Concept Group

See how Brickflow helped Areeb secure multiple development finance loan offers, a lower deposit, and our quickest ever credit approval rating in 4.5...

Borrower Story

Borrower Story

See how Brickflow's software helped Simon structure a development finance application & secure a site he thought he wasn’t ready for. The £1.79m deposit reduction helped too!

The borrower

H2B Investments Limited is a West Midlands based developer that uses their strong community ties to realise planning gain and larger scale development opportunities.

The challenge

H2B had a tremendous opportunity that had arisen through their strong local connections. However, at 63 new-build units, the opportunity had come about a bit sooner than they would have liked. It was a big step up in terms of development size, but it would also mean a lot more equity was needed.

“ I couldn’t recommend Brickflow highly enough. The platform has really helped us progress a lot quicker than I would’ve ever imagined. Our business is 10 years further forward than where we thought we’d be, as we’ve learned how to structure our funding properly. Brickflow has enabled us to go into the bigger schemes a lot quicker, and grow our business, exactly how we want to.”

Our solution

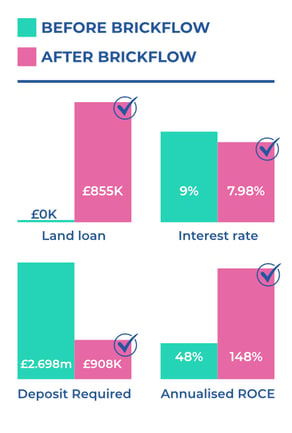

By splitting the development into phases, they were able to overcome both hurdles. Using Brickflow's comprehensive loan search, Simon could see that as as a single phase, their deposit would need to be close to £ 2.7m. This would have meant borrowing the bulk of the deposit from investors, and paying away a huge percentage in profit share.

Also, based on the level of previous personal development experience, a lot of lenders would have seen this as too big for them as it’s verging on the type of scheme a regional house-builder undertakes.

By running 2x phases and a more manageable 33 unit and 30 unit scheme, Brickflow's loan search demonstrated that the equity requirement was reduced to just £ 908k. A much more manageable amount. Lenders would also be more receptive to the application due to a reduction in scheme size.

Whilst H2B know they have the construction experience, by their own admission, their lack of understanding around how to structure finance to minimise equity, and maximise profit, was holding them back. In the words of the owners of H2B, their business is now 5 to 10 years further along than it was thanks to Brickflow.

The Results

H2B had been told by one of their lenders that they would need a deposit of £2.7M (GDV of £12.6M) Through one of Brickflow’s preferred lenders, H2B received a lower deposit, that was reduced by £1.79M. With an interest rate of 7.98%.

See how Brickflow helped Areeb secure multiple development finance loan offers, a lower deposit, and our quickest ever credit approval rating in 4.5...

See how Brickflow helped Botany Homes reduce their deposit by £190k and obtain a 0.8% lower interest rate.

Mandeep Poonian discusses why he become a property developer and how Brickflow is helping him to scale his business.