Refurbishment Finance

Compare 50+ refurbishment finance lenders in seconds using Brickflow

Compare loans from 50+ refurbishment finance lenders

See how much you could borrow against a specific project & at what rate

Check detailed eligibility criteria to avoid wasting time & money

Ensure your deal stacks & make smarter investment decisions

What is a refurbishment loan?

Property refurbishment loans are a short-term finance solution used to fund a property purchase and any refurbishment work that will be carried out.

A type of bridging finance, refurbishment finance, is secured against the property and/or other properties or assets. They are repaid at the end of the loan term by selling the renovated property or refinancing.

Typically, refurbishment loans are used by property investors looking to ‘flip’ a property for profit or by landlords who want to enter the buy-to-let market with a below-market value property that can be refurbed to achieve higher rental.

They are designed to support small-scale development projects and are very different from development finance, which is generally tailored to ground-up developments, or large conversion projects.

First and second charge

Refurbishment finance can be either a first or second-charge loan. A first-charge refurbishment loan is the principal loan on the property. A second charge refurbishment loan is when the borrower has an existing loan secured against the property, such as a mortgage, but may need additional borrowing to fund the development work.

Second-charge loans are paid after the first charge lender has been paid. This makes it a riskier proposition for the lender and typically results in higher loan rates for the borrower.

Residential vs commercial refurbishment loans

Refurbishment bridging loans can be used for residential, commercial and semi-commercial properties.

Residential refurbishment bridging is, unsurprisingly, for residential properties or the conversion of a commercial building into a residential dwelling.

Commercial refurbishment loans are for the purchase and refurbishment work on commercial properties. Examples of this include:

- Care homes, retirement homes & medical facilities

- Education facilities

- Hotels

- Leisure & Retail

- Licenced HMOs

- Light Industrial

- Mixed-use (part residential, part commercial)

- Mixed-use (all commercial)

- Multi-freehold block

- Offices

- Student accommodation

What types of works are allowed when using a property refurbishment loan?

The type of work you will be allowed to carry out with a refurbishment loan will depend on the lender you use – every lender will have their own criteria and lending parameters. But some typical examples of what refurbishment loans are used for include:

- General refurbishment projects on residential or commercial properties

- Cosmetic alterations such as a new kitchen/bathroom or redecoration

- Improving EPC ratings; upgrading central heating systems, new windows, etc.

- Plumbing and drainage work

- Electrical work and rewiring

- Structural changes and property extensions, e.g. a loft or conservatory

- House-to-flats conversion

- Commercial-to-residential conversion

- Residential-to-HMO (multiple household) conversion

- Refurbishment for buy-to-let investments

- Making upgrades to a business premises, such as office space

Refurbishment loans can be used for properties that are deemed un-mortgageable by traditional mortgage lenders. For example, properties that are classed as ‘uninhabitable’ because they have no working kitchen or bathroom, properties of non-standard construction or structurally unsound buildings. Uninhabitable properties like this are often found for sale at auction, where bridging finance is a key tool to being able to meet the short 28-day completion for auction sales.

The type of work allowed when using a refurbishment loan will also further depend on whether it’s a light refurbishment loan or a heavy refurbishment loan.

What’s the difference between light, medium, and heavy refurbishment?

The exact definition of ‘light’ refurbishment and ‘heavy’ refurbishment will differ from lender to lender, and there is also medium refurbishment loans, but they are generally categorised as follows:

- Heavy refurbishment will involve some kind of structural change; loft conversion, extension, adding an additional storey, etc.

- Light refurbishment involves minor upgrades like installing a new kitchen, or installing a new central heating system.

- Medium refurbishment falls between the two and normally involves cosmetic works, plus the moving of internal walls, and/or replacing wiring & plumbing.

Light refurbishment finance

A light refurbishment bridging loan would be suited to properties that require minor upgrades, mostly focusing on aesthetics, and do not involve any major structural change or planning permission.

The intended use of the building will remain unchanged.

Some lenders may determine whether the refurbishments are light or heavy based on the cost of the refurbishment works – anything less than 15% of the value of the property would be considered light. Heavy refurbishments will usually cost more than 15% of the property’s value.

Examples of light refurbishment include:

- Installing a new bathroom or kitchen

- Replacing old windows and doors

- Installing a new central heating system

- General redecoration and cosmetic upgrades, such as flooring, painting, plastering etc.

- Repurposing one or more rooms

- External work such as re-rendering, renewing roofing or landscaping gardens

- Most non-structural upgrades

Medium refurbishment finance

A Medium refurbishment bridging loan would be best suited to properties in need of cosmetic upgrades as well as altering internal walls, or carrying out electrical rewiring and replacing plumbing.

Examples of medium refurbishment loans include:

- Any structural work that involves removing internal walls

- Altering the internal layout of a property

- Replacing wiring and plumbing (pipes rather than fixtures)

Any structural work, including removing walls or altering the internal layout of a property

Heavy refurbishment finance

Heavy refurbishment bridging loans are geared towards larger-scale, more costly projects typically involving structural changes where it’s necessary to obtain planning permission and adhere to building regulations.

Examples of heavy refurbishment include:

- Any work that requires planning permission (or permitted development)

- Extensions or loft, garage and basement conversions

- Conversions, such as changing a house into an HMO

- Any work to change the use of the property

For any heavy refurbishment project, it’s always worth exploring your finance options – for example, is the scale and building works involved more suited to a development finance loan?

Click through to find out more about development finance loans or, input your details into our development finance calculator to see what loan you can secure.

Property refurbishment rates & costs

With every property investment project, it’s crucial to consider the cost of your loan from the start. Otherwise, it’s impossible to calculate what profit you can achieve, whether or not the property is priced too high, and if you’re actually able to afford the cost of the project.

At Brickflow, you can search the breadth of the bridging loan market instantly and compare live borrowing options from over 50 lenders. It’s the fastest, most efficient way to find the best refurbishment bridging loan for your circumstances. Using real-time data you’ll be able to identify the best loan rates, all whilst understanding the true costs involved. These costs include:

- Interest rates

- Arrangement fees

- Exit fees

- Total lender costs

- Maximum LTVs

Property refurbishment loan rates

There are many factors that will influence the interest rates on a property refurbishment finance, including:

- The term of the loan (longer loan terms can carry higher rates and fees)

- The loan to value (LTV) – lower LTV’s (higher deposit) can achieve better rates, but it would typically require a 40%+ deposit before significant rate reductions kicked in

- The complexity and scale of the project

- The exit strategy

- The strength of the borrower, including experience of completing similar projects, especially for heavy refurbishment loans, and their net asset value and credit file

- Market conditions and the desirability of the completed property

- The lender, who’s criteria may differ to other bridging finance lenders

Generally, residential bridging finance is deemed less risky for lenders compared to commercial properties, so there are more market participants and as a result rates will generally be lower and leverage higher.

Additional costs to consider

As with any financial arrangement, you’ll have to cover various set-up costs as well as the interest charges. These include:

- Valuation or survey fees

- Legal fees (the lender’s legal fees as well as your own)

- Broker fees (normally paid by the lender)

- Arrangement fees (up to 2% of the loan amount)

- Exit fees – they can exist but are not that common when it comes to bridging finance. Almost none of the bridging finance lenders on the Brickflow platform charge exit fees, but they instead might stipulate a minimum loan term – between 1 & 6 months normally (development finance will normally carry an exit fee).

What are the refurbishment finance lending criteria?

To secure any form of finance in the UK, there are standard eligibility criteria as well as criteria specific to the loan type, the project and the lender’s own requirements.

Standard eligibility criteria:

- Aged 18 or over

- UK resident with proof of ID and address history (UK nationals living abroad and non-UK residents can still secure bridging finance from a UK bridging lender, but there are fewer options)

- Employed/self-employed or retired

- Available to individuals, partnerships, LLPs, Limited companies, offshore companies, foreign nationals and pension funds

Additional lending criteria for a refurbishment loan:

- Loan size: Borrowing a minimum of £25,000 (though a lender is more likely to engage for £150,000+), up to £ 100 million

- Security: Has suitable collateral (usually property) that can be secured against the loan

- Loan-term: Typically, the longest bridging loan term available is 24 months, with most lenders offering 12 or 18 months. Where significant build works are involved, and the work is unlikely to be completed in 24 months, development finance might be more appropriate

- Deposit requirements: Most lenders offer 70-75% gross LTV. Interest and fees will be deducted from the gross loan unless you're servicing the loan, but the best rates start to kick in at around 55%-60% LTV (gross)

- Exit strategy: A clearly defined exit strategy is crucial, whether selling or refinancing. Lenders love to see, for example, a BTL mortgage decision in principle to support the application

- Valuation: The lender will instruct a valuation of the property. For heavy refurbishment projects where the lender is required to monitor progress, they will appoint an independent monitoring surveyor (IMS) who will check the quality and progress of the work

- Good credit: Refurbishment bridging loans are asset-secured so credit history is less important than with residential mortgages, but having clean credit can help to secure better rates

Project specific criteria:

- Property type: Residential, commercial and semi-commercial properties.

- Other finances: Where the refurbishment loan is the second charge, the primary mortgage (or other loan) payments must be up to date

- Project details: A clear, detailed outline of the project, including all the work involved, material costs, the professional team involved (where relevant) and market research to substantiate the suggested GDV (Gross Development Value).

What information will I need to provide?

Any application for bridging finance for refurbishment will need to include a professional presentation (our software creates this presentation for you) that demonstrates your planned project and your ability to complete it on time and on budget. It will need to include:

- Property details: Price, location, condition

- Project details: What you plan to do with the property, the work involved, costs of the refurbishment, timescale for completion and estimated value once completed

- Your experience: Detail any previous property projects you have successfully completed

- The exit strategy: Sale or refinance

- Your current circumstances: Employed, retired, income, credit history, proof of ID and address

- An assets and liability breakdown

Refurbishment examples

Whether refurbing a property as a quick ‘property flip’ project or as a rental investment, the journey usually goes something like this:

- Find a property

- Apply for refurbishment finance

- Loan approval and terms agreed

- Funds distributed: For some projects, funds may be released in stages as the work progresses and certain milestones are reached

- Refurbishment work begins: Where the funds are released in stages, lenders will arrange for an independent monitoring surveyor or asset manager to monitor progress and quality and ensure the work is going to plan. The next stage of funding can be withheld if the renovations are not progressing as agreed at the application

- Completion and loan repayment: After the works are finished, the property is sold (at an increased value) or refinanced on a longer-term mortgage.

Looking at an example scenario of using refurbishment finance for property development is the best way to understand how it works.

| Property Purchase Price |

£200,000 |

| Purchase Costs |

£10,000 |

| Cost of Refurbishment Works |

£50,000 |

| Estimated Value after Refurbishment |

£340,000 |

| Loan Term |

12 months |

The process:

- ENTER your project criteria and model deals

- COMPARE loans from 50+ bridging lenders

- APPLY for a loan with your intermediary

When you apply for a loan through the Brickflow platform, you can use our digital application form, which lenders love because it covers everything they need to know. If lenders have all the information they need from the start, they can make quick and confident credit decisions, meaning faster turnaround times for your loan.

Bridging loans can be arranged in as little as 7 days (or sooner), so you can get your project underway within a week of first seeing the property.

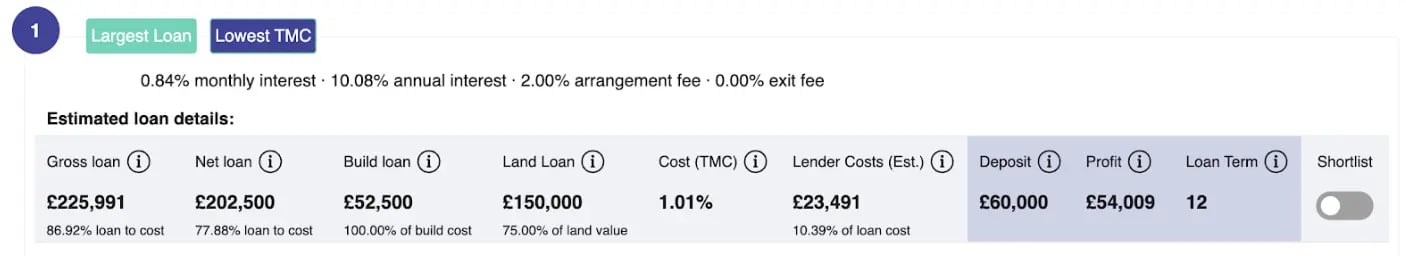

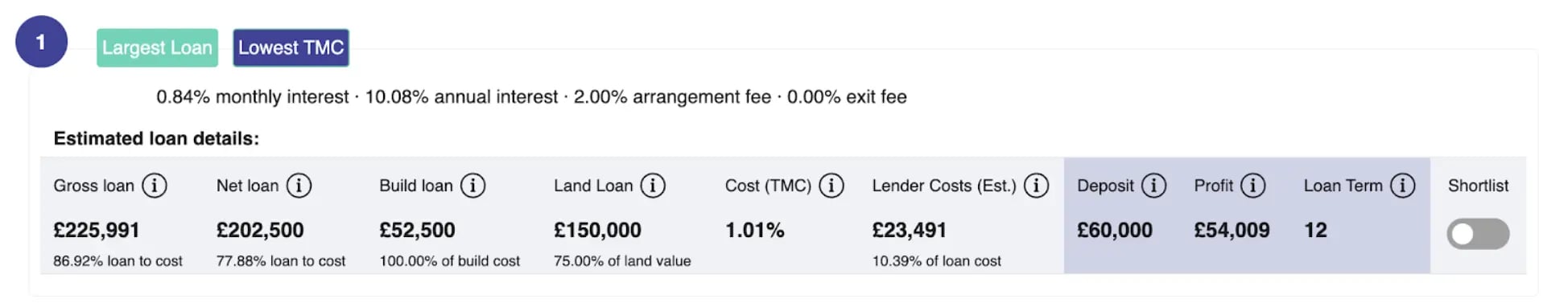

In our scenario above, with a £60,000 deposit, the borrower could secure a net loan of £202,500, covering all of the refurbishment costs.

Tips to help secure a refurbishment loan

Bridging loan lenders specialise in arranging fast, flexible loans for borrowers – but only if they’re confident in the project and in you as a borrower.

Here are some tips to bolster your application and help you secure a refurbishment loan:

- Model your deal using Brickflow: It takes seconds to run your project numbers through Brickflow’s bridging loan search and see how it stacks up against live borrowing costs. Lenders are only interested in clearly viable deals – if your deal doesn’t stack on Brickflow, it won’t go anywhere with lenders

- Present a strong exit strategy: A lender’s priority is how they’re getting repaid, so don’t approach a lender and say, ‘I’ll maybe sell, or maybe keep it for renting’ – they want a definitive plan from the outset. If the plan changes, then that is ok, but certainty on the direction of travel is preferred. Having a BTL mortgage pre-agreed in principle, if possible, will strengthen your case

- Be upfront about credit issues: Refurbishment bridging loans are based on the project and the exit strategy, so issues with your credit history won’t necessarily stop you from securing a loan. However, be upfront about any missed loan payments, previous bankruptcy or CCJs – uncovering this midway through the application will delay things, and you might lose the lender's confidence in you as a borrower

- Maintain open communication with your lender: Respond quickly to lender’s requests and maintain a dialogue throughout the application process

Why you should use Brickflow to secure refurbishment finance

Brickflow is the quickest and easiest way to search for bridging finance and secure the best value refurbishment loan for your project.

- ENTER YOUR PROJECT CRITERIA & MODEL DEALS: It takes seconds to enter your project details and see whether or not your deal is viable against actual borrowing options.

- COMPARE LOANS FROM 50+ BRIDGING LENDERS: Instantly search over 50 lenders from the breadth of the market, including mainstream banks, challenger banks and specialist lenders. Compare costs from arrangement fees to interest charges, and shortlist your preferred loans.

- APPLY FOR A LOAN: With your intermediary, or a Brickflow partner, you can request a DIP from multiple lenders, using the same online form and get results back within the hour – our record is 7 minutes! Then apply directly from the platform using our lender-favoured digital application.

At Brickflow, we’ve made the bridging loan market accessible and transparent for all. You can make informed decisions about your loan choice, ensure your deals stack against live market borrowing costs, and ultimately make smarter property investments.

Get in touch to find out more.

How can you get a loan for refurbishment?

Brickflow is the quickest and easiest way to secure the best value refurbishment loan for your project.

The process:

- SEARCH & COMPARE loans from 40+ bridging lenders on Brickflow, instantly

- SHORTLIST your preferred lenders

- RECEIVE a same-day DIP (our record is 7 minutes!)

- APPLY for a loan with your broker or a Brickflow partner

What exit strategies are acceptable to the lender?

Lenders will expect you to sell or refinance the property, typically on long-term finance such as a buy-to-let mortgage.

You can also repay your refurbishment finance by selling other assets -you would need to provide proof of these other assets at the outset.

Do bridging loans cover refurb costs?

Yes, bridging loans can typically cover up to 100% of the build costs and up to 75% (gross) of the purchase costs.

How do refurbishment loans work?

Refurbishment loans are a type of short-term, secured bridging finance. The loan is used to purchase and refurbish a property before selling it on at an increased value or refinancing on a longer-term mortgage.

The typical process involves:

- Finding a property

- Applying for refurbishment finance

- Loan approval and terms agreed

- Funds distributed

- Renovations begin

- Completion of project and loan repaid by sale or refinancing

What is refurbishment buy-to-let?

Refurbishment finance can be used by buy-to-let investors to purchase a below-market value property and carry out renovations and upgrades to bring it up to standard for a rental property.

Once the refurbishment is completed, the loan is repaid by refinancing the property on a buy-to-let mortgage.

What type of properties can be refurbished?

Refurbishment finance can be used for residential, commercial or semi-commercial properties.

How do lenders monitor refurbishment projects?

Where a refurbishment project requires monitoring by the lender (usually large-scale, heavy refurbishment projects), the lender will appoint an independent monitoring surveyor (IMS) or an Assets Manager (normally an employee of the lender that has IMS experience). The IMS will be a chartered surveyor who will visit the site at regular intervals to check the progress and quality of the work.

Funds may be released in stages as certain work milestones are completed. If an IMS carries out an inspection and sees that the work is not progressing as planned, they can withhold the next funding release until the expected outcome is achieved.