Large Bridging Loan

For those bigger property opportunities, large bridging loans can provide the funding you need.

Secure a Large Bridging Loan Quickly Using Brickflow

Brickflow is the quickest way to secure the best value large bridging loan for your project, and it takes just a few simple steps:

- ENTER your project criteria and model deals loans

- COMPARE loans from 50+ large bridging loan lenders

- APPLY directly from the platform with your intermediary or a Brickflow partner

With our live market search, you can enter the details of your project in a matter of seconds, and compare actual borrowing options from the breadth of the market. When you’ve found the right loan, you can have a DIP (or multiple DIPs) back within the hour. It doesn’t get quicker than that.

As well as our ultra-fast process, securing a large bridging loan through Brickflow means you can:

- Instantly access today’s bridging market and compare current lender rates, fees, maximum LTVs and more

- Find out exactly how much you can borrow (loans up to £100 million) and at what cost

- Filter out lenders who don’t match your criteria

- Sort your results based on what’s most important to you (e.g. largest loan, best ROCE, lowest rates)

- With your intermediary, or we’ll connect you with an intermediary through the platform, apply to multiple lenders with 1 x online application; if one lender says no, instead of filling out a new form, it’s one click to send to a different lender.

- Use our pitch-perfect digital application that covers everything lenders need to know to make quick, reliable credit decisions – meaning quicker completion times.

Compare loans from 50+ large bridging lenders

See how much you could borrow against a specific project & at what rate

Check detailed eligibility criteria to avoid wasting time & money

Ensure your deal stacks & make smarter investment decisions

What Constitutes a Large Bridging Loan?

A large bridging loan is a type of short-term secured funding for residential or commercial properties, generally with a value of £2m or more.

There’s no definitive figure for what constitutes a large bridging loan though, and it depends on the lender, but from our experience working with lenders on the Brickflow platform, the £2 million threshold is generally accepted, as this is the point where some lenders stop lending.

Just like other types of bridging finance, large bridging loans can be used to:

- Purchase residential, commercial or mixed-use properties quickly

- Purchase uninhabitable properties

- Prevent the collapse of a property chain sale

- Purchase a property before selling

- Buy at auction

Eligible Projects for Large Bridging Loans?

When the transaction is £2m or above, the types of properties are more likely to include:

- Larger-scale commercial investments, such as hotels or large shopping malls

- Prime luxury residential properties

- Multi-unit freehold blocks

- Mixed-use sites (residential & commercial, or commercial with different property types)

- High-value land acquisition

- Portfolio acquisition, buying multiple properties simultaneously

What Are the Main Differences Between a Large Bridging Loan and A Smaller Loan?

The key difference between small and large bridging loans is the scale of the funding. Otherwise, the process is much the same for securing a small or large bridging loan, with some nuances to be aware of:

- The Lenders: Bridging loans between £2m and £10m are fairly common, with the majority of bridging finance lenders able to accommodate this size of borrowing, but the number of lenders offering finance of £10m + is slightly less. On Brickflow, around half of our lenders offer loans above £10m. When it comes to big-ticket bridging loans, working with a lender who specialises in and is used to arranging large bridging loans will ensure a smoother process.

- The Process: Naturally, a £90m bridging loan poses more risk to a lender than a £900,000 loan. Therefore, the due diligence and underwriting process for large bridging loans can be more involved, with more scrutiny given to the proposed exit strategy, the securing asset value/values, and the borrower's credit history and financial position.

- Security: The higher loan amounts might mean more substantial or multiple assets are required as collateral, which can add a layer of complexity to arranging the loan.

- Rates and Fees: As with any bridging loan, the interest rate and fees you pay will depend on many factors, from your project to you as a borrower and to the lender's own parameters. Typically, fees don’t change according to loan size. However, lenders can manipulate arrangement fees on larger loans if the broker is willing to lower their procurement fee (far more likely with larger loans). Some lenders will, however, offer tiered rates based on loan sizes, but this is not a general rule.

- The Borrower: On Brickflow, the value of our bridging loans goes up to £100 million. Whilst the majority of property developers or investors with a strong exit strategy can be accepted for a large bridging loan, the security and deposit requirements typically limit this type of finance to high and ultra-high-net-worth investors. For example, a £50 million property purchase with a 75% bridging loan will require at least £12.5m equity (assuming the loan interest is to be serviced).

In general, large bridging loans are tailored to suit the borrower’s situation and will typically be more complex transactions with lenders carrying out more in-depth risk assessments.

Eligibility and Criteria for Large Bridging Loans

To apply for a large bridging loan, you’ll have to meet some standard criteria, as well as criteria specific to the loan type and lender requirements:

| The Borrower |

|

| Employment Status |

|

| Income |

|

| Credit History |

|

| Loan Amount |

|

| Loan Term |

|

| Experience |

|

| Security |

|

| Loan to Value (LTV) |

|

| Deposit |

|

| Exit Strategy |

|

| Interest |

|

Paperwork & documentation required

- Proof of identity: ID and proof of address

- Loan Application: A professional presentation detailing your personal information, financial status, and the specifics of your project or investment. Brickflow’s Smart Appraisal™ covers everything a lender needs to know

- Property details: Price, location, condition, freehold or leasehold, any existing planning permission, outstanding balances, vacant or tenanted and rental income if applicable

- Project details: What you plan to do with the property, the work involved, costs of the refurbishment, timescale for completion and estimated value once completed

- Ownership: Proof of ownership for additional collateral

- Your experience: Detail any previous property projects you have successfully completed – at Brickflow, you can save your developer CV, and we’ll automatically update it as you complete your projects

- The exit strategy: Sale or refinance, including your marketing strategy

- Financial Health: Provision of up-to-date financial statements

- Assets: A breakdown of all assets and liabilities

- Anti-money laundering: Borrower’s identity documents and proof of address

- Source of wealth: Summary of how funds were obtained, with supporting evidence

How Much Can Be Borrowed Using a Large Bridging Loan?

On Brickflow, our large bridging loans range from £2m to £100m. How much you can borrow depends on the criteria above, your circumstances and these key factors:

- The lender you use

- The maximum LTV available for your property/project

- Your exit strategy – for example, if you plan to repay the large bridging loan with a 75% LTV by refinancing onto a commercial mortgage, but this is limited to 65% LTV, your bridging loan will be adjusted accordingly

- Your collateral

- Your available capital

At Brickflow, you can secure a bridging loan as low as £25,000. Find out how much you can borrow using the leading bridging loan calculator in the UK.

Advantages of Securing a Large Bridging Loans

Bridging finance is a key financial tool for most property investors and developers, offering a fast, flexible borrowing solution for various situations. Bridging loans for large projects offers the same benefits:

- Substantial funding, arranged quickly

- Bridges the gap between buying a property and selling or arranging long-term finance

- Tailored for large investments like expansive developments, large commercial acquisitions, or quick capital injections

- Flexible, often with an ‘open-ended’ term and no early repayment charges (though typically they will carry a minimum term, typically between 1 & 6 months)

- Can facilitate property transactions that other finance types can’t, such as auction purchases or uninhabitable properties

- Borrowers with adverse credit can still secure a loan

Disadvantages of large bridging loans

With the yin comes the yang, and being aware of the downsides to large bridging loans can help you make more informed decisions:

- Higher rates: Bridging finance is arranged quickly, with fewer checks and boundaries than traditional finance, and can involve vast sums of money, especially with large bridging loans. Therefore, borrowing costs are higher than other longer-term finance options – like everything, you pay for convenience.

- Secured: Like all specialist property finance types and mortgages, bridging finance is secured against your assets – typically the property you buy and/or other assets. If you default on the loan, the lender can take these assets into possession or force sales. For larger bridging loans, you may use multiple assets to secure the loan, meaning they are all at risk if you cannot repay them.

- Unregulated: Both a pro and con of bridging finance because an unregulated loan allows for faster completion times and applicants with poor credit history. It also means you have no protection from the Financial Conduct Authority (FCA) if you are sold an unsuitable product or given incorrect advice.

To learn more, take a look at our guide, which covers the pros and cons of bridging loans.

Associated Interest Rates, Costs and Fees

- Valuation fees: A surveyor will assess the property’s value or the value of other securing assets. The fees will vary depending on the property type, size, value, and the valuer used. The lender should provide options and allow you to choose your preference. As a guide, budget 0.1% of the property value.

- Legal fees: The lender’s legal fees, as well as your own

- Broker fees: Normally charged as a percentage of the loan amount, but the lender typically pays this. For example, of the lender’s 2% arrangement fee, they might give 1% of that to the broker. Some brokers might add an engagement fee when they start the application.

- Arrangement fees: Up to 2% of the loan amount

- Exit fees: They can exist but are not that common when it comes to bridging finance. Generally, bridging finance lenders on the Brickflow platform do not charge exit fees, but they instead might stipulate a minimum loan term – between 1 & 6 months normally

- Early repayment penalties: Not common in large bridging loans, but the loan will usually carry a minimum loan term of between 1 & 6 months before it can be repaid without charges

- Non-utilisation charges: If you don’t draw on a portion of the loan within the specified period agreed at the outset, some lenders can charge fees on the undrawn amount

Application Tips for Large Loan Approval

When it comes to securing a large bridging loan, there are a few things you can do to make sure your loan gets approved and completed quickly.

For any bridging loan, if your deal doesn’t stack, lenders won’t even look at it – running your numbers through Brickflow’s bridging calculator is the most accurate way to model your deals against actual borrowing options and determine whether or not you have a viable investment; is there enough profit in the deal? Does it make sense to do it?

The great thing is that it takes less than 30 seconds!

When you’re sure your deal stacks and you’ve found your loan, your specialist finance advisor or a Brickflow partner can secure a DIP for you within an hour or less – our record is 7 minutes.

Here are Brickflow’s top tips for getting your large bridging loan approved:

- Prepare your documentation: As soon as you begin the loan process, start gathering documents detailing your ID, proof of address, your financials and your developer CV if necessary.

- Present your project professionally: If your loan is for a property development project, show the lender exactly how you will use the loan, specifying building costs, completion timescales and expected GDV with supporting market research.

- Have a solid exit strategy: For large bridging loans, your exit strategy will be highly scrutinised – a vague or unrealistic exit strategy will be quickly dismissed, so make sure projected sales figures are supported with relevant market comparables. If you’re refinancing, evidence of your next loan arrangements will help – unlike bridging finance, traditional long-term finance solutions can be difficult to secure if you have any credit issues, which poses a risk to the strength of your exit.

- Be upfront about credit issues: Don’t hide any previous bankruptcy, CCJs or other issues from the lender – they will find out, and it will only promote a loss of trust in you as a borrower.

- Work with a specialist bridging broker: Brokers have a depth of knowledge they’ve gathered over years of working in the industry. They know the market – tap into their expertise and networks to ensure you get the right loan.

- Choose the right lender: Your intermediary will know which lender to work with to ensure your loan gets over the line, on time and at the right price

- Choose the right solicitor: A solicitor with no experience in arranging large bridging loans can drastically hold up the progress of the loan – don’t take the risk

Refinancing Options After Using a Large Bridging Loans

Depending on your plans for the property/properties, if you are not repaying the loan through re-sale or from liquidating other assets, you will typically refinance on one of the following:

- Development Finance: Suitable if you have bought bare land and are planning a ground-up development, intend to carry out extensive development work, or are doing a major conversion from, for example, an office building to residential units

- Commercial investment mortgage: Suitable if the property is a habitable commercial property that you intend to keep and let out or requires minor upgrades before letting

- Portfolio finance: Whether expanding your existing portfolio or financing multiple properties under one arrangement

Applying for a Large Bridging Loan with Brickflow

The easiest and quickest way to apply for a large bridging loan is by using Brickflow.

1. ENTER your project criteria and model deals

- Enter the details of your purchase into Brickflow’s live bridging loan calculator; it takes seconds

- Brickflow covers the breadth of the market, including banks, non-banks and specialist lenders, offering loans up to £100 million - so you can be sure you’ll find the best large bridging loan and fast

2. COMPARE loans from 50+ bridging lenders

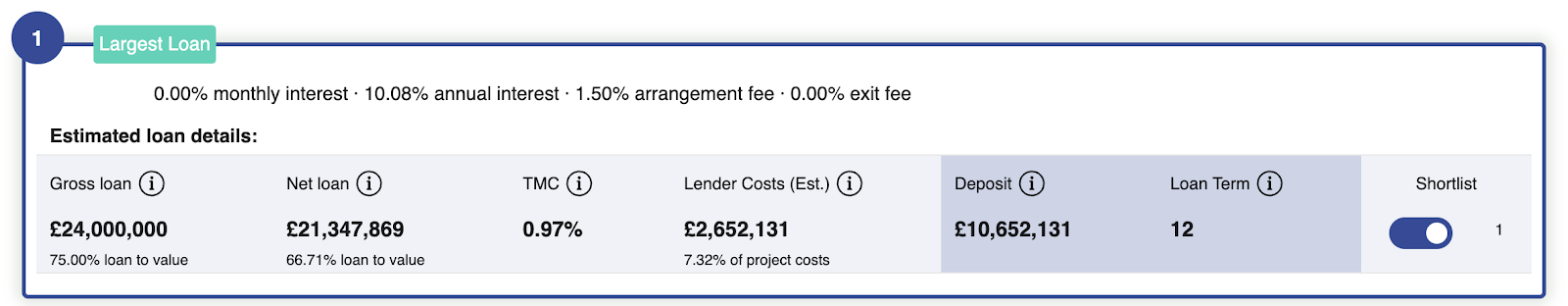

- Compare like-for-like details on loans currently available for your project, such as LTVs, interest rates, fees, deposit requirements and more

- Your search will be saved so you can log back in later and modify your numbers if needed

- Shortlist your preferred loans, and with your intermediary request, a DIP from each lender - you could have up to 5 DIPs back within an hour

3. APPLY for a loan with your intermediary or a Brickflow partner

- Apply to multiple lenders with a single online application; if one lender says no, you can simply send the same application to another lender, and avoid repetitive form-filling

- Our lender-favoured digital application covers everything lenders need to know to make quick, reliable credit decisions

Compare large bridging loans now and see the great deals available on Brickflow.

What are the main differences between a large bridging loan and a smaller loan?

The key difference between a large bridging loan and a smaller loan is the amount being borrowed, with large bridging loans typically being anything of £2 million and above.

The process for securing a large bridging loan is much the same as for smaller loans, except the lender may carry out further due diligence on the exit strategy and the securing assets. Where multiple assets are used as collateral, securing the loan can take a bit longer, but generally, large bridging loans will still have the same quick completion times as smaller loans.

Are large bridging loans regulated by the Financial Conduct Authority?

Not always. If the large bridging loan is used for a property that is or will be the borrower's main residence, then yes, it will be regulated by the Financial Conduct Authority (FCA).

The FCA oversees lenders and ensures they adhere to certain guidelines, such as affordability checks and ensuring the borrower can repay the loan. Therefore, a regulated bridging loan is subject to more paperwork and can take longer to arrange than an unregulated bridging loan.

Can I get a better deal if I’m borrowing more?

Not necessarily – some lenders might offer tiered lending rates (the larger the loan, the lower the rates) since a larger loan represents more money for a lender and, therefore, more room to flex. But it’s not a hard and fast rule.

Rather than just loan size, the rates you pay will be determined by other factors, including:

- LTV

- Your exit strategy

- Your experience in similar property investments

- Your creditworthiness and net asset value

Where you might get a better deal is with arrangement fees - lenders can manipulate arrangement fees on larger loans if the intermediary is willing to lower their procurement fee, which is far more likely with a larger bridging loan.

Do lenders have set criteria for larger applications?

Lenders do not have a differing set of criteria for larger bridging loan applications – the same criteria and eligibility requirements will apply to large bridging loans as do to smaller bridging loans.

Key criteria include:

- Age 18+, UK resident or national (limited options for foreign nationals)

- Employed, self-employed or retired

- Borrowing up to £100 million

- Loan term 1- 24 months

- LTV typically limited to 75% on a gross loan basis (LTV can be reduced on larger loans)

How big of a bridging loan can I get?

Through the Brickflow software you can source up to £100 million on a bridging loan. The exact amount you can borrow will depend on your circumstances and the property you are purchasing.

The quickest way to find out is to search for a bridging loan on Brickflow – it takes less than 30 seconds to enter the details of your potential purchase and compare live borrowing options from over 50 bridging lenders.

Are large bridging loans high risk?

Any large debt always carries a level of risk, so a larger loan inherently carries more risk.

Mitigate your risk with thorough market research and due diligence on:

- Your Finance: Unless you know accurate borrowing costs for your land purchase, you can’t accurately calculate profit and determine if it’s a viable investment or not. Before wasting weeks’ worth of time drilling into the details of your development or investment project, costing materials, researching rental prices, etc. check actual real-time costs of your large bridging loan on Brickflow. It takes 30 seconds and can save you weeks of pointless work and tens of thousands of pounds.

- The Property: Whether your plan is to develop or retain the property as a rental investment, research your market, supply and demand, comparable properties in the area, selling /rental timeframes, etc.