Fix and Flip Loans: A Comprehensive Guide For Beginners

What are fix and flip loans? Discover how fix and flip loans work, their benefits and risks, and tips for securing these loans to succeed in property...

Industry Insights

Industry Insights

Welcome to October's Industry Insights, our monthly round up of the conversations we’re having with commercial finance brokers, property entrepreneurs, agents and lenders. This month we look at interest rates, bridging finance and the commercial mortgage market.

Development Finance

After a tumultuous 7 weeks of government and economic upheaval, this month we assess the effects this has had on the commercial property and finance markets.

As we’ve said before, property development is counter-cyclical. If you are buying land to build new homes on at the moment, then you are around 2 years away from delivering those properties to market, and that’s if you have your planning. If you need to go through the planning process, then that could easily become 3 years. Therefore, what house prices do in the next 12 months or so, is less of a concern. Property developer’s instead want to know what prices will be doing in 2 or 3 years time.

Everyone will have their own view on interest rates.

The consensus now seems to be that they won’t increase by as much as previously forecast, and that any rise will be fairly short term. High enough to get our stubborn inflation under control, but short enough not to cause a property market collapse through unsustainable mortgage costs.

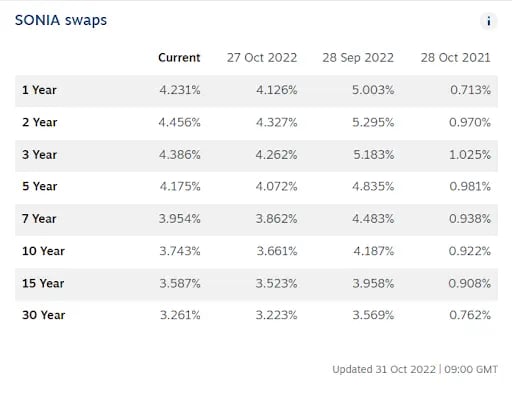

This theory is part-supported by SWAP rates - the 2 year SWAP rate is currently higher than the 5 year SWAP rate, which means the markets feel that interest rates will be lower on average over the next 5 years, than they will over the next 2 years.

Source = https://www.chathamfinancial.com/technology/european-market-rates

With 2024 being an election year - assuming of course, that we hang on that long - you would think the government will be doing all it can, to ensure that the end of 2023 and beginning of 2024, will be looking a lot more positive than the end of 2022 and beginning of 2023.

Whilst rate-setting is independent, government policy is a huge arbiter of interest rates, and you can expect policy to be shaped with that end goal of a more vibrant economy and a decreasing rate outlook, come election time in 2024.

What has been most interesting about recent events is the effect it has had on the pricing of loan products. In the development finance market you can borrow from banks and what we call non-banks.

Loans from banks are typically pegged to an index; like the Bank of England Base Rate or SONIA, therefore the cost of borrowing from banks at the moment has increased and will increase much further as interest rates push higher.

Within the non-bank category, you have various different types of funding sources and structures. Some offer floating rates and have equally been affected as the banks. But most importantly, and unlike with banks, there is still some fixed rate money available with non-banks.

So how are these non-banks funded?

Well, perhaps counter-intuitively to some people reading, some non-bank lenders are funded by banks. Figure that out. So their funding costs have behaved in the same way as a bank, in that if their funding line tracks an index that is going up, then their cost of funding is also increasing.

However, some non-banks are funded by other institutional funding lines, perhaps a pension fund or insurance company. There is not a uniform way in which these funding lines are priced.

Some will be strongly correlated to an index such as the base rate or SONIA. Others will not. It’s those that are not pegged to an index, that will deliver the best value to borrowers right now.

Other non-bank lenders are funded by Peer to Peer money. There aren’t many lenders that I can think of that are still purely funded by this source of capital anymore, most will have alternative arrangements in addition. But, it will be interesting to see how resilient the retail investor money is to increasing interest rates.

The biggest driver for investors within the P2P sector has been the attraction of the much higher returns that could be achieved, in comparison to their money sitting with their bank.

If interest rates rise and retail investors can earn 5% in a 30 day notice account, will they still be seduced by a 6% return on a permitted development scheme to a novice developer?

Regardless of how you have sourced your funding before, it is now more important than ever for borrowers and brokers to shop around. Only going back to the same lender at the moment is bordering on reckless. If your normal lender’s sources of capital have been unduly affected by the recent turbulence, then that lender, that has always looked well-priced, could now be very expensive. And whilst they might tell you everyone has been affected the same, they definitely haven’t.

As one very experienced development finance broker that uses the Brickflow software remarked this week;

‘Twelve months ago I would have known with a very high degree of certainty, what every one of the 40 lenders on Brickflow would be pricing at and what their lending appetite was. But today, I have no idea.’

As I said at the start, there has been little change in appetite and leverage, and that is primarily due to there being a lot of liquidity in the market. There is currently no evidence to suggest development finance will dry up like it did in the aftermath of 2008. Instead of a lack of credit, it appears the two biggest barriers to property developers building more stock for the foreseeable future will be high land prices and the planning process.

Land prices are beginning to fall, but still have a considerable way to go. As rates increase and more forced sellers come to market next year, there will be discounts to be had.

The planning process however, is a mess and needs wholesale review and structural change to make it fit for purpose. One can only hope that our new political leadership can take the radical steps needed, rather than apply the recent sticking plasters of stamp duty amnesties and permitted development reform

Bridging Finance

Much like development finance, you have similar funding structures in this space. Those that are funded by banks, have seen rates spike. Whereas those that have alternative and more diverse funding structures have been less affected. Again, it’s super important to shop around to find the best value.

Two lenders that used to price very similarly could now be several percentage points apart, depending on their funding structure, so speak to a good broker that understands the market.

The bridging sector will almost certainly be the busiest commercial property sector next year and will have a big part to play in any property price corrections that we see in 2023.

Firstly, borrowers with bridging loans on land where the plan was to sell the land post-planning, or where they were even going to develop the site themselves, will be seeing the value of those assets fall.

Since they’ve purchased that land, build costs have risen, and property prices are now stalling. A site that might have had a residual land value of £ 1m, 12 months ago, might now be worth £ 800k, or lower. If I’m a bridging lender that lent 70% of the value 12 months ago (£ 700k), I am now very worried. I will be in regular contact with that borrower trying to understand their plan for me to be repaid.

Can they introduce more equity? If they can, I want to see a capital reduction now and I want a very credible plan and timeline as to how I can be repaid.

If the borrower can’t introduce more equity, then me as the bridging lender, needs to get this asset to market quickly, before prices fall further.

Whilst, the above is an example of bridging being a catalyst for land price correction, bridging finance will also be the safety net as well.

What I mean by that, is that in a distressed market, the only way to buy these assets is with bridging finance or cash.

With distressed assets, there will be a short window where lenders give owners the opportunity to control their own destiny, by allowing them to sell on their own terms. Buyers will need to transact in weeks or days though. Past that, the lender will take matters into their own hands and the property is likely to end up in an auction, where again the buyers are using cash or bridge money to purchase.

Again, this availability of credit throughout the market will mean that prices can only fall so far.

In 2008, prices dropped like a stone as the only buyers were cash buyers. This time, the number of buyers is multiplied many times, providing credit remains available.

Whilst a correction is due, I think those expecting huge discounts will be disappointed.

Commercial Mortgage Market

Of the three commercial property finance markets, commercial mortgages will by far be the most affected by the recent market volatility. When we say commercial mortgages, we’re talking loans against commercial property like hotels, offices, retail, warehouses, etc. but also large residential property portfolios and / or blocks as a few examples.

Again, in this sector you have a spread of bank and non-bank lenders, and again you have some lenders, mainly banks, whose pricing has been materially affected by the recent volatility.

Non-banks, on the other hand, have been affected to differing degrees, and how much their pricing has gone up by, will all depend on their underlying capital sources.

However, the big difference in this sector, is that unlike with bridging finance and development finance, the interest on commercial mortgages needs to be serviced by income.

Interest on bridging and development loans is rolled up onto the loan and paid at exit, so the higher rate isn’t as much of a problem. Yes, if interest costs are higher, the equity cushion is eroded quicker therefore the lender will want to lend less money at the outset. But the effect of rising rates is much more pronounced with income producing assets where income cover ratios are the main driver of loan quantum.

As an example, prior to the recent market turmoil, a £ 20m commercial property with income of £ 1m per year, might have supported £ 12m in debt. Now with rates at 6% to 7% and higher, the available debt quantum falls to around £ 7m to £ 8m.

We know loan pricing is artificially high due to higher market interest rate forecasts. This was caused by the majority inflationary policies introduced by the previous government’s mini-budget.

Now, with a new government and most of those policies reversed, markets are settling down. However, whilst interest rate predictions are now lower, we still have the actual interest rate rises to come.

Lender spreads are likely to narrow to offset some of the increase, the actual underlying cost will increase by a bigger margin, so for a while at least, buyers of commercial properties will have to come up with significantly higher deposits. Or, sellers will need to accept lower prices.

Of course, much like the residential sector, if you don’t need to sell, then you won’t.

The new debt positions point towards a huge fall in prices, but the reality is, that if the interest rate spike is short term, very few owners will be affected. Instead, trading volumes will fall and the lack of stock will support prices.

Fast forward 12 months, and if rates are forecast to fall, then debt serviceability improves and debt quantums return. Buyers and sellers are back to where they were after a 12 month stalemate.

Much like in the residential mortgage sector, if you have a commercial mortgage that matures in the next 12 months, then you are an unfortunate victim of timing. Re-financing will be hard, and depending on your rental cover and leverage, you may need to make a capital reduction. If you can’t then you may be forced to sell. This will of course depend on the underlying lender. Engage them early and come up with a plan and they should be more sympathetic.

Whatever happens, it will be very interesting to see how the next 12-18 months plays out. We will of course provide regular updates on what we’re seeing and hearing through our conversations with brokers, property entrepreneurs, estate agents and lenders every day.

Brickflow is designed to be used by experienced finance & property professionals and property developers using Limited Companies or Incorporated Partnerships, to source and apply for development finance and bridging loans.

Brickflow is not an advisory business and does not give advice. It can deal with purely factual inquiries and provide information but it will not give an opinion or recommendation in any circumstances.

Property development carries risk, including variables beyond the developer’s control. A property development loan is debt and should be procured with caution.

Brickflow does not provide personal mortgages, but your home and other assets are at risk if you provide a personal guarantee for a corporate loan.

What are fix and flip loans? Discover how fix and flip loans work, their benefits and risks, and tips for securing these loans to succeed in property...

All you need to know about the Capital Stack. Includes: what it is, how it works in practice and the difference between mezzanine and equity finance.

Solving the UK's Housing Shortage, a comprehensive white paper by Brickflow that examines all the issues hindering UK house building.