Find the right property loan in minutes, not weeks.

.png?width=470&height=295&name=Gross%20loan%20(1).png)

.png)

.png)

.png)

.png)

Jonathan Studdert - Studdert Property

London-based founder Jonathan Studdert of Studdert Property transforms homes with bespoke loft conversions and extensions.

With Brickflow, he funded his latest multi-million-pound project in record time, saving him tens of thousands

Pierre Lombaar - Purple Pepper Homes

Purple Pepper Homes are a successful regional housebuilder, covering Surrey, Sussex and the South Coast.

They have developed more than 330 quality dwellings over the last 10 years. Their current scheme is a 104 unit scheme that was successfully funded via broker using Brickflow.

Rosey Cassidy - Build Up

Rosey Cassidy is a well-known name in the industry, offering educational and property development mentorship.

A second-generation developer with over £1bn in projects delivered, she partnered with a broker using Brickflow to fund her latest £9m GDV scheme, for its simplicity and savings.

Areeb Azam - Concept Group

Areeb is a successful South-West London developer and investor with a portfolio spanning residential, gyms, offices, and retail.

A regular Brickflow user, he chose a broker using the platform for his latest 27-unit London scheme because of the certainty and speed it provides.

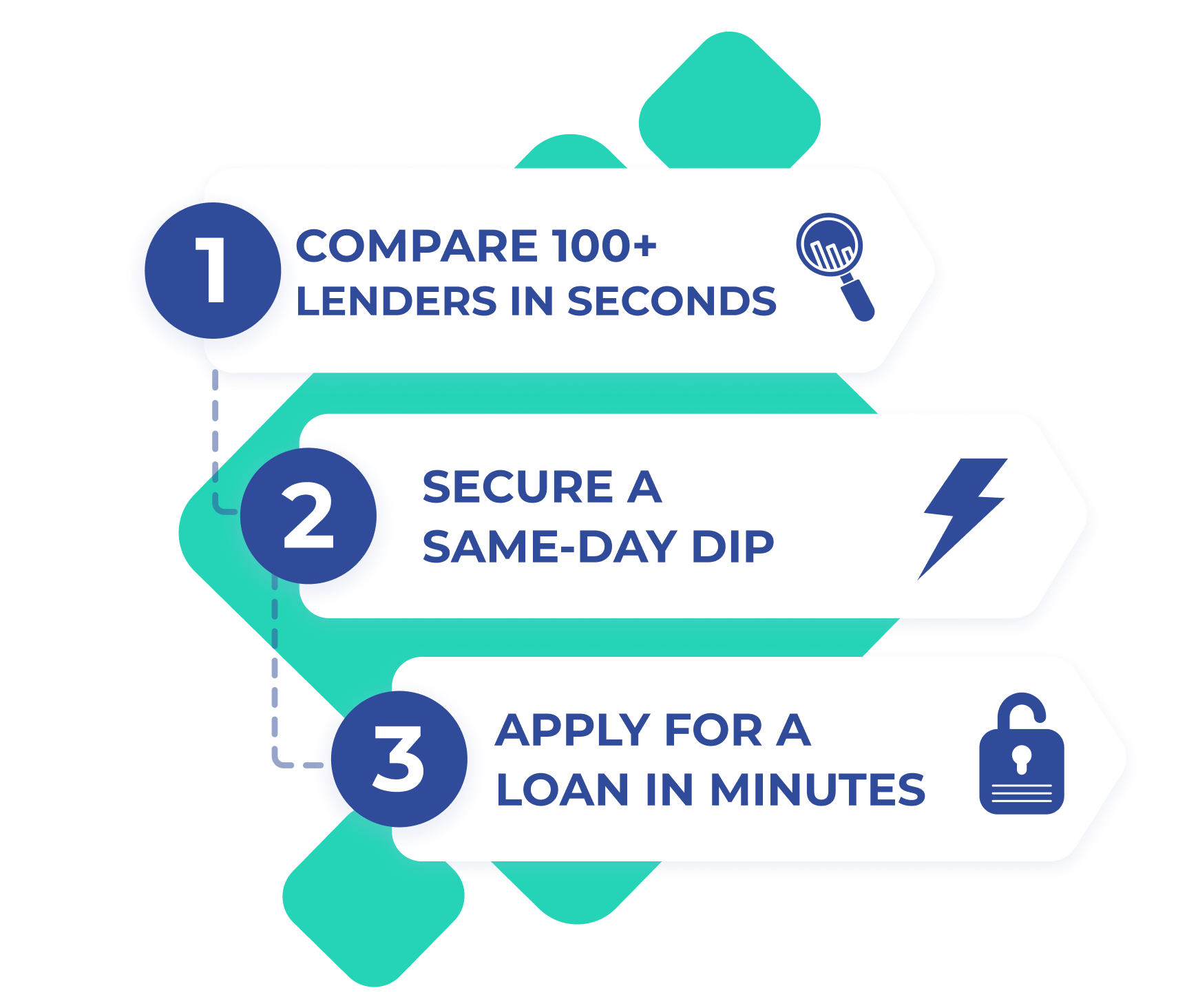

The most efficient journey to specialist property finance

We understand your frustrations when it comes to securing commercial property funding. That’s why we created Brickflow; a marketplace where you can model deals, source and apply for specialist property finance, all in one place.

We provide instant access to 100+ lenders and the quickest way to secure a Decision In Principle; our record stands at 7 minutes. Unheard of in our industry, right?

Not anymore.

Intermediaries

Search & apply for specialist property finance

Embed Brickflow Enterprise & expand your reach

Borrowers

Model deals to ensure your deal stacks

Check lender criteria & apply through a lending manager

Agents

Increase deal certainty & conversion

Reduce time-wasters & capture serious buyers

Sign Up & Get Smarter

Sign up to receive valuable insights on the CRE market. We won't bombard you with spam – instead, you'll receive exclusive updates on:

- Market Insights - Find out what your competitors are up to

- Industry Insights - The latest policies, news & strategies shaping the industry

- New products & features - Explore the tools that streamline your funding process

- Rate alerts - The latest live rates from lenders on the Brickflow platform