What is the difference between bridging and development finance?

What is the difference between bridging and development finance, and how are they both used?

Borrower Tips

Borrower Tips

A Design and Access Statement (DAS) is an integral part of a planning application and required by planning rules. Every property developer or architect working on anything other than a very small project must submit one.

A DAS is your chance to explain how you arrived at the final design for your project. In this Guide we explain what it should contain, when you might need one and how to create one. We also share some finance tips and answer FAQs.

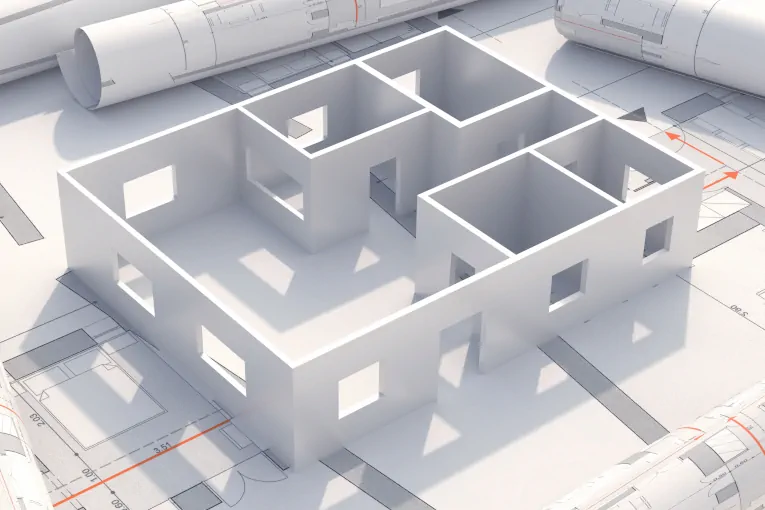

A Design and Access Statement is a short report that supports a planning application, explaining the thinking and design behind a proposed development. A well-written DAS explains how your building and open spaces will meet the needs of the development users.

It can include plans, elevations, illustrations and photographs, and for more complex or larger developments, models may be supplied.

The idea behind a DAS is to show the local authority you’ve thought about the day-to-day needs of the people living and working on your development, and not just the buildings.

A DAS looks at the relationship between buildings, open spaces and users, and should consider several factors, such as:

*Access must be inclusive, considering age, disability, ethnicity and social grouping.

Other areas to include are crime prevention and how you’re helping site users feel safe.

When do I need a Design and Access Statement?

You need to produce and submit a DAS alongside your planning application when:

To create a Design and Access Statement, think carefully about all aspects of the development. Start with the people and how it will impact them, and finish with the design. This should be a short document summarising and justifying your design decisions.

Your framework should cover:

Assessment - in this case, the devil’s in the detail. For example with accessibility, assess the travel distances within the site and to local amenities, such as shops and public transport links. Consider gradients and how buildings are sited for site topography.

Evidencing green credentials is a priority and planners will want you to assess your site’s energy efficiency. How will it perform in the winter and summer? What will the energy consumption be and what conservation measures do you have in place to reduce bills?

Consultation - your design should take on board comments from neighbours, local groups and official bodies like the police and National Highways. By asking various end-users what they would like to see in your design, you can show how their feedback has impacted your decision-making, resulting in a truly inclusive project.

Evaluation - having undertaken a consultation process, it will be easier to demonstrate how you’ve used research and data analysis to thoroughly evaluate the project; from assessing the site to final design.

Design - this is where you show how the final design evolved and how you resolved any issues raised during the assessment and consultation stages.

Tip: When drafting a DAS, highlight how your development meets sustainability guidelines and the National Planning Policy Framework.

Planners will expect your DAS to:

To help you with the layout and content, here’s an example of a Design and Access Statement.

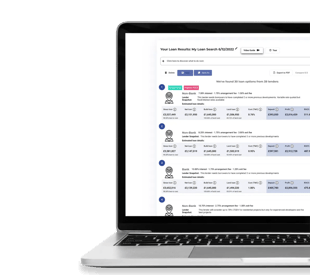

By using Brickflow’s development finance platform, you’ll be giving your property development project a solid foundation for success. And by saving time and money, you can plough more energy into your Design and Access Statement.

Brickflow is the UK’s first comparison site for development finance, enabling you to:

Brickflow delivers estimated loan sizes and pricing from around 40 lenders in two minutes. Borrowers then can complete one online application for a decision in principle from up to 3x lenders in just 20 minutes. The platform instantly selects lenders likely to make a loan offer, resulting in a 90+% loan conversion rate.

.gif?width=646&height=364&name=Untitled%20design%20(2).gif)

Here are some answers to commonly-asked questions about Design and Access Statements.

Why do developers need a Design and Access Statement?

It’s a mandatory requirement of The Town and Country Planning Order 2013 and applies if you meet the criteria in our ‘When do I need a Design and Access Statement?’ Some planning authorities may have their own rules about when to submit a DAS, so check before completing your planning application. A pre-app consultation should identify what you need.

What if plans are filed without a DaS?

If your application requires a DAS and you fail to submit it, planners will not register or consider your application. The planning process stops until you provide one.

What is classed as an accessible home?

The Equality and Human Rights Commission publishes a guide to accessible homes for local planners. It is a great toolkit for architects and designers, covering access areas, lighting and the pitch of stairs. Find it here.

How can I show how my development will impact a neighbourhood?

Effective graphics are a good way to show how your development will impact a neighbourhood. They enable you to overlay the finished look onto images of the area as it is now, and will give a better sense of size and scale than the written word.

Is there a DaS template online?

Many local authorities have a template DAS, so check your local council online. Or check out the Design and Access Statement example we shared with you earlier in this Guide.

When should you arrange your finance?

As with most things in life, the more prepared you are, the less mistakes you’ll make. Some developers make the mistake of trying to arrange their funding after a site offer is accepted.

However when doing this, you’ll be making an assumption on the deposit size and lending costs, which means you could end up overpaying for your site. Similarly if there’s a deposit shortfall, it can often be expensive to plug.

To meet this shortfall, you’ll either have to raise the funds from investors, divert them from current projects or forgo the opportunity of developing future sites.

If lending costs are greater than you forecast, this means less profit. And if you’ve already agreed to the land price, you have no choice but to renegotiate or swallow the loss (caused by bad planning!).

This is easily avoided by getting a lender decision in principle - it takes 20 minutes on the Brickflow platform, and our Deal Forum process provides the greatest chance of the best outcome.

This is easily avoided by getting a lender decision in principle - it takes 20 minutes on the Brickflow platform, and our Deal Forum process provides the greatest chance of the best outcome.

Brickflow is designed to be used by experienced finance & property professionals and property developers using Limited Companies or Incorporated Partnerships, to source and apply for development finance loans.

Brickflow is not an advisory business and does not give advice. It can deal with purely factual inquiries and provide information but it will not give an opinion or recommendation in any circumstances.

Property development carries risk, including variables beyond the developer’s control. A property development loan is debt and should be procured with caution.

Brickflow does not provide personal mortgages, but your home and other assets are at risk if you provide a personal guarantee for a corporate loan.

What is the difference between bridging and development finance, and how are they both used?

A short guide on bridging loan eligibility criteria, what they are used for and what you need to apply.

What is the criteria and who is eligible for development finance: a quick guide that also covers the costs involved and how to apply.