How do I fund a permitted development project?

We explain how to fund a permitted development project, the options available and latest legislation. We also share our experience & lender insights.

.jpg)

Insights into development finance, the landscape/challenges, essential info, stretching equity, the application process, pitfalls and how Brickflow can help.

Property development finance is a short-term loan used to finance the construction, conversion or refurbishment of buildings. The size of a loan is based on four key metrics; gross development value (an estimate of what the site will be worth post-development), total project costs, minimum borrower equity and day one land leverage. Once the project is complete, the borrower repays the loan through the sale of the property or via refinance.

Since 2008’s financial crash, tightening regulations has caused high-street banks to lose their dominance of the development lending market. Fast forward to 2022, where challenger and specialist banks had a record year, providing a cool £35.5 billion in lending, surpassing the major UK banks and taking a 55% share of the market (British Business Bank).

Having said that, the ‘big 4’ UK high-street banks (Barclays, Lloyds, HSBC and NatWest) still make up a significant part of the market. They are more cautious nowadays though and mostly arrange loans for existing clients or experienced developers. This means it’s more important than ever for borrowers to gain access to the entire market, and the best available deals.

The rise of ‘alternative lenders’ has therefore been a phenomenon for the property development market as a whole, bringing a more flexible and accessible way for borrowers to secure funding. As a result, the appetite for lending and borrowing has increased, and crucially for developers, if they find the right lender, it takes far less time to secure a loan, meaning they can close a deal far quicker.

Opening up the market brings more choice, which is a positive, but development finance options have overwhelmingly poor visibility and this poses the biggest challenge within the market.

Many developers simply aren’t aware of the breadth and depth of non-bank lenders that exist, and/or lack the relationships to access the key decision makers within those organisations.

Poor transparency, little or zero marketing capability and a subsequent lack of brand awareness mean that credible, alternative lenders with large and flexible lending funds are often missed, along with the opportunities they proffer.

Most developers can identify around five lenders, when in reality, as all brokers in the industry know, there are many more options. It is however critical to be cautious. A lot of new lenders have entered the market in the last few years, so it’s questionable whether they’ll be around during and after the next economic downturn.

It’s important to understand how lenders are funded, and whether their backers are likely to withdraw their funding lines at the first sign of trouble.

There are examples already of lenders taking on too much risk, (remember Lendy?) but others are close to the line. If prices fall due to an economic downturn, more lenders will disappear, meaning serious repercussions for developers who may have invested their life savings in a scheme. If the leverage offered seems to be higher than the rest of the market, or a rate seems too good to be true, it probably is, especially if the operator is new to the property finance market. It’s essential to work with trusted lenders.

To maximise equity, mobilise quickly and ultimately get ahead in the property development game, borrowing from the big UK banks isn’t always the most viable option. Rates are low but deposits are big, which means paying away profit shares or limiting developers to smaller sites.

Working with brokers that have the right expertise, knowledge and relationships to navigate the market is the sure-fire way for developers to get the right lender and finance for their build.

For the optimum market access and visibility of available financing, search for a trusted lender on Brickflow, the UK’s first search engine for development finance loans. We provide instant access to the development finance market, in real-time, and with easy-to-use tools for searching loans and applying via our platform, making it the quickest and easiest way to secure development finance.

First-time developers

Starting out in property development for the first time is not an easy game. It’s by far the riskiest of all property loans for lenders, despite the potentially big returns, so borrowing opportunities can be difficult to secure.

It’s a catch-22 - experience is key, but if a first-time developer can’t secure finance, they can’t accrue experience. So, what are the essential skills a developer needs to demonstrate and how can lenders be convinced that a first-time developer can make a scheme a success?

Skills

Like most projects, managing a property development has multiple strands, and different skills are needed for each stage. If someone is a champion builder or a seasoned QS, it doesn’t mean they will naturally be a good developer.

It’s rare to be good at all three, which is why the majority of development deals involve more than one stakeholder. For instance, if a developer has a DM or PM background, they can probably manage a scheme to delivery, but it’s unlikely they’ll have the same follow-through when it comes to the planning or sales processes.

Lenders like lending to experienced property developers. It normally takes three relevant schemes to be classed as ‘experienced’ by a lender. Most appreciate that previous projects might be smaller in size and value as developers gradually build up to bigger schemes, but it’s relevance that is key.

If a developer has completed a loft conversion or split a house into two flats, for example, it doesn’t follow that they will easily secure funding to build twenty new houses.

Developers also need to consider whether a development involves specialist areas such as basement digs or a listed building, as lenders will often want to see direct experience, whether from the developer or an associated contractor.

Lenders prefer experience to be in a developer’s name, but if they’ve worked on similar schemes under others, as a project manager or in an advisory capacity for example, these may also qualify. Related industry experience counts for a lot, so builders, QS’s, architects, PM’s or DM’s that have worked on or managed multiple development schemes for other developers will be able to use this to build their case for funding.

If it seems like a first-time developer still doesn’t have enough relevant experience, nor will a lender, so bringing in outside expertise might be the best option.

Property development often works best as a collaborative effort. Developer’s should consider the skills and experience they do have, for example an established estate agent will be expert at sourcing the best sites for the best price, or someone who has worked long-term in planning will know how to influence the planning process.

Developer’s need to be honest about their strengths and weakness so they can identify the areas where they need to bring in relevant help.

Lenders favour partnership where stakeholders are incentivised. For example, if a developer purchases a site but doesn’t the experience to secure funding, they can bring in a PM as a contractor. The PM takes a 20% share of the scheme, so is incentivised to deliver on time and to budget, making for a happy lender.

As well as making a stronger case for a lender, working with the right team allows a developer to grow and move onto bigger schemes, sooner. As a developer’s experience grows, so should their equity, and they can eventually undertake property development without utilising outside help.

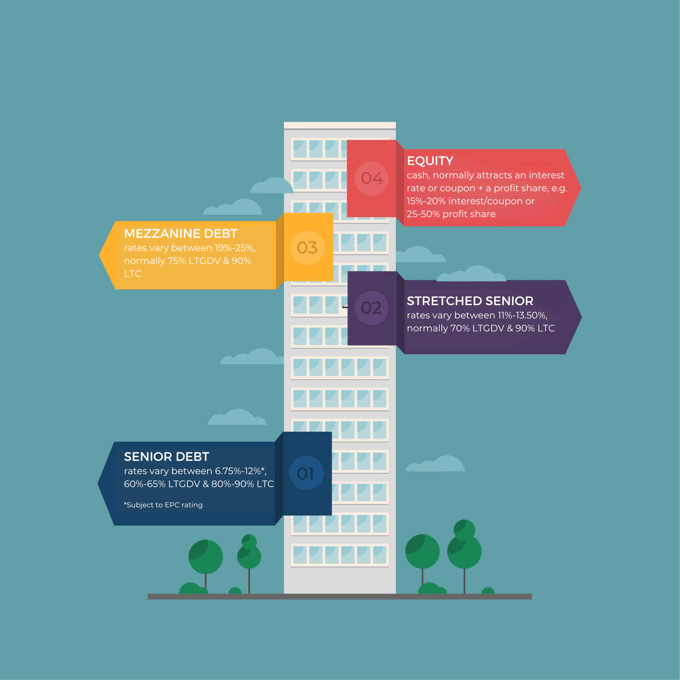

The Capital Stack is the structure of development finance, or the different layers that fund a scheme. The typical stack has three layers, and normally includes senior debt, mezzanine debt and equity.

Strategically determining the best Capital Stack for a scheme means minimising equity investment and maximising profits.

Need-to-know

In practice

Like building a development, work from the bottom up when structuring the debt.

Read our full guide to the Capital Stack for a worked example of experimenting with different loan structures.

Development finance is the most complex property-based loan to calculate. Maximising profit often means maximising debt, which cracking the Capital Stack will enable.

A loan is calculated like this:

Also consider:

Sweat Equity

If a site has already been purchased and enhanced in value through planning, this may be considered as part of developer equity. This is called Sweat Equity because essentially all the hard work has been done to add value. Every lender has a different way of calculating sweat equity, some are more generous than others, and some can use 100% of sweat equity, creating a ‘cashless deal’, so again, shop the market.

Costs

Again, if the developer has met ongoing site costs (debt servicing, security, maintenance, etc.) they can legitimately assign them to the project and the lender will take them into account for their calculations, so keeping a ledger is important.

Like any financial product, development finance interest rates are dictated by risk (or implied risk). Size matters. Risk and leverage are inextricably linked, so the higher the leverage the more risk there is for the lender.

One of the most common questions we get asked is what kind of interest rates developers can expect to pay. The simple answer is there is no simple answer.

Every lender has a different way of calculating development loans, which is why it’s so important to shop around for funding. If the same project is sent to 10 different lenders then 10 different loan amounts and 10 different lots of interest rates & fees will be returned.

If we break down the market by lender type and leverage ranges, we can however apply some typical loan interest rates.

Typical Rates for Loans Over £1m

| Lender Type | Typical LTGDV | Typical LTC | Typical All-In Rate* | Comments |

| Mainstream Banks | 50-60% | 65-75% | 8.5-12% | The most conservative and therefore the cheapest. Generally more conservative on LTC (remember they will lend the lower of the two figures). |

| Challenger Banks / Specialist Development Funds | 60-70% | 75-90% | 10-14.2% | More aggressive on leverage and LTC and slightly more expensive, but generally more flexible than mainstream lenders. |

*All-in means the total rate paid, i.e., the lender margin and the cost of funds (such as Libor or base rate).

These rates are based on loans of £1m plus. When borrowing less than £1m, borrowing costs will increase due to the resource required and relative costs of underwriting a development loan.

The labour cost to a lender of sourcing and underwriting a £10m development loan is much the same as a £2m loan but with five times the return, so they prefer to focus on the large loans. For a lender to analyse 10 £1m loans, it would take 10 times the resource but the same return as one £10m loan, so the higher cost of underwriting smaller loans needs to be passed on.

Loans up to £1m

The smaller loan market is still covered by mainstream banks and challenger banks, but the biggest presence is with specialist development funds and bridging turned development lenders.

Pricing is around 1.5%-2.5% higher, so typical All-In Rates would be:

In addition to interest rates, the total cost will normally include an arrangement fee of 1.25%-2% and an exit fee of 1%-1.57% of the gross loan. It’s therefore very difficult to compare lenders on a like-for-like basis because of the three different costs.

Most lenders have a minimum annualised rate of return on their capital, and it’s the combination of the three costs that are used to meet this. If a lender is charging a lower interest rate than their peers at the same leverage level, expect to pay higher arrangement and exit fees (AKA In & Out fees).

True Monthly Cost

Brickflow employs what we call ‘True Monthly Cost’ as the best way to compare fairly:

A personal guarantee is the developer's legal promise to repay loans issued to a business where they are a beneficial owner. Providing a personal guarantee means if the business becomes unable to repay a debt, then the developer accepts personal liability, meaning they can’t just walk away.

They are standard practice for development finance and are required from all shareholders, or as a corporate guarantee. The Industry average is 15%-25% of total loan amount.

Normally, the higher the LTGDV, the higher the personal guarantee. Banks usually want twice the cover on a personal guarantee amount, so if the amount is £1m, they require evidence of a Net Asset Value (NAV) of more than £2m.

Need-to-know

In practice

Personal guarantees are conceptual security, rather than actual, alternative security. They’re there to ensure both lender and borrower are strategically aligned. Lenders don’t expect to enforce them and they only do as a last resort, but they exist in case things go wrong.

Each lender will take a different approach, but here’s how they might work in reality:

Here’s how you may be able to reduce a personal guarantee amount:

If a developer doesn't have a hefty deposit to help secure development finance, it doesn’t mean it’s game over for their ambitious development plans.

As well as getting your Capital Stack right, there are many ways to stretch equity further and source appropriate funds.

The default setting for many developers is to stick to a tried and tested senior lender. But deposits vary from 10% to 35% of total costs (including land, build, finance and professional fees), so on a scheme with costs of £5m, the required deposit could be anything from £500K to £1.75m. A huge and potentially deal-breaking variance. If developers only have a relationship with one lender who requires a deposit at the higher end of the spectrum, it could mean investing an additional £1.25m of equity, blocking investment for other schemes, and preventing progress to bigger sites, sooner.

The best property developers have the ability to bring in the right partners to make a scheme work. This applies to obtaining finance for property development, and making debt work efficiently.

It’s unlikely that using a single source of funding is the most cost-effective route, so looking to friends, family and wider professional network to help raise equity is an option.

Having said that, if a developer needs to partner with investors to make a scheme happen, they shouldn't be too generous with profit share. They are the driving force behind the development, which wouldn't be happening otherwise, which is worth remembering when assessing funding options.

As previously mentioned, buying a site without planning permission and gaining it later adds value to the site in the form of sweat equity. This places value on the time and effort put into a project. Securing planning permission isn’t easy, so good lenders will take this into account when assessing a funding application for a property development loan, and lending opportunity.

Every lender will place a different amount of value on sweat equity, so searching the market will reveal the lenders who appreciate the value added by a property developer's experience in gaining planning.

An added benefit of a developer buying during the pre-planning phase is that it can reduce the profit owed to investors. Providing enough value is added, the equity can be repaid when the development finance for the build stage is raised, meaning they’ll only need to pay investors a percentage of the profit on the uplift in value during the planning process, not on the total profits at the end.

Second charge loans mean using equity in background portfolio properties as security for another loan, even if they have an existing mortgage, so it's a great way to conserve cash. They offer flexible funding, and can normally be secured fairly quickly as second charge lenders are setup to work quickly, making them a strong alternative to re-mortgaging or draining developer's cash.

If developers have any BTL properties in the background that are lowly geared, this could be an option. Lenders can even take a second charge over multiple properties to give an overdraft type facility to use as and when needed to raise a deposit.

When a developer is looking to buy a piece of land, the landowner can agree to receive part of the payment once the properties have been built and sold (usually at a higher price as the trade-off). This is known as a deferred land payment, and it can sometimes be used to make up an equity shortfall. The lender providing the development finance has first charge over the land and lends all of the build costs, plus a portion of the land acquisition costs.

Therefore the buyer would be giving the lender security over a site that is worth more than what was paid for it (so far). This de-risks the lender and allows access to greater value projects with smaller deposits, so it’s a full circle win. The landowner will normally request a second charge behind the lender and would have to agree to be repaid only after the lender. Not every vendor will agree to this, so using a broker with a good relationship in place helps. A small profit share can also be offered to further sweeten the deal (if needed).

Read our full guide to Stretching your Equity Further, for worked examples and case studies.

Developers will need to provide the below key elements to apply for a loan.

Once the lender receives all of the above, they will confirm credit-backed terms and instruct their Quantity Surveyor (QS) and valuer. These fees need to be covered upfront or agree to cover the cost even if the loan does not complete.

The valuer will:

The QS will:

Once the reports have been assessed by the lender, solicitors will be appointed. They can be appointed at the same time as the QS and valuer, but we recommend waiting to avoid incurring unnecessary costs.

Solicitors:

Drawdown

Once the lender’s solicitor is happy that all of the lenders requirements have been met, then they will arrange for the land loan to be drawn down.

As works commence, contractors will be paid from the ‘Build Loan’. The build loan drawdowns will be approved by the lender appointed QS, who will pre-agree site visits based on milestone events.

With smart decision-making at the core of property development, there are few more important ones to make than choosing the right development loan. But, there are some common mistakes that even the most experienced developers frequently make. See our post regarding pitfalls to avoid.

If you speak to 10 lenders about the same deal, you’ll get 10 different answers. That’s 10 different loan amounts and 10 different pricing structures.

Just by the law of averages, seeking finance through just one or two lenders is highly unlikely to return the best available deal on the market.

By shopping around and speaking to different types of lenders, including challenger banks, debt funds and specialist lenders, developers have far more visibility of the best available deals.

Putting down a large amount of equity as a deposit can be avoided, simply by finding a more generous loan offer with an alternative lender.

This can free up funds for investment in other schemes and bigger sites, and prevent or reduce hefty profit share pay-outs to additional investors.

Whilst joining forces with the right partners can strengthen a case for securing a property development loan, choosing the wrong ones can often harm the chances.

This includes everybody from contractors, to shareholders and lenders, to professional partners. We’ve all heard the stories of feuding partners and sites getting repossessed. Much like a divorce, a fallout will always be expensive, so choose partners wisely.

When bringing in others, developers must discuss Personal Guarantees (PG) early on. If a partner doesn’t stand behind the PG it’s not necessarily game over, it just means that despite their experience, their value should be weighted slightly lower than another partner willing to commit to a PG.

Navigating the fragmented development finance market of non-bank lenders inevitably brings increased risk, alongside greater opportunity. Whilst many of these lenders are credible and bring a different dynamic to the market, unfortunately some are less trustworthy. If a lender is offering far cheaper rates or more leverage than anyone else, question why, as they’re probably taking undue risk.

Remember how hard a developer has worked for their equity - it's not worth risking their future by betting on a bad lender.

Make sure you dig deep. Ensure every lender passes the credibility test, and has the infrastructure to underwrite loans properly, especially if they’re new to the market. Also watch out for hidden terms, and ensure developers get full transparency on the HOTs. For example, a lender may offer a great rate but insist on a 100% Personal Guarantee, or additional charges on other assets, rather than the industry standard of 15-25% of build costs. Having said all this, Brickflow only lists lenders we trust, so we have already done the due diligence.

It’s easy for a developer to get weighed down by the complicated process of securing development finance, but it’s essential to be reminded of the wider view in the economic and political climate. The time that elapses between site acquisition and/or planning applications, and actual completion of a scheme is a minimum of 18 months, but is usually somewhere between two and five years; potentially even more.

Think how much has happened in the UK in the last two to five years with Brexit, the cyclical economy, changes in legislation, fluctuating currency and the Coronavirus.

A developer’s ability, or lack of, to acknowledge and plan for changes that are outside of his or her control could be make-or-break for a property development scheme, and a developer’s future success.

Brickflow is revolutionising the development lending market by bringing it online. We know the market is old-school and slow, so we’ve created the UK’s first search engine for development finance, which will ultimately benefit our entire industry. Access to finance is key to delivering the housing that the UK needs, so our mission is to make it as quick and easy as possible.

Brickflow provides instant online access to the development finance market, 24/7. We search the market, including non-banks and specialist lenders, in real-time, providing loans from trusted lenders in under 60 seconds.

For more information on securing a peak debt facility, or development finance in general, please call us on 020 4525 6764 or email info@brickflow.com.

We explain how to fund a permitted development project, the options available and latest legislation. We also share our experience & lender insights.

The points brokers & property developers need to cover to help ensure that when a lender has 25 new enquiries in their inbox, yours is the first they...

Find out 7 popular ways to stretch your equity, source the funds you need and maximise your cash return.