How to finance your property development?

Wondering how to finance your property development? Read our short guide on development finance options, the documentation needed and how to get...

Borrower Tips

Borrower Tips

Whether it’s a low-key investment or large-scale site, property development projects wouldn’t get off the ground without funding. We’re looking at the key features and main uses of property funding, beginning with how does property development finance work?

| Table of Contents |

Property development finance is money loaned to developers for the purchase of land or sites and the construction of new residential, commercial or mixed-use buildings. Unlike homeowner mortgages, which can stretch over 35 years, development finance is short-term and typically repaid within 9-36 months, depending on building completion.

Developers receive tailored funding for the project and build programme so a full property development finance package is complex and resource-heavy to arrange. Therefore, most lenders don’t consider applications below £150,000 but prefer much bigger loans due to the economies of scale available. It takes a similar resource to underwrite a £500,000 loan as it does a £5m loan. There are other types of development finance that can be used for smaller projects though, such as buy-to-sell or buy-to-let mortgages, bridging loans and personal loans.

How much a developer can borrow depends on some key figures:

The lender will complete professional valuation reports of the site and building plans and calculate loan to Gross Development Value (LTGDV) and Loan to Cost (LTC) to determine their lending limits. The criteria and lending parameters will differ with every lender of property development finance UK wide. Development loans are repaid once the new development is sold, or by refinancing on a longer-term mortgage. Finance is arranged through either a bank or non-bank lender.

Property development has so many variables, but how it’s financed has some consistent key features, which helps developers to make realistic financial projections. So, what are the key features of development funding?

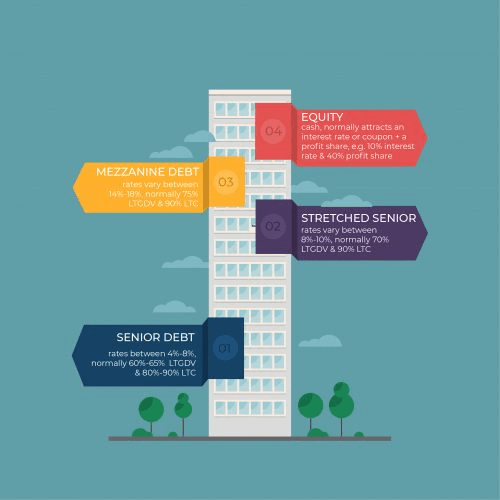

Funding is made up of layers of debt and equity (deposit input by the developer/shareholders). The debt can be broken into tranches according to who is repaid first in the event of default. Typically, a development finance loan will have senior debt (this lender has a first charge, therefore is repaid first), and a secondary, smaller mezzanine loan. This lender has a second charge and is paid after the first lender. This carries more risk and therefore higher interest rates.

Equity might also be borrowed through a developer’s own network, although some lenders play in this space (family offices, P2P, HNW). This preferred equity is paid after all other debts but before the owners/developers. These funds are brought together in The Capital Stack, which could look something like this:

Debts are repaid from the bottom up. The capital stack is a key feature of any development funding so lenders can see where they fit into the hierarchy to assess their level of risk.

Another key feature of property development finance explained is how it’s paid out - since property development happens in stages, development finance is allocated incrementally. Phase one covers part of the site cost and phase two is the building finance, which is paid in segments, or tranches. As construction progresses, appropriate funding is available at each stage and drawn-down as work is completed and signed off by the lender’s monitoring surveyor. This avoids funds sitting unused in the bank accumulating interest charges. The specifics of the tranches (how much/how often) are agreed from the outset with the lender and their IMS (Independent Monitoring Surveyor) to align with the schedule of works.

With so many possible avenues in property, what are the main uses for development finance? Development finance is solely for developing property as a business, i.e. to generate a profitable sale or rental income and is not designed to be used for homeowner renovations. Development finance can be used for ground-up construction as well as refurbishments or conversions of existing buildings, and it can be used for residential, commercial or mixed-use/semi-commercial developments.

Residential development finance would be used for the purchase of land or property that will be developed for residential use. This would also include where a developer is converting an existing commercial building (such as a warehouse) to become residential. Crucially, development finance is used when the site has detailed planning permission or permitted development rights. Prior to permission being granted, a bridge loan should be used to provide the finance, and then converted to a development loan.

Commercial development finance is loaned specifically for developing commercial properties. Usually a pre-let or pre-sale (a business has pre-agreed to a rental contract or purchase) is required by lenders. Where the development is a mix of residential and commercial, such as flats above shops, every lender sets limits on what’s an acceptable percentage of the overall scheme being commercial.

Development finance is the most appropriate funding for ground-up construction, large-scale and large-budget builds or renovations. The other finance options that fall under the umbrella of development finance, such as buy-to-let and buy-to-sell, also allow developers to invest in property for the purpose of developing for profit. Bridging loans are a form of short-term development finance used to buy auction properties or properties that don’t meet traditional mortgage criteria, like housing with no kitchen or bathroom facilities. Or, to purchase land or properties prior to having detailed planning, or where a developer wants to rework existing plans.

Choosing appropriate funding is crucial for a profitable development outcome, but with so many lenders and options, it’s hard to find the best deal. Using a specialist mortgage broker for development finance is the best way to search and compare the breadth of the market. Their expertise means they quickly eliminate lenders with unsuitable eligibility criteria and focus solely on relevant lenders.

Since development finance is tailored and complex, there’s no one-size-fits-all loan. Lender criteria vary dramatically with different caps on what percentage of land and build costs they’ll offer, as well as LTGDV. Most significant is that deposit requirements can range from 5%-35%, so a development with costs of £10m could vary by a whopping £3m.

Developers often return to the big-bank lenders, believing the comparatively lower interest rate equals the best deal. But in reality, paying slightly higher interest is outweighed by reducing deposits, potentially freeing up hundreds of thousands of pounds, and increasing your return on capital employed (ROCE). A property development finance broker understands these nuances, and moreover, they have relationships with the alternative lenders who traditionally offer higher leverage and more flexible funding.

At Brickflow, we’ve democratised the process of getting finance for property development, allowing every borrower to access the best funding for every project. We work with the best brokers in the market, and our platform allows them to source and compare loans in a matter of minutes. Receiving a decision in principle (DIP) normally takes weeks, but we’ve got it down to under an hour! Using a specialist mortgage broker for development finance is key to securing the best deal and Brickflow is revolutionising the process, making it lightning-fast and efficient.

If you're a broker, register for Brickflow today and have a DIP on your desk tomorrow. If you're a developer, model your deals and check how profitable they are, or if you're ready to apply, contact Brickflow to be connected to one of the best brokers in the market.

Wondering how to finance your property development? Read our short guide on development finance options, the documentation needed and how to get...

Why is development finance important? A look at the benefits of using development finance, what paperwork is required and if it’s the right choice...

What are the different types of development finance? A short guide looking at the options for funding property development and how to get finance.