Industry Insights (January 2024)

The inside track on property development in January 2024.

Industry Insights

Industry Insights

The UK’s housing shortage continues to drive problems throughout the market, from affordability to homelessness, spurring private ventures into action. Meanwhile, could commercial mortgage arrears signify the next opportunity?

Last month’s Spring Budget was disappointing for those in the property market and undoubtedly a missed opportunity to address the UK’s chronic housing shortage.

Some small wins:

Some changes to be aware of:

What was missing:

As the government sits on its hands when it comes to housing, a privately funded commission, headed by Dame Kate Barker, is looking to address England’s housing shortage.

Barker led an influential housing inquiry 20 years ago calling for more new homes to be built and describes it as ‘depressing’ that many of the problems she identified in her 2004 review remain. The commission is a partnership between Radix Big Tent and Shoosmiths LLP, who will be sharing the costs, and will investigate ways to increase housing supply, consider specialised housing needs, and promote affordability.

Their recommendations are expected after the next general election and will no doubt align with the 10-point action plan we outlined in the Brickflow white paper (we have shared a copy with Dame Kate Barker.)

Resolution Foundation has just published a report that found that the UK’s housing is more expensive, more cramped and more aged than any other developed economy.

Unsurprisingly, it calls for government action, stating ‘bring on the manifestos, where policies to tackle the UK’s housing crisis must surely be centre-stage.’

Housing shortage = unaffordable homes

The exponential growth of the housing shortage means house price increases have far outstripped wage growth. Currently, house prices are approximately 8.8 times the average earnings, more than doubling since the 1970’s when the average home required just 4.1 times income.

Rise in mortgage arrears

It’s no wonder therefore that with the sustained period of ultra-cheap borrowing people are overstretched, and when combined with inflated living costs, the repercussions are now showing in the rise in arrears.

In Q4 23, mortgage arrears jumped by 9.2% from Q3 and by 50% on the previous year, according to Bank of England, with the total value of mortgage balances in arrears reaching £20.3bn.

Borrowing rates are predicted to drop this summer, but are unlikely to reach the low rates we were used to, and with more than 1.5m households expected to refinance their loans this year, arrears could rise further yet.

Forced sales have not been rising in line with arrears however, because lenders have been proactive with forbearance measures and adhering to the mortgage charter, allowing borrowers to switch to interest only or extend terms.

Rise in rent

For those struggling to get on the housing ladder, the rental market doesn’t offer much respite, with prices rising by 9% in the year to February - the highest annual increase recorded, according to ONS figures. Rents have consistently increased since the series began in 2015, but has accelerated recently as landlords cover their rising mortgage and associated costs and demand continues to far surpass supply.

Chief executive of Generation Rent, Ben Twomey, states that tenants are reaching ‘the very end of what we can afford’ and goes on to say that 50% of PRS properties are not mortgaged, so rather than covering costs, landlords are increasing rents because ‘tenants have no choice but to pay these prices.’ (The Guardian)

At the heart of the matter is of course, lack of available homes, with Twomey calling on the government to build more affordable and social homes.

(When it comes to landlords, we’ve become used to negative rhetoric, however a new study by Aldermore has revealed that 69% (around 5.2 million) of UK renters have a positive experience with their landlord.)

Social Housing

Also hitting a record high is the amount of unpaid rent owed to housing associations, spiking at nearly £800m last year. The 8.4% jump is the highest single year jump since before the coronavirus pandemic.

The increased financial pressure, from borrowing costs to increased expenditure in maintenance, facing housing associations drove prices up by 7% last year – far higher than salary or benefit rises. Four in five council landlords reported rent arrears. (Inside Housing)

These figures come alongside news that Scottish social housing starts fell to a 10-year low in 2023, with construction starting on just over 6000 affordable homes - a 20% decrease compared to 2022.

Meanwhile, NatWest has pledged £5bn of funding to help housing associations deliver a pipeline of new homes and improve living conditions in existing properties. The money could also help landlords finance energy-efficiency and retrofit upgrades. The funding pledge covers new funding, gross of repayments and amortisations from 1 January 2024 to year-end 2026.

Homelessness

The toxic combination of a housing shortage and inflated costs of living was inevitably going to increase the number of homeless people in the UK.

In 2017, 86,000 young people, aged 16 – 24, were recorded as homeless or at risk of homelessness and approached their local council for help. Last year, that number grew to 135,800.

LandAid, a homeless charity that awards monetary grants and arranges free property expertise to enable charities to provide secure accommodation and support services, held their annual LandAid Sleep Out this month. The Sleep Out invites property professionals to spend a night on the streets, helping to raise funds and support the charities across the UK that provide lifelines to young people experiencing homelessness.

Some of the Brickflow Team joined 1300 other property professionals to brave the cold and bring awareness to the issue of homelessness in the UK, whilst helping to raise over £740,000.

BTL arrears

Despite the rent rises, it’s evident that PRS landlords continue to struggle – UK Finance data from Q4 23 shows an 18% leap in BTL arrears compared to Q3 and 500 properties were taken into possession, an 11% rise from Q3.

UK finance also warns that 230,000 BTL mortgage holders have fixed-rate deals due to end this year.

Commercial mortgages

The commercial mortgage market is showing similar stress, albeit a much less significant increase in arrears. An October 2023 study from Bayes Business School found that the default rate on UK commercial real estate reached 4% in H1 of 2023, up from 3% at the end of 2022. The amount of outstanding debt has remained steady though.

However, many commercial mortgages are due for renewal this year, for the first time since covid. As well as higher mortgage payments, commercial property values are weaker since the pandemic ignited the remote working era, there are more vacant commercial spaces and tenants want flexibility in their leases, i.e. shorter leases.

All of which are problematic for lenders.

The Bank of England has warned that the commercial property market could create yet more financial instability – CRE prices could fall further and spark losses for lenders. Adding to the risks is Chinese property owners selling off their UK assets for depressed prices to cover the finance crunch they’re facing at home.

The European Central Bank last month signalled to banks that they may face higher capital requirements if they have an insufficient handle on risks they face from their exposure to commercial property. (Bloomberg)

The need for cash amongst Chinese developers and a consensus that commercial property prices have corrected faster in Britain than elsewhere will likely promote more deals. In fact, a survey by INREV indicates that ‘Britain has rebounded to become Europe’s preferred destination for property investments after a six-year hiatus.’ (The Business Times)

As well as the cash-strapped Chinese sellers, more commercial mortgage holders will be looking at the numbers for refinancing, no doubt bringing more motivated sellers to market. The next few months could be a great time to invest into reduced rate prime commercial spaces in the UK.

With pretty apt timing, lenders on the Brickflow platform are beginning to show more flexibility in their rates.

Brickflow Exclusive

We've secured our first exclusive rate from one of our lenders, now available to Brickflow users. Specialist lender Hana Capital is offering a rate of 0.99% at 70% LTV on bridging loans – a rate usually offered only on 65% LTV. It represents a 2% saving on an annual basis.

At Brickflow, our aim has always been to bring transparency to the CRE market, to facilitate cheaper borrowing and more deals for everyone – our first exclusive rate is a great example of how transparency can stimulate competition within a traditionally opaque market.

As Hersh Patel, director of Hana Capital said;

“To conduct a competitor analysis and establish where we sit within the market would normally take days, if not weeks. Having this data at our fingertips thanks to the Brickflow platform means we are able to offer more competitive rates for borrowers. Healthy competition within the market can only increase buoyancy, which benefits everyone involved, from borrower to broker to lender.”

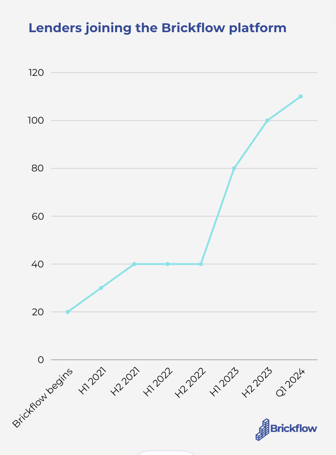

Competitive lending is the only way to make deals stack

Despite the challenges the CRE market still faces, there are endless opportunities to be had – but without competitive lending, deals just won’t be viable. Our platform is growing continually, as everyone from borrowers to brokers to lenders want more access to the market.

For borrowers, securing the most competitive specialist property finance loan means more opportunities become viable deals.

More deals benefits the whole market, not least the housing shortage.

Brickflow is a digital marketplace for commercial property finance. We connect brokers & borrowers with lenders to source the best-value loans, quickly and easily.

The inside track on property development in January 2024.

The inside track on property development in January 2023.

The inside track on property development in September 2023.