Brickflow Academy

Grow your knowledge & build your business

Short, sharp masterclasses from Brickflow CEO & Founder, Ian Humphreys to help you expand your knowledge of the commercial property finance industry.

Whether you’re a seasoned broker, developer or lender, or new to the specialist property finance sector, we share the essential info you need to know about property finance in a series of succinct videos that take less than 12 minutes to watch.

How does property development finance work?

It may sound like a simple question, but a more in-depth understanding of how property development finance works could mean saving hundreds of thousands of pounds on a deal. In this masterclass, we share:

- How development finance is calculated

- What is sweat equity

- What is the capital stack

- How interest rates work

- The concept of True Monthly Cost

- The importance of personal guarantees

How does bridging finance work?

Bridging loans are no longer a last-resort funding option for property developers and in fact, they’re a powerful tool to facilitate both simple and complex transactions, quickly. In this video, we cover:

- The key features of bridging finance

- When to use a bridging loan

- Using assets to secure a loan

- The differences between regulated & unregulated

- The differences between open & closed loans

- The downsides to bridging finance

- Who can secure bridging loans for property development

The issues that matter to you

We’ve got plenty more videos coming soon, from ‘Why the most successful property developers use a broker’, to ‘The cost of getting your development finance wrong’.

If you’ve got other ideas on topic areas for a commercial property finance masterclass, we’d love to hear them and we’ll do our best to get them made.

Let us know at info@brickflow.com

Enjoying the Brickflow Academy?

If you’ve enjoyed these videos and would like to learn more about development finance, bridging loans or commercial property finance more generally, have a browse of our guides or our award-worthy blog, Brickflow Thinks.

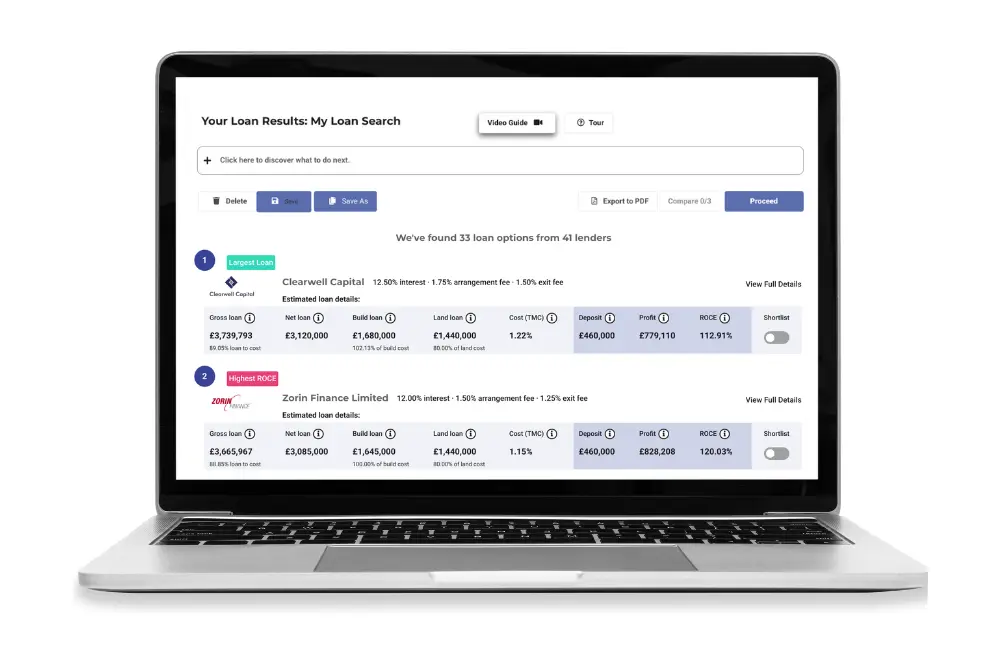

Compare loans from 105+ development finance, bridging loan & commercial mortgage lenders in minutes