Industry Insights (January 2023)

The inside track on property development in January 2023.

Industry Insights

Industry Insights

Embracing an inner chameleon helps developers to continually adapt to market conditions, but in today’s climate should property investors and developers change how they measure a successful project? This month’s Industry Insights looks at why some property businesses are now focusing on Return on Capital Employed (ROCE) rather than profitability.

Planning delays stretch the length of development cycles

Following on from July’s Industry Insights discussing the problems facing planning departments, this month we are looking at the impact planning delays are having on a developer’s career. Many developers are telling us that a full development cycle is now taking 4 years, rather than the historical 2 – 3 years, due to delays in planning.

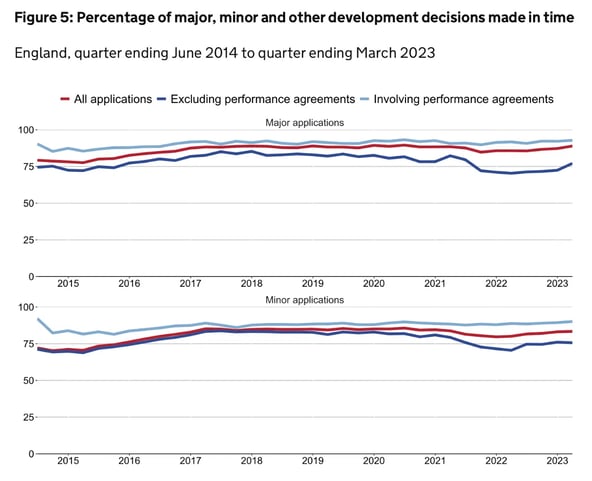

Despite continual accounts of delays from developers all across the UK, the government’s most recently published figures show that they are deciding 86% of major applications within the agreed timescale.

Approval times

Every application is meant to be approved within a set period:

Percentage of major applications in England decided within 13 weeks

| % of major applications decided within 13 weeks | % change from the same quarter in the previous year | |

| January - March 2023 | 86% | Up 1% |

| January - March 2022 | 85% | Down 3% |

| January - March 2021 | 88% | Unchanged |

| January - March 2020 | 88% | Unchanged |

| January - March 2019 | 88% | Unchanged |

| January - March 2018 | 88% | Unchanged |

| January - March 2017 | 87% | Up 4% |

| January - March 2016 | 82% | Up 7% |

| January - March 2015 | 75% | Down 1% |

| January - March 2014 | 76% | - |

Government data also states that in the same quarter, 83% of minor applications were decided within 8 weeks or within the agreed time (up 3% from Q1 2022).

In Q1 of 2023, 45% of all applications involved a ‘Performance Agreement’ – a voluntary undertaking that enables local planning authorities and applicants to agree on the timescales, actions, and resources necessary to process a planning application. Since 2013 there has been a marked increase in performance agreements, going from almost zero to 45%. Applications without performance agreements are less likely to be decided on time:

Gov.uk

Nonetheless, the figures don’t seem to represent what we are hearing on the ground, with most developers we speak to having experienced protracted delays. We also know that several London councils have added blanket caveats to their websites and communications asking for patience as they work through backlogs. Camden Council for example is issuing automated responses stating that officers will not be replying whilst they deal with older applications, with the expectation that applications will take upwards of 6 months to process. (www.formedarchitects.com)

The only reason we can think of why the data doesn’t align with reality is that government statistics are based on when the application is determined as ‘received’ by the council, and this is when the clock starts.

The rate of on-time approvals also highly depends on which council you are submitting to. Whilst North Northamptonshire, Coventry and King’s Lynn and West Norfolk councils are returning 95% of applications on time, London Thames Gateway Development Corporation is only returning 58% on time. Bromley, Suffolk Coastal, Exeter and Kingston upon Hull, Barrow on Furness and East Devon are also at the lowest, or slowest, end of the scale, deciding just 65% or less on time. (gov.co.uk)

The problems are more heavily felt for SME’s

Delays to approval and project starts will always be more detrimental to SME developers than large-scale schemes. This is due to several factors, some of which we discussed last month:

The most problematic effect for SMEs however is that they are likely to have their capital tied up in just one or two sites, so lengthy delays in planning can bring their development business grinding to a halt.

On the other hand, when a large developer faces delays they will have multiple other sites they can progress in the interim. (hbf.co.uk)

Hence it is now more important than ever to be savvy about funding, finding the best deals that allow equity to be spread further, across more sites

The impact it's having:

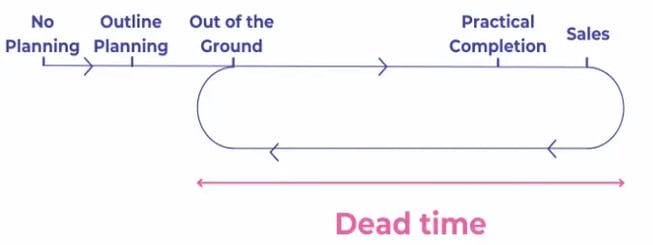

With developers now factoring in 4 years for a full development cycle, the number of schemes that they can complete over the span of their career is significantly impacted.

When the average cycle for a development is 2 – 3 years, a developer will typically complete 10 projects over a 25-year career to meet their financial goals for retirement as well as how comfortably they live in the meantime. With planning delays reducing the number they can complete from 10 to 6, it puts immense pressure on profit in a less profitable market.

Working backwards to look at the numbers:

|

The compounding impact of planning delays. John is a property developer and wants to retire in 25 years.

Development lifecycles (site purchase/planning/construction/sale) were typically estimated to be 2 to 3 years - let’s assume a median figure of 2.5 years. |

This is almost impossible, or at the very least, highly unlikely for most SME developers to achieve. The only viable way to achieve these results is by reducing the capital employed per project, so you can have several sites at different stages of the development cycle running simultaneously.

It all comes down to stretching equity and smarter borrowing

The most successful SME development businesses will typically have 1 (or more) projects at pre-planning, 1 (or more) in planning, 1x coming out of the ground and 1x being sold. The only way to achieve this multiple-project model, beat the odds and scale sooner is by being clever with funding.

The Developer Lifecycle:

As developers mature and gain experience, they will diversify their investments and take on sites with planning risk but balanced with consented sites. This is something we are already seeing in practice, as more developers are spreading their equity over multiple sites at different stages of the planning process, to try and get that conveyor belt of sites moving.

By having the multiple-project model including consented sites and sites without planning, developers are still able to proceed with a project and take it to completion whilst grappling with the process of achieving planning on another site. Since a lot of money can be made at the planning stage, and it is therefore a smart way to improve return on a deal, it is crucial that developers have this flexibility.

In the below example, we demonstrate how using a bridging loan, reduces Developer X’s equity input and increases return:

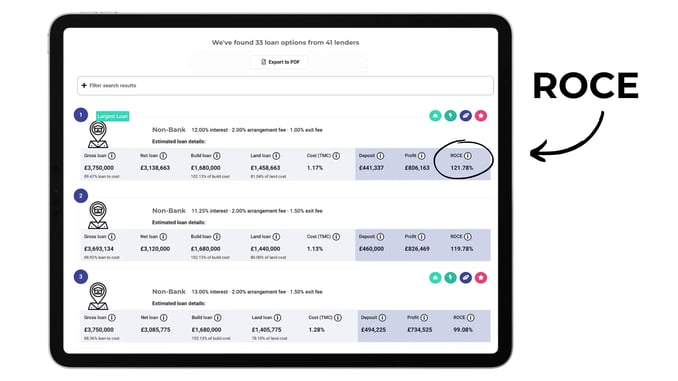

By using funding, the ROCE has more than doubled for the developer.

Unfortunately, many property investors don’t know that they can access bridging finance to fund the journey between acquiring a site to getting it shovel-ready.

Pre-construction bridging loans can be used for land without planning, land with outline planning or land with planning that needs to be enhanced or altered and can be used to fund up to 75% LTV (on a gross loan basis).

ROCE is the new black

In today’s climate, more and more developers are considering their Return on Capital Employed (ROCE) above profit generated. If we compare two identical scenarios, one without pre-construction bridging finance and one with, the latter, whilst having a lower profit, has nearly double the ROCE rate and uses less than half of the amount of equity.

A. Worked example

Developer purchases a site with outline planning at £ 900k

Value after detailed planning £ 1.5m (6 months)

ROCE without finance £ 525k / £ 975k = 107.69% (annualised figure, as project was 6 months)

B. Now, in the same scenario, but with funding:

Purchase £ 900k

Value after planning £ 1.5m (6 months minimum)

ROCE with finance £ 453k / £ 444k = 204.05% (annualised figure, as project was 6 months)

In scenario B, the property investor has saved over £ 500k in initial equity, giving them the freedom and flexibility to invest in another project simultaneously.

If the big fellas are doing it…

At Brickflow, we’ve recently heard that the UK’s second-largest developer has now moved to a ROCE model rather than profitability; something that we have been advocating since we first founded Brickflow.

According to Vistry Group PLC’s (a partnership between Countryside Partnerships and Vistry Housebuilding) Annual Report, central to their partnerships strategy is ROCE targets of 40% or higher. The report states that ‘historically Countryside has not prioritised ROCE resulting in a level below our 40% target’ but they are now focusing on achieving that target on every build. By increasing the proportion of pre-sold revenues on numerous sites, particularly the more capital intensive high-rise developments in London, they are better able to drive ROCE towards their target. Every new development undertaken by the Vistry Group Partnerships now uses ROCE as a key metric, with a 40% minimum hurdle.

In the same way that a financial advisor would tell their clients to spread their investments over several stocks/shares/assets rather than just one, property investors and developers should be thinking along the same lines. By focusing on ROCE rather than profit, equity can be spread further and property businesses can scale sooner.

If the big development businesses are now using ROCE as a key metric to manage a scheme, then SMEs should follow suit. To help developers with this, Brickflow displays project ROCE next to every lender on the results screen.

Before you or your clients secure the next site, compare pre-construction bridging finance on Brickflow now.

Brickflow is a software company only. Our product is designed to be used by experienced property finance professionals to source and apply for development finance loans.

Property investors can search the finance market by using our software to model and analyse their deals, but they cannot apply for finance through Brickflow without a Broker. Speak to your Broker about Brickflow or ask us to connect you with a Broker.

Property development carries risk, including variables beyond the developer’s control. A property development loan is debt and should be procured with caution.

Brickflow does not provide information on personal mortgages, but your home and other assets are at risk if you provide a personal guarantee for a corporate loan.

Brickflow is a digital marketplace for commercial property finance. We connect brokers with lenders to source the best value loans, quickly and easily.

The inside track on property development in January 2023.

The inside track on property development in February 2024.

The inside track on property development in March 2023.