Exit fees: They can exist but are not that common for bridging finance. Almost none of the lenders on the Brickflow platform charge exit fees, but they instead might stipulate minimum loan term – between 1 & 6 months normally.

Eligible Properties for Commercial Bridging Loans

- Care homes, retirement homes & medical facilities

- Education facilities

- Gyms and sports complexes

- Hotels

- Leisure & Retail

- Licenced HMOs

- Light Industrial

- Mixed-use (part residential, part commercial)

- Mixed-use (all commercial but different property types)

- Multi-freehold block

- Offices

- Student accommodation

- Warehouses and storage facilities

Commercial bridging loans can also fund land acquisitions for a commercial property development, but a planning bridging facility would be more suited.

Tips for Securing a Commercial Bridging Loan

Before securing any commercial bridging loan, you need to check that your property investment or project actually stacks-up against live loan costs.

If it doesn’t, your application is going straight into the lender’s reject pile.

Brickflow’s instant live-market search enables you to run your numbers and compare loans from over 50 bridging lenders, with details on interest rates, arrangement fees, maximum LTV and more. By knowing your actual borrowing costs, rather than a vague guess, you can accurately calculate your profit and the maximum price to pay for the property.

Once you’ve done your due diligence, here are some tips to get your application over the line:

- Prepare your documentation: ID, proof of address, your financials, developer CV, etc.

- Present your project professionally: If using your bridging loan for commercial property development, demonstrate in detail your project plans, specifying building costs, completion timescales and expected GDV with supporting market research.

- Show a solid exit strategy: If your plan is to sell, make sure projected sales figures are supported with relevant market comparables. If you’re refinancing onto a commercial mortgage, evidence of your next loan arrangements will help – if you do have credit issues, securing long-term finance can be difficult, which poses a risk to your exit.

- Be upfront about credit issues: Commercial bridging lenders are flexible and used to dealing with complex situations – hiding any previous bankruptcy, CCJs, or other issues from the lender will only cause a loss of trust in you as a borrower because they will come up.

- Use a specialist finance intermediary: Brokers deal in commercial bridging loans day-in and day-out, and have built a depth of knowledge over years, or decades of working in the industry. Utilise their expertise and networks to ensure you get the right loan.

- Choose the right lender: Once you’ve gather loan options from your Brickflow search, your intermediary will know which lenders are better positioned to deal with your specific situation and ensure your commercial bridging loan gets over the line, on time and at the right price

- Choose the right solicitor: You might be tempted to just use your family solicitor or residential conveyancer to process your loan – but don’t! A solicitor with no experience in arranging commercial bridging loans can drastically slow down progress.

Beyond the Bridge: Refinancing Options

If your commercial property purchase will be either a long-term investment or a large-scale development project, you must arrange refinancing for the end of the commercial bridging loan.

Typically, you will refinance with:

- Commercial Mortgage: A long-term property investment solution, serviced monthly, with interest-only or interest and capital repayments. With terms available up to 30 years or more. Commercial mortgages are assessed against the rental income from business tenants or, for owner-occupied commercial premises, your business's financial strength.

- Development Finance: Intended for ground-up property development or extensive and large-scale developments of an existing property. Short-term (9 to 48 months) and tailored to your project and build schedule.

- Portfolio Finance: Where you combine the debt on multiple properties and arrange into a large loan, with one lender. This means that rather than having several mortgage payments per month you will have just one single payment.

Whether carrying out refurbishment work before selling the office building, or retaining it as a rental investment, knowing the exact loan costs is critical to assess if the property purchase is viable or not.

Run your numbers through Brickflow’s live loan search – it can save you tens or hundreds of thousands of pounds on your next commercial property investment.

How long does it take to arrange a commercial bridging finance?

Commercial bridging loans can be completed in just a few days, but it will generally take between 1 and 4 weeks.

Using Brickflow’s live-market bridging loan calculator is the easiest, quickest and most transparent way to arrange commercial bridging finance. It takes seconds to search the breadth of the market to find the best loan and you can then apply through our ultra-streamlined digital process and have a Decision in Principle within just 7 minutes.

Once you’ve submitted your application, it will typically take around two to three weeks for the funding to be released. The timeline is primarily down to how long it takes the lender’s valuer to complete their report and for the solicitors to complete property searches. However, where a lender works with an AVM (automated valuation model) and accepts title insurance and therefore does not require searches, then completion can be as quick as a few days.

Working with an intermediary, solicitor and lender who specialise in bridging finance will speed up the loan process.

Find out more about how long it takes to get a bridging loan and the factors that can delay or speed up your application.

What is a commercial bridge?

A commercial bridging loan is a short-term financing solution that can bridge the gap between buying a commercial property and securing long-term funding or selling a property. It acts like a temporary cash injection, allowing you to move quickly on an opportunity or cover unexpected costs while you arrange more permanent financing, such as a commercial mortgage. It can be used to purchase or release equity from commercial properties.

What is the difference between residential and commercial bridging finance?

Residential and commercial bridge loans share the same core concept of short-term financing, but they cater to different asset classes:

Residential bridging loans:

For the purchase or refinance of residential properties, like houses or flats, and including land that will be developed for residential use and commercial buildings that will be converted to flats and housing. Where the property being purchased will be used as a home by the borrower or their immediate family, the bridging loan will be regulated. Lenders typically offer lower interest rates on residential bridges due to the perceived lower risk due to more available buyers, compared to commercial properties.

Commercial Bridging loans:

Cater to financing commercial properties like office buildings, retail spaces, warehouses, gyms, etc. or land for development. All commercial bridging loans are unregulated. They also tend to be more expensive than residential due to the higher risk to lenders – higher risk of vacancy and generally, it is easier to liquidate residential assets rather than commercial in the event of a default on the debt.

To secure a commercial bridging loan against a property or properties with both residential and commercial, the overall use has to be more than 40% commercial. Otherwise, a semi-commercial bridging loan might be more apt

Why are commercial rates higher than those for residential loans?

Commercial bridging loan rates are generally higher than residential because of the perceived higher risk to lenders – commercial properties inherently carry higher vacancy risks, potentially causing financial difficulties for the borrower and increased likelihood of defaulting.

It is also relatively more difficult to liquidate a commercial property compared to residential due to less available buyers, further increasing the lender’s risk level.

Are commercial bridging loans high-risk?

For lenders, when compared to residential bridging loans, the risk associated with a commercial bridging loan is generally higher. But it depends on several factors:

- Loan-to-Value (LTV) ratio: Borrowing a smaller portion of the property value (lower LTV) reduces risk for the lender and can lead to lower interest rates.

- Your borrower profile: A strong financial track record with a history of successful property ventures can make you a more attractive borrower and potentially qualify for better rates.

- The property itself: The type, location, and condition of the commercial property all influence the risk assessment. Prime locations with high occupancy rates generally translate to lower risk.

As a borrower, any financial arrangement carries risk. Mitigate your risks by carrying out proper due diligence on your finance, the property and property market and your exit strategy.

Can I borrow money against my commercial property?

Yes, in most cases, you can use your existing commercial property as security for a commercial bridging loan. This allows you to leverage the equity you've built in the property to access funds, whether to facilitate another property investment or cover temporary cashflow problems that have a clear and definite strategy to resolve them.

What are the advantages of a commercial bridging loan?

Bridging loans are a useful type of finance that can help you grow your property portfolio and facilitate more market opportunities, as well as providing a cash injection when you need it. The key advantages of a bridging loan are:

- Fast: Can complete in a matter of days, though the most typical arrangement time is around 14 days - still far quicker than a commercial mortgage which can typically take up to several months to complete.

- Expands market opportunities: Can facilitate auction purchases with quick completion timeframes, or contested commercial property sales where being a ‘cash buyer’ can secure the sale. Can also be used for purchases where a commercial mortgage wouldn’t be available, such as buildings in a poor state of disrepair and deemed uninhabitable, properties of non-standard construction, land without planning.

- Flexible: Can be ‘open-ended’ meaning there is no set date to repay the loan, though there will be a maximum loan term. Most bridging loan lenders don’t charge exit fees or early repayment charges after a minimum term has passed, usually three months.

- More accessible: Unregulated, so require a fraction of the paperwork of a traditional mortgage and since they are based on the property rather than the borrower’s ability to meet payments, borrowers with adverse credit can still potentially secure a loan.

- Provides a quick cash injection: Businesses can release equity from their commercial premises.