Development Finance Calculator

Brickflow’s development finance calculator is the only tool on the market that lets you search and compare live development finance loans from over 50 lenders, instantly.

Why Use Brickflow’s Development Finance Calculator?

Unlike existing calculators that guess interest rates and fees (or worse still, let users guess!), Brickflow's development finance calculator is actually a live search of the market, allowing you to model your deals and ensure they stack against actual borrowing options.

Here’s why you should use our calculator:

- Instantly search and compare loans from over 50 development finance lenders

- Model your deal, make sure it stacks and avoid wasting time on unviable projects

- Like-for-like comparison of loan options

- Detailed search results showing deposit requirements, Return on Capital Employed, interest rates, arrangement fees & more

- Filter results to perfectly match your criteria

- Find the best deal on the market, save time and save £££

Brickflow is the only platform that directly connects borrowers, brokers and lenders. Our digital marketplace allows you to model deals, source, and apply for development finance – all in one place. It is the most efficient and streamlined way to secure the best development finance loan on the market.

How it works:

- SEARCH & COMPARE loans from 50+ lenders, instantly

- RECEIVE a same-day DIP (our record is 7 minutes!)

- APPLY directly from the platform with your intermediary or a Brickflow partner

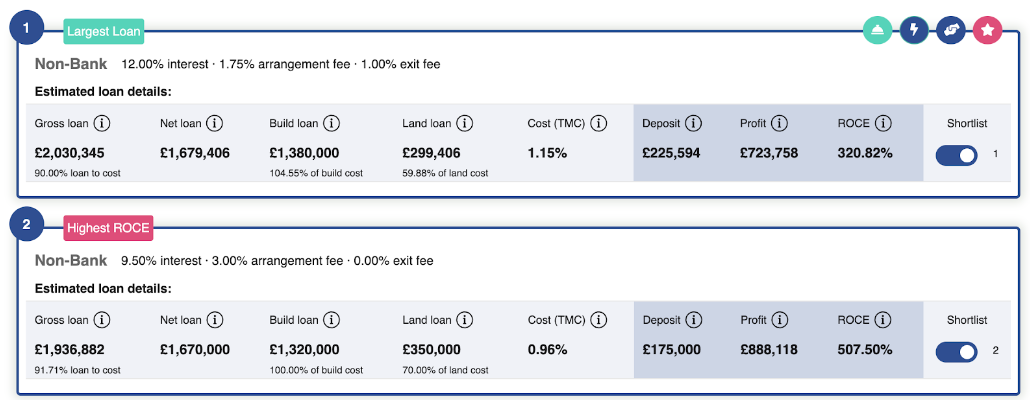

Your search results will show every lender on the platform who can potentially offer a loan on your project. Using the filters will help to narrow down lenders. You can then delve into the details of your live market search, looking at accurate and up-to-date figures for:

- Interest rates

- Arrangement and exit fees

- Gross loan, Net loan, Build Loan and Land

- Loan figures

- True Monthly Cost (TMC)

- Deposit requirements

- Profits

- Return on Capital Employed (ROCE)

Compare loans from 40+ development finance lenders

See how much you could borrow against a specific project & at what rate

Check detailed eligibility criteria to avoid wasting time & money

Ensure your deal stacks & make smarter investment decisions

Development Finance Criteria

Securing a development finance loan primarily depends on the strength of your project and your ability as a developer to complete it on time and on budget.

There are some basic eligibility criteria you will have to meet, though, as with most finance commitments in the UK, including:

- Age: 18 or over

- UK Resident (ideally): There are fewer options for UK nationals living abroad and non-UK nationals

- The project is a business venture: Whatever your project, the aim of the project must be to generate a profit either from a sale or rental income

- Equity requirements: Any development finance loan will require a level of equity contribution. Typically, between 50% and 70% of site value can be borrowed and up to 100% of build cost – the shortfall is the amount of deposit required

- Credit history: Lenders will perform a credit search – poor credit history won’t necessarily prevent you from securing funding as lenders are driven more by the project and the people behind it, but poor credit could mean lower LTVs, higher rates or additional security. Bad credit should always be declared at the outset, to build trust with lenders

Lenders will also want to see documentation for:

- Anti-money laundering: Borrower’s identity documents and proof of address

- Source of wealth: Summary of how funds were obtained, with supporting evidence

Beyond the basics, lenders will then deep dive into your project. Providing a comprehensive presentation detailing every aspect of the development is essential.

After you’ve searched for loans in the UK using the development finance calculator, you can continue to apply to lenders using our Smart Appraisal Tool where our software builds a lender friendly presentation for you, that lenders love it because it covers everything they need to know, meaning they get the right information first time, leading to quicker decisions and deal certainty.

You can also read our guide on how to build the perfect project presentation.

As a minimum, your presentation should include:

- Developer CV covering professional qualifications and previous development projects (at Brickflow, you can save your CV, and we’ll automatically update it with newly completed projects)

- Development appraisal detailing land value, building costs and expected GDV, as well as relevant market comparables

- Development schedule – a detailed list of all properties being built, with square footage and sale prices

Every development finance lender will have different criteria and different lending parameters, but if your numbers don’t stack up, or the profit margin is too small, lenders won’t take the risk.

Using Brickflow’s calculator to model your deal can help you to understand the viability of your project before spending hours on due diligence, or how you can make it viable, for example, renegotiating what you pay for the land.

To find out more about development finance eligibility requirements, take a look at our guide “Who Is Eligible For Development Finance”.

True Cost of a Development Finance Loan

Until you understand the actual cost of a development finance loan, you can’t accurately calculate profit, and therefore how do you know what the site is worth?

Any investor should concentrate on determining the residual land value, or fair value for the site before they make an offer.

The residual land value is calculated by subtracting the build costs, funding costs and developer profit from the GDV.

If you think the GDV of a site is £ 10m, your build costs are £ 4m, and you want to make a profit of £ 2m (20% of GDV), that leaves £ 4m for the land value. However, you still need to deduct the funding costs and every investor underestimates their funding costs.

If you estimate your funding costs at £ 500k, then you might offer £ 3.5m for the site. If you later work out your funding costs are closer to £ 1m, this means you have overpaid for the site.

You can avoid this common pitfall by modelling your site on Brickflow.

The costs involved in a development finance loan include:

- Interest: The interest rate that lenders charge for borrowing money, is rolled up and paid off at the end of the term. Lenders determine their rates based on their cost of funding, the size of your loan, the LTV ratio, the strength of the project and demand for this particular property type in this location, your experience of successfully delivering similar projects, and your equity contribution.

- Arrangement fees: A one-time fee to cover the lender costs of setting up the loan, typically between 1% and 3% of the gross loan amount.

- Exit fees: Typically between 1% and 2%, and payable at any time (so not the same as an early repayment charge on a regular mortgage). Not all lenders on the Brickflow platform charge this, but most do. If you repay the loan early, the exit fee will not change, but you could reduce overall interest costs by repaying early.

- Valuation fees: Lenders will instruct a professional valuation of the site as it is, and the future project to determine its finished market value. The borrower meets this cost.

- Legal fees: You will have to pay legal fees, yours and the lenders, for drawing up the loan agreement and for carrying out the necessary searches and checks on the property.

- Monitoring fees: During the development process, the lender will require regular updates and reports before they advance monies to meet the build costs. This is outsourced to an Independent Monitoring Surveyor (IMS), and there will be fees charged for this monitoring service and for the upfront appraisal of the site.

The rates and fees that you pay will vary with every lender, and so will your deposit requirements, as each lender has different lending limits. Brickflow’s development calculator is the easiest and most accurate way to understand the cost involved.

We also use the metric ‘True Monthly Cost’ (TMC) as a way to fairly compare loan options, which is calculated as below:

(Interest Rate / 12) + (arrangement fee + exit fee) / number of months = TMC

- E.g. (10% / 12) + (2% + 1.5%) / 18 = 1.03% per month

TMC gives an overall representation of what each loan costs. The costs involved are shown on every Brickflow search for development finance.

In this example, you can clearly see the 2nd option, once the interest rate and the arrangement & exit fee is considered, is 0.19% cheaper per month (2.28% per year) - which would mean a saving of nearly £ 23k per £ 1m borrowed.

Development Finance Example: How a Development Finance Loan Works?

Development finance loans are complex and take time to arrange, with every loan tailored to each individual project. As well as the lender, there are additional third parties involved.

Once you have submitted your documentation and development appraisal presentation to the lender, they will confirm credit-backed terms and instruct their Independent Monitoring Surveyor (IMS) and valuer – these fees must be covered upfront, even if the loan does not complete.

The valuer will:

- Confirm site value and suitability for security

- Run a high-level sense check on the build costs

- Confirm the GDV of the end units

The IMS will:

- Closely examine costs and construction methodology

- Assess the developer and their team's ability to deliver the scheme on time and within budget

- Agree a build loan drawdown schedule

Legal work: Once the lender assesses the reports, solicitors will be appointed to deal with the construction and loan documentation -development finance lenders will prefer you to use a solicitor with construction expertise in-house.

Drawdown: When the lender is happy with all valuations and reports and their solicitor is satisfied that all development finance criteria have been met, funds will be sent to the borrower’s solicitor to initiate the loan.

Development finance is allocated in phases; phase 1 is for site acquisition, and phase 2 is to fund the construction. Phase 2 is paid in stages (called tranches) at agreed milestones throughout the construction process. The specifics of the tranches (how much and how often) are agreed from the outset to align with the build schedule, but each tranche can only be drawn when signed off by the lender’s monitoring surveyor.

The loan is drawn in stages because it protects the lender and avoids funds sitting unused in the bank accumulating interest charges for the borrower.

A worked example of a development finance loan:

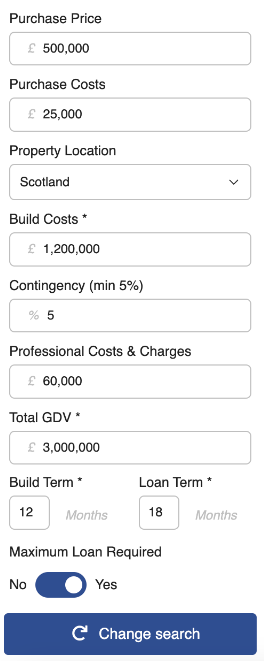

We can look at an example scheme with a £525,000 total purchase costs, £1.2m build costs + £60k contingency and £60k professional costs to see how a development loan works in practice.

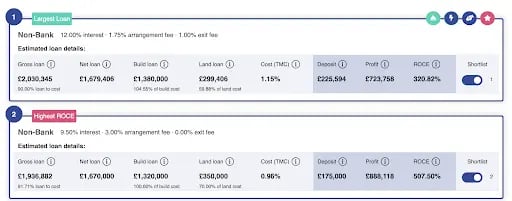

Two potential loan options in this scheme look like this:

A lender’s maximum lending limits, including the land LTV, can affect your deposit requirements by tens or hundreds of thousands of pounds – in these two examples, there is a difference of over £50,000.

Enter your project numbers into Brickflow’s Development Finance calculator today – it takes less than 2 minutes and gives you the clearest, most accurate demonstration of how development finance works and how much it costs.

Whether it’s residential or commercial development finance you’re after, Brickflow’s development finance calculator is the go-to option.

If you’re interested in other types of finance, including bridging finance or commercial mortgages, why not try out our other calculator options below:

- Bridging Loan Calculator

- Commercial Mortgage Calculator

If you have specific questions that need answering, please do get in touch with our team today.

What if I don’t get any search results?

Where a property development project is unviable, i.e. not generating a large enough profit relative to the loan amount, then no lender will offer a loan. Try amending your numbers where possible, but if you’ve done your due diligence and cannot make any amendments, then it’s likely your deal simply doesn’t stack up.

Development finance loans range from £26,000 - £300m on the Brickflow platform, but few lenders will engage below £150,000.

How is development finance calculated?

For development finance, a lender will calculate their loan based on 4 key variables:

- A % loan cap against GDV

- A % loan cap against total project costs (inc. loan interest & loan arrangement fee)

- A % loan cap against the day 1 land value

- A minimum % input of client deposit / equity

The loan amount needs to respect all four of these caps and whichever cap is hit first determines the gross loan amount.

From the gross loan, the lender deducts in the following order:

- Their forecasted interest costs (more on that below), arrangement fee and projected professional fees - what’s left is known as the ‘net loan’ this is the amount that is available to the borrower.

- After their fees have been deducted, they next deduct the build costs and build cost contingency. This is the build loan. This will be drawn in stages. The lender will always want 100% of build costs funded before making a land loan available.

- Any residual loan after 100% of build costs, is made available against the land (providing the lender day 1 land cap is adhered to), and this is the land loan.

Can you get 100% development finance?

Yes. However, think of it more as a joint venture with a funding partner rather than a lender offering you all of the funding to complete your own project. Typically, the funding partner purchases the land (which acts as a security), and if the scheme is delivered on time, on budget and as expected, you’ll receive a profit share (after all costs, including funding costs, have been deducted).

How much can I borrow for property development?

Property development finance loans can stretch to £300 million and beyond. How much you can borrow depends on various factors, including:

- Your project, the location and market demand for that type of property

- The GDV, build costs, and purchase price of your project

- Your equity contribution

- Your experience as a developer and ability to deliver the scheme

- The professional team you’re working with and their level of experience

- Your creditworthiness

Who is eligible for development finance?

Any property developer or investor with a viable project that demonstrates exact details on what they build, where, for how much and with a realistic end value and profit is potentially eligible for development finance.

Other considerations such as minimum age requirements, residency status, creditworthiness and past experience will also help to determine eligibility.

Can I get a bank loan for property development?

Development finance for ground-up builds, large conversions or heavy refurbishments can be secured with a bank, specialist lender or via private finance/investment companies.

How do you fund a development property?

The quickest way to secure the best value funding for your project is to search for development finance loans on Brickflow.

It takes less than two minutes, covers the breadth of the development finance lending market and enables you to compare live borrowing options with details on rates, fees and maximum loan sizes.

What is the exit fee for development finance?

When your loan term ends, some lenders charge an exit fee on repaying the loan. It is typically between 1% and 2% of the gross loan value.

Can you get extensions on finance?

In some circumstances lenders will extend the term of your finance after your original term ends. Maintaining an open and honest relationship with your lender is key, so they can fully understand why exactly you need an extension, or why you were unable to complete within the agreed timeframe.

Lenders can make life difficult when they want their money back, pushing you to sell below what you want to achieve or offering an extension that is overly expensive and eats into your profits, with seemingly punitive conditions. Where your project is complete but has not yet sold, or only partially sold, refinancing onto a development exit bridge might be a better solution.

Can I get development finance with very bad credit?

Yes, it is possible. A lender’s primary concern is the strength of your project and the exit strategy. Being upfront about any issues with your credit file from the outset will help gain lender trust and confidence, rather than it being uncovered later down the line. Where bad credit can be an issue is if you intend to refinance on completion, such as onto a Buy-to-let mortgage, as your credit file is much more key to securing long-term finance from a traditional lender.

Do you need a deposit for development finance?

Yes. Deposit requirements vary greatly depending on the lender, the project, the location, the borrower, and their financial standing, but it typically ranges from 40% to 50% of the total project cost.

In some circumstances, you can apply to work with a Joint Venture Build Partner on your project, who will cover land purchase and build costs for a profit split.