Bridging Loans in Glasgow

Glasgow’s property market is fast-moving—Brickflow helps you secure bridging finance quickly by comparing the best deals from over 100+ lenders. Compare now.

Brickflow: Helping You Stay Ahead in Glasgow

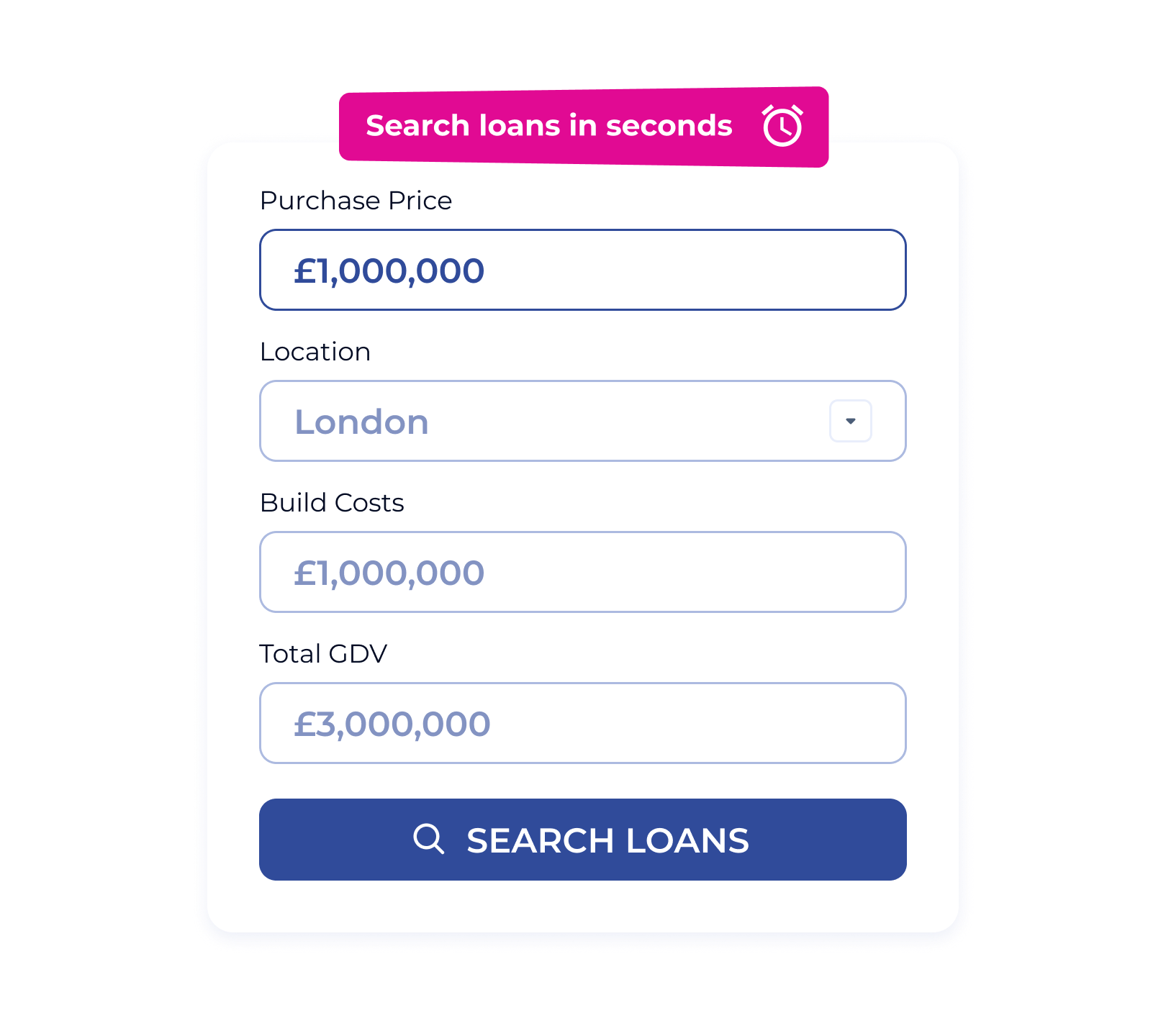

Finding competitive bridging finance in Glasgow has never been simpler. Brickflow’s platform allows you to compare lenders in real time, ensuring you secure the best possible deal:

- Compare from 100+ Bridging Finance Lenders

- Decision in Principle (DIP) secured in minutes

- Fast bridging loans processed in hours

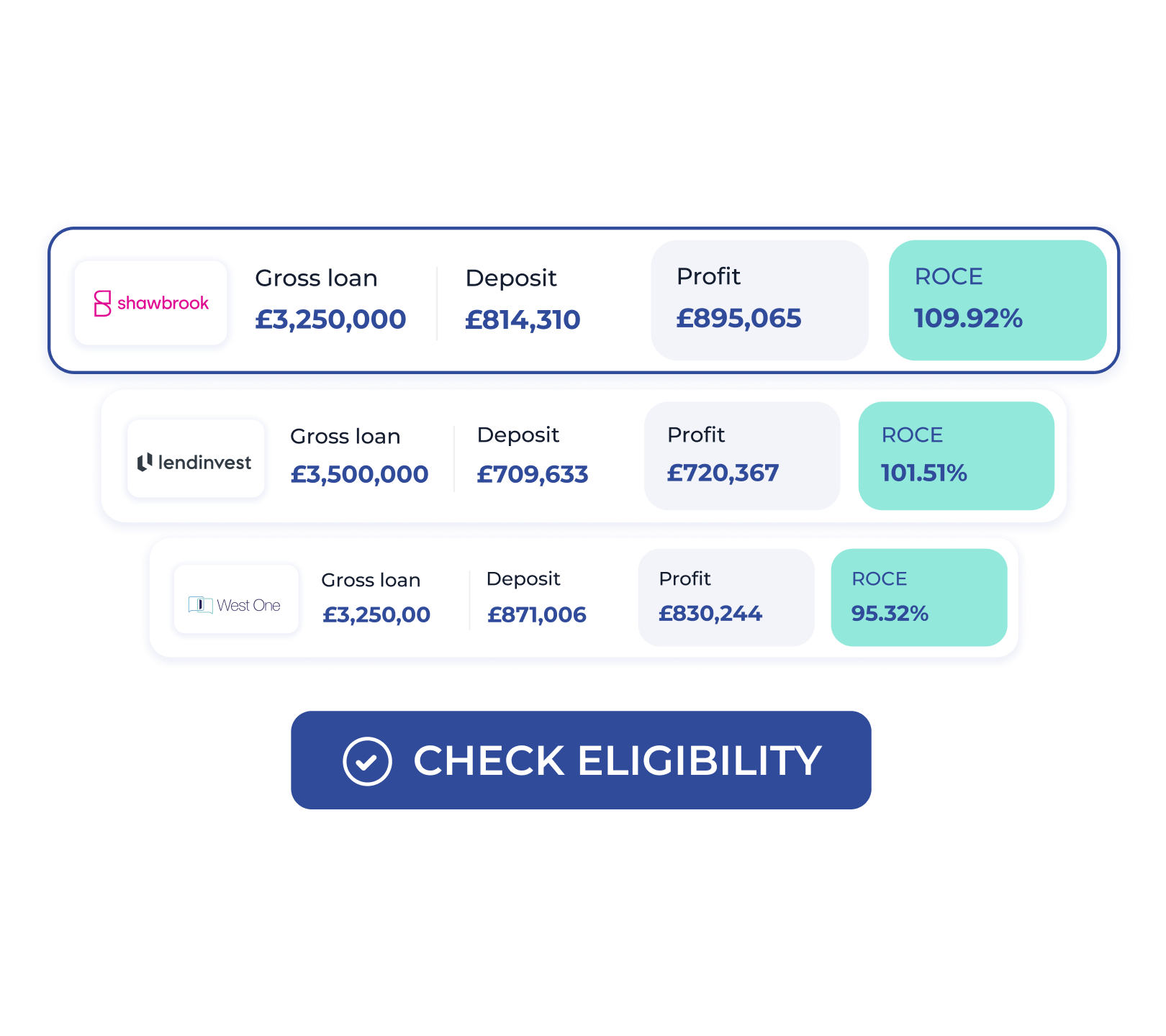

- Compare lenders' rates, fees, and maximum LTVs

- Eligibility filters to refine your search

- Market-leading bridging loans up to £100 million

Bridging Solutions Tailored To Your Needs

Glasgow is a vibrant city with a thriving property market—whether you’re restoring a traditional townhouse, expanding your rental portfolio, or securing a commercial property, bridging finance helps you stay ahead. Areas we support include:

Changing The Way You Finance Your Next Glasgow Property Project

Brickflow streamlines the bridging finance process. Instantly compare live rates from over 100 bridging lenders and secure the best funding solution for your Glasgow property.

Compare loans from 50+ bridging finance lenders

See how much you could borrow against a specific project & at what rate

Check detailed eligibility criteria to avoid wasting time & money

Ensure your deal stacks & make smarter investment decisions

Is Bridging Finance Right for Me?

Still unsure if bridging finance is the right choice? Speak with one of our team for expert guidance or explore our helpful guides:

Compare Bridging Loans

Searching for a bridging loan on Brickflow is the fastest, easiest way to find the best loan for your circumstances. You can compare like-for-like loans from over 50 bridging lenders, see live borrowing costs and filter loans based specifically on what you need.

A search takes just seconds, covers the breadth of the market and could save you enough money to start another project.

How Brickflow Can Help

Looking for a tailored bridging finance solution for your next Glasgow project? Get in touch with our team today. Or, if you’re ready to start, use our bridging loan calculator to compare rates and secure the best deal.

.webp)

What is bridging finance, and how does it work?

Bridging finance is a short-term funding solution designed to provide quick access to capital. It’s commonly used for property purchases, renovations, or securing investments before obtaining longer-term financing.

Can I get bridging finance for a property in Glasgow?

Yes, bridging finance is available for both residential and commercial properties in Glasgow. Whether you’re acquiring a rental investment, buying at auction, or funding a development, lenders offer tailored solutions.

How long does it take to get approved for bridging finance?

Bridging finance is designed for speed. Depending on your circumstances, approval can take as little as 7 to 14 days, with funds released shortly after submitting your application and supporting documents.