Does your deal stack?

Smart developers & investors don't wing it. Model deals in seconds & know your numbers before you pursue a project.

The seamless way to model deals & make smarter investments

Financing makes or breaks a deal. Run your numbers through the platform at the start of a scheme to save time, money & ensure your deal stacks.

Read to apply? Tell your intermediary about Brickflow & secure a Decision In Principle today.

Mandeep Poonian, Property Developer

“At any one time I might have 10 sites on my desk. I run all the ones I like through Brickflow, and I’ve found I can cut 10 sites down to one or two as most don’t work for me financially. I then only run further due diligence on those two sites.

Prior to using Brickflow, I’d often spend days and weeks getting excited about a site only to realise at the end I couldn’t make it work.

By running each project through Brickflow first, I save myself and my team between 30-40 hours per month, from researching sites that don’t work.”

Model deals

Compare live rates from 100+ lenders in seconds, saving you weeks of wasted phone calls and unanswered emails.

If you’ve found a potential site, run your numbers through Brickflow to check if the project is financially viable.

Discard schemes that aren’t before you waste time and money and focus your resources on deals that stack.

.webp?width=2000&height=1777&name=Search-Loans%20(3).webp)

.webp?width=2000&height=1777&name=Check%20Eligibility%20(3).webp)

Check eligibility

Brickflow searches the breadth of the market, ensuring you find the right lender and the best value loan based on your specific project.

Increase profit on every deal by finding the cheapest loan options and decreasing your borrowing costs, whilst reducing your deposits and maximising your return on equity.

Avoid wasting time & money pursuing an unsuitable loan by checking eligibility against each of your search results in seconds.

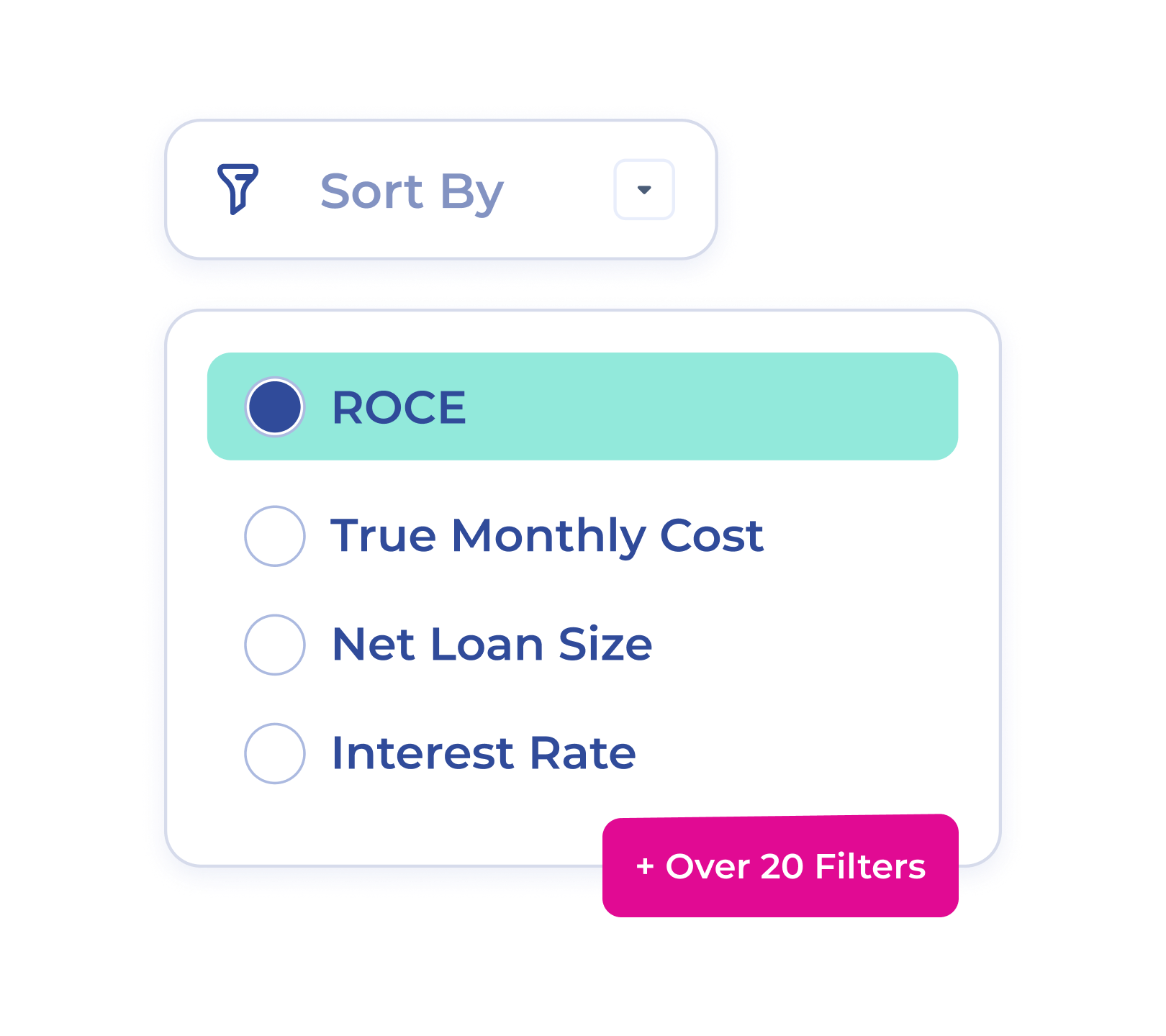

Refine Results

The difference between finding funding and finding the right funding is normally tens or even hundreds of thousands of pounds.

Select from over 20 filters and sort the results to streamline your search and focus on the loans that fit your project priorities.

See ROCE against every deal or sort by True Monthly Cost; choose the parameters that help determine if your deal stands up.

Personal service behind the automation. Brilliant!

The service I received was a great surprise- a person behind the automation! With knowledge and skill to feedback valuable insight on the deal presented!

Will definitely use this service again!

Brickflow have exceptional customer care

Brickflow have exceptional customer care as well as brilliant knowledge. We will be using their services for the foreseeable future.

Brickflow have been absolutely brilliant

Brickflow have been an absolutely brilliant company to deal with. They have been very helpful and always quick to get back to me. I would highly recommend them to anyone who is looking for development finance.

How does property development finance work?

Property development finance is a short-term loan used to finance the construction, conversion or refurbishment of buildings. Once the project is complete, you repay the loan through the sale of the property or via refinance.

Residential development finance

Commercial development finance

The development finance process

How does Brickflow work?

Brickflow is a digital marketplace for specialist finance, connecting brokers and borrowers with lenders online. Our algorithm compares your project requirements against more than 100 lenders. It is a high-level search against real criteria provided by some of the UK's most reputable lenders.

How does Brickflow calculate finance?

We use the same loan modelling process across all lenders, to allow easy comparison between lenders. Each lender will have their own model, which will constantly be tweaked, so the loan figures provided on the Brickflow results screen may differ to the final quotes provided by the lenders. However, we constantly monitor our estimates against the actual quotes received to ensure any differences are minimal.

How many lenders do you search?

As of today, we have 100+ lending options on Brickflow offering development finance, bridging loans and commercial mortgages with ambitious plans to grow these numbers. We handpick our lenders to represent the entire market, covering a full range of pricing and leverage, as well as all UK geography and loan sizes.

Which lenders are on the platform?

We work with mainstream banks, challenger banks and specialist development lenders.

How do I apply for a loan via Brickflow?

There are currently two ways a developer can apply on the Brickflow platform.

1. Refer your broker to Brickflow

2. Contact Team Brickflow by emailing info@brickflow.com to be connected with a loan manager who can make the application with you.

Brokers or our loan manager can apply on the platform on your behalf using our Smart Appraisal™ tool, and can invite you to collaborate on your development appraisal.

Brickflow connects directly with over 100 lenders, so there’s zero paperwork and zero delay. Lenders will respond with a Decision in Principle in hours (rather than weeks), and your broker or loan manager can then apply for your preferred loan on your behalf.

What size loan can you source via Brickflow?

Loans start from as little as £150k and go up to £150m. Some lenders have a published maximum loan of £40m or £50m but will work on bigger loans as part of a syndicate. If you are looking to source a loan above £40m and find your options are limited, contact us and we can arrange a syndication deal for you .If you are ready to secure a loan, please call us on 07562 956 709 or email us at info@brickflow.com

How do you rank the loans?

Loans are ranked in order, from largest to smallest. When the loan amounts are the same, the Brickflow software ranks them in price order, with the cheapest loan first.

How much does it cost to compare loans?

It is free for developers to compare loans, and receive search results from over 100 lenders. In order to see the lender names and apply for a loan, you can request that your broker registers to use Brickflow, which costs just £32 per month.

Sign Up & Get Smarter

Sign up to receive valuable insights on the CRE market. We won't bombard you with spam – instead, you'll receive exclusive updates on:

- Market Insights - Find out what your competitors are up to

- Industry Insights - The latest policies, news & strategies shaping the industry

- New products & features - Explore the tools that streamline your funding process

- Rate alerts - The latest live rates from lenders on the Brickflow platform