Bridging Loans in Edinburgh

Edinburgh’s property market is competitive—Brickflow helps you move quickly by comparing the best deals from over 100+ lenders. Compare now.

Brickflow: Helping You Stay Ahead in Edinburgh

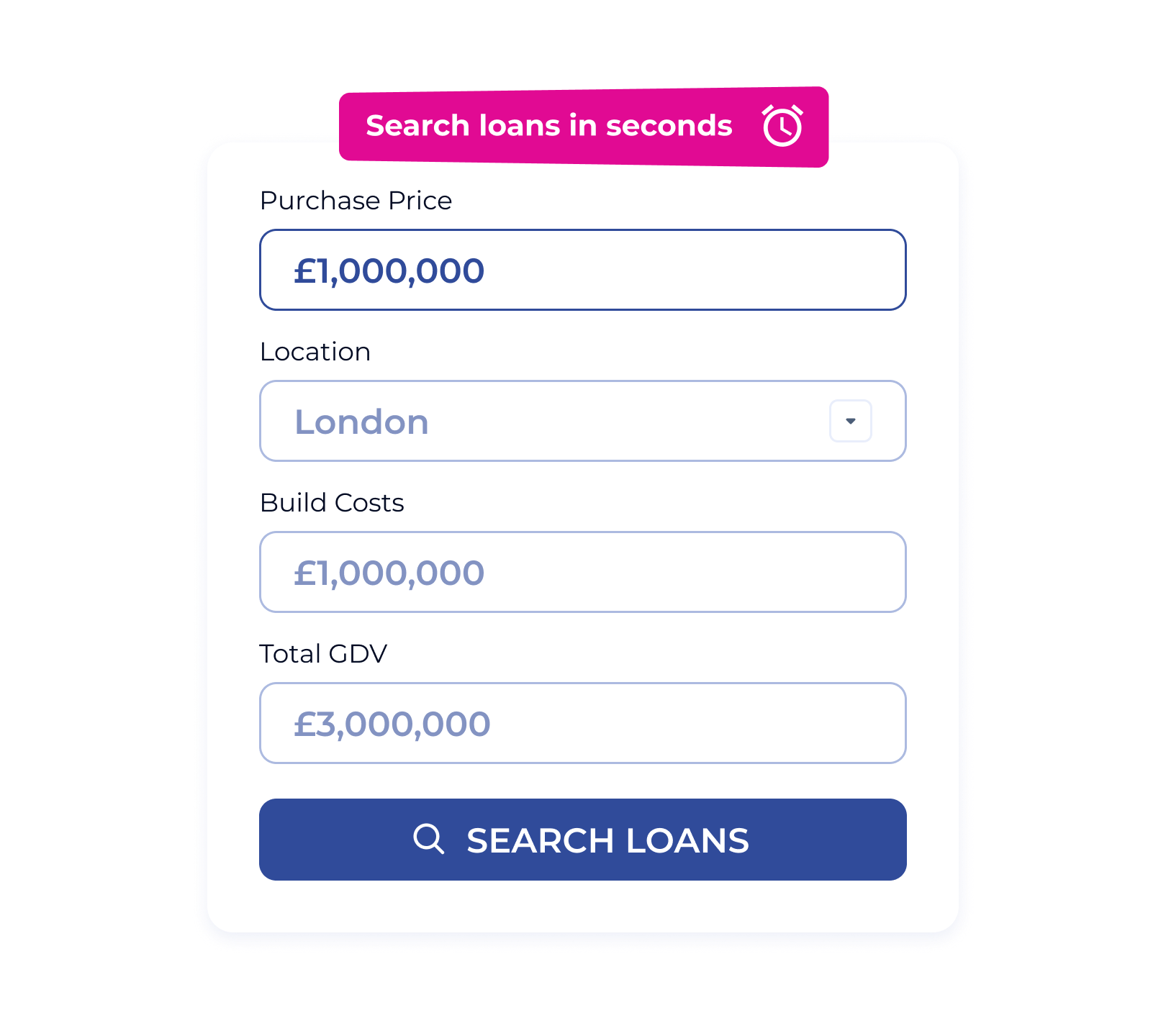

Finding the right bridging finance in Edinburgh has never been easier. Brickflow’s platform allows you to compare lenders in real time, ensuring you secure the most competitive deal:

- Compare from 100+ Bridging Finance Lenders

- Decision in Principle (DIP) secured in minutes

- Fast bridging loans processed in hours

- Compare lenders' rates, fees, and maximum LTVs

- Eligibility filters to refine your search

- Market-leading bridging loans up to £100 million

Bridging Solutions Tailored To Your Needs

Edinburgh is a city with a strong property market—whether you’re restoring a historic townhouse, expanding your rental portfolio, or securing a commercial space, bridging finance helps you move fast. Areas we support include:

Changing the Way You Finance Your Next Edinburgh Property Project

Brickflow takes the guesswork out of securing bridging finance. Instantly compare live rates from over 100 lenders and secure the best funding solution for your Edinburgh property.

Compare loans from 50+ bridging finance lenders

See how much you could borrow against a specific project & at what rate

Check detailed eligibility criteria to avoid wasting time & money

Ensure your deal stacks & make smarter investment decisions

Is Bridging Finance Right for Me?

Still unsure if bridging finance is the right solution for you? Speak with one of our experts for guidance or explore our detailed guides:

Compare Bridging Loans

Searching for a bridging loan on Brickflow is the fastest, easiest way to find the best loan for your circumstances. You can compare like-for-like loans from over 50 bridging lenders, see live borrowing costs and filter loans based specifically on what you need.

A search takes just seconds, covers the breadth of the market and could save you enough money to start another project.

How Brickflow Can Help

Looking for a tailored bridging finance solution for your next Edinburgh project? Get in touch with our team today. Or, if you’re ready to get started, use our bridging loan calculator to compare rates and secure the best deal.

.webp)

What is bridging finance, and how does it work?

Bridging finance is a short-term loan designed to provide quick access to capital, helping property buyers and investors complete purchases before securing long-term funding.

Can I get bridging finance for a property in Edinburgh?

Yes, bridging finance is available for both residential and commercial properties in Edinburgh. Whether you’re purchasing at auction, funding a refurbishment, or expanding your portfolio, lenders offer flexible solutions to suit your needs.

How long does it take to get approved for bridging finance?

Bridging finance is designed for speed. Depending on your circumstances, approval can take as little as 7 to 14 days, with funds released shortly after submitting your application and supporting documents.