How do changing interest rates affect my development finance?

Insights into changing interest rates, development finance and property loans. Find out which lenders link to the BofE base rate, pricing methods and...

.jpg) Market Watch

Market Watch

Property developers and contractors have been faced with rising build costs for the best part of two years. Find out why they increased, whether or not they’ve peaked and what this means for you.

We think you’ll agree when we say since Covid struck, property developers and contractors have faced huge cost increases for material and labour, making previously profitable schemes unviable and locking up consented sites.

While we believe construction costs have peaked and are now beginning to plateau, we thought we’d share our thoughts on why build costs increased, how they’re now plateauing and what this means for developers at different stages of their projects.

Why have building costs gone up?

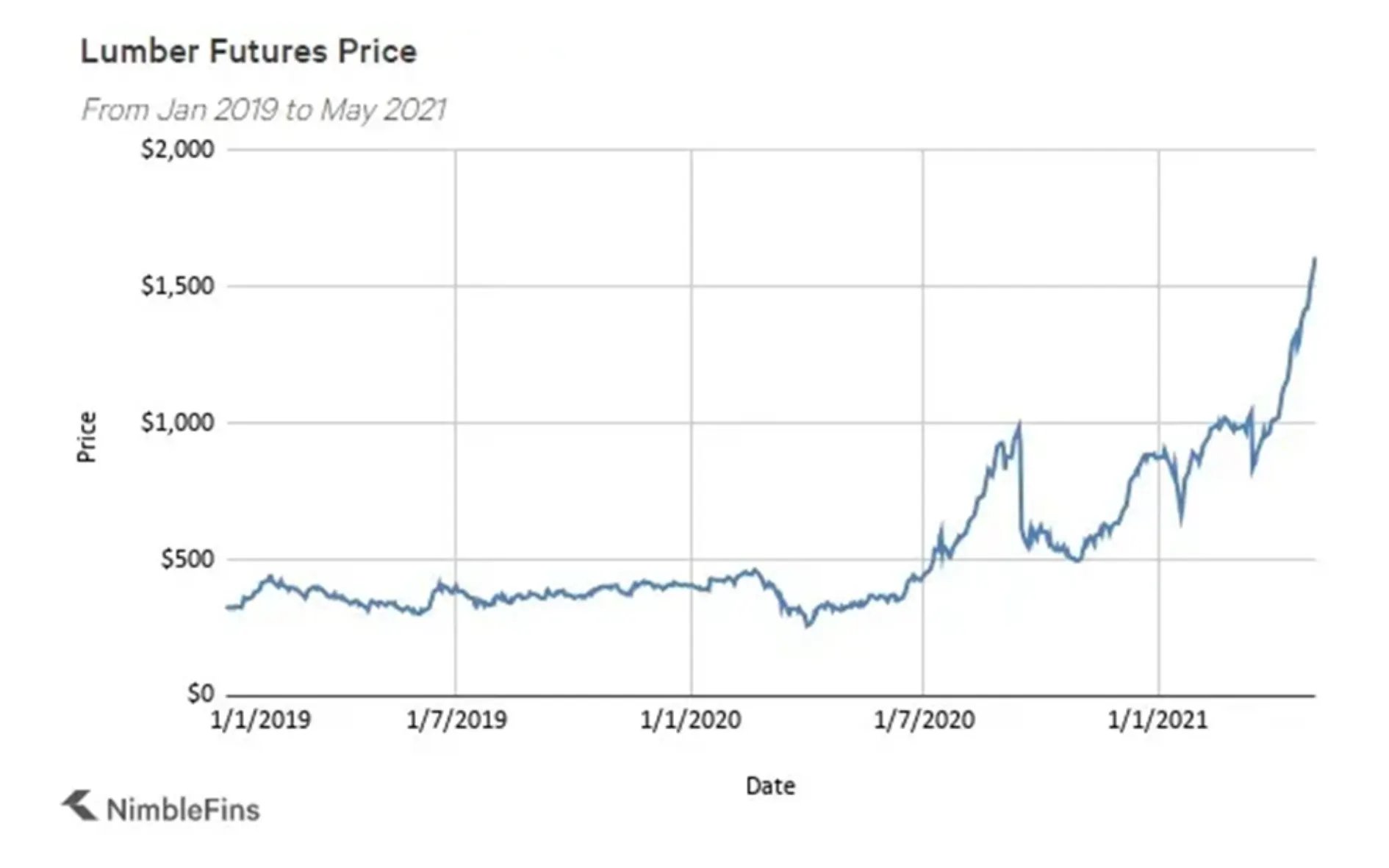

Although we’re all experiencing record breaking inflation across the board now, construction costs have risen faster and for longer than most other sectors. As only one example, since the start of the pandemic, the cost of timber has tripled.

Credit: https://www.nimblefins.co.uk

This is because demand increased after the pandemic and suppliers struggled to keep up, creating a global inflationary issue. In addition, the UK had Brexit to contend with, so not only was it more difficult to source overseas materials, the UK had a depleted labour supply, caused by many construction workers leaving the UK.

Mains contractors have struggled, in fact The Insolvency Service reports the UK construction industry has the highest percentage of insolvencies – 3,213 or 19% of the UK total – in the 12 months ending Q1 2022.

Will building costs go down in 2022 because of an economic downturn?

It’s often said that oil prices and construction indices are the first to fall when we hit an economic downturn. In June 2008, before the financial crash, oil was at $133 per barrel. By February 2009 it was $39 per barrel. In contrast oil prices today are at $108.76, down from the March record peak of $126.51 (prompted by the Russia-Ukraine war). Is a similar fall on the cards now?

We don’t think so, but it’s thought the price of oil would already be much lower, based on demand alone. However, restricted supply (Russia, Opec), is having an artificial impact on price.

The cost of living crisis will further dampen demand, so costs should fall further.

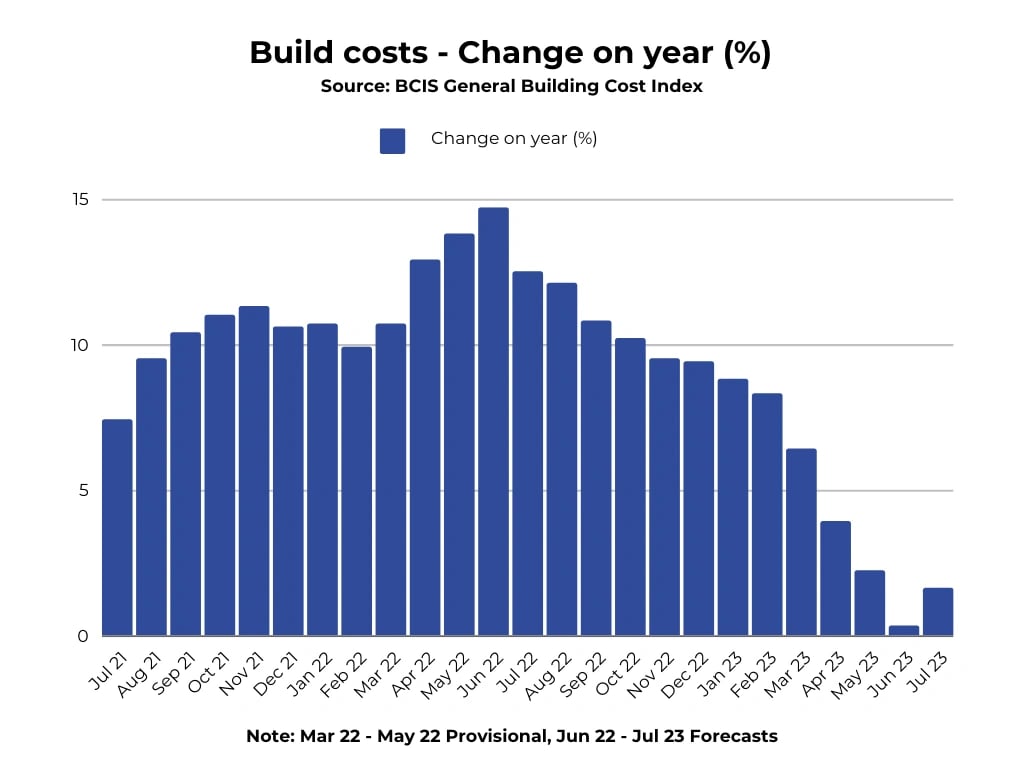

BCIS (Build Cost Information Service) predicted June 2022 to be the peak of monthly inflation for build costs, reaching a 14.7% rise year on year.

Why are build costs plateauing?

Many developers have sat on their hands, waiting for the market to return to some sort of normality, so has this drop in demand prompted the end of price rises?.

One developer recently commented to me, that how six months ago he couldn’t get mains contractors to return his calls, whereas now they’re getting in touch and quoting prices 8-10% lower than discussed in April.

Part of this change is undoubtedly due to contractors looking to secure pipeline ahead of a period of economic uncertainty. But how much of the quote reduction is due to contractors cutting their margins and how much is down to falling material costs? Time will tell.

What this means for property developers in 2023

Lower build costs will have a different impact, dependent on where you are in your project:

Developers on site at the moment

Developers that own land or have option purchase agreements

Developers looking for their next site

Property development – be ahead of the pack

Property development is typically counter-cyclical. Whilst most people don’t want to buy finished stock (residential or Buy To Let) in a falling market, property developers tend to buck the trend.

If you’re buying a piece of land today, especially if it’s pre-planning or only has outline planning, then you are three to four years from delivering those houses to market. By being ahead of the pack however, even if we are entering into a downturn, the chances are the property market should be on the way back up when you come to sell.

How can Brickflow help?

At Brickflow we know being able to source and easily access commercial funding is fundamental to kick-starting a building project. It’s equally important to be able to access development finance loans and compare estimates from compatible lenders, ranked by loan size and price.

Brickflow can save you money by giving you access to development finance and bridging loans that give the best Return on Capital Employed. At a time when every penny counts, why wouldn’t you want to improve this?

Compare 80 lenders in under two minutes by clicking here, and see if we can reduce your deposit by hundreds of thousands of pounds; cash which can be ploughed into more property development projects.

Insights into changing interest rates, development finance and property loans. Find out which lenders link to the BofE base rate, pricing methods and...

The inside track on property development. Read our views on material costs, contingency plans, site bidding, delays, commercial loans, & new...

The inside track on property development in August 2022. Covers interest rate rises, lender reactions, build costs and land price predictions.