Industry Insights (February 2023)

The inside track on property development in February 2023.

Industry Insights

Industry Insights

March means Spring Budget, so this month we’re looking at any opportunities arising from the Chancellor’s announcement, and of course, the tremors in the global banking sector.

The UK economy has had some pretty gloomy forecasts over the past few months. March however, has seen an uplift in rhetoric as the economy and public finances proved more resilient than expected in the Office for Budget Responsibility’s (OBR) November 2022 forecast.

The Chancellor, Jeremy Hunt, has seemingly delivered a budget with ‘the largest permanent increase in potential GDP the OBR have ever scored in a medium-term forecast as a result of government policy.’ (gov.co.uk)

Further encouraging Hunt’s scathing of the ‘declinists’ is the UK avoiding technical recession, return to growth predicted from mid-2023, and perhaps the biggest golden nugget, inflation reducing to 2.9% by the end of the year. However, February saw a surprise inflation increase again to 10.4% up from 10.1% in January - so whether this sub-3% year-end figure is realistic, remains to be seen.

In an attempt to further curb inflation, The Bank of England announced its 11th consecutive rate hike on the 23rd, increasing by a quarter point to 4.25%.

High interest rates and inflationary pressures continue to weigh heavily on household incomes, so any growth will be stagnated in the meantime.

Silicon Valley Bank and Credit Suisse (and others!)

March has seen some seismic tremors in the banking sector.

The first big banking troubles came when the 16th largest bank in the US, Silicon Valley Bank (SVB), collapsed after four decades of trading.

As the go-to bank for tech companies worldwide, SVB had exponentially grown throughout the pandemic, as tech innovations were front and centre during the never-ending lockdowns.

Deposit purse bulging, SVB invested in typically stable government bonds, but six months of interest rate rises dramatically devalued these.

Simultaneously, the volatile economic climate was particularly problematic on those same tech start-ups, so customers started drawing on their deposits. To cover the withdrawals the bank sold its bonds at deep losses. Cue the spooked investors, cue panicked withdrawal of funds and 48 hours later the $230bn company had collapsed.

The announcement came after crypto lender Silvergate closed, closely followed by Signature Bank being shut-down by regulators, sending shudders through the market and speculation of another banking crisis.

To prevent a swelling panic, the U.S government assured all deposits would be made whole and to bolster confidence in the banking system, Biden laid out details on how the $23tn US banking system will maintain resilience. Treasury secretary, Janet Yellen, said conditions did not match the 2008 financial crisis, stating that ‘the American banking system is really safe and well-capitalised.' (The Guardian)

Credit Suisse

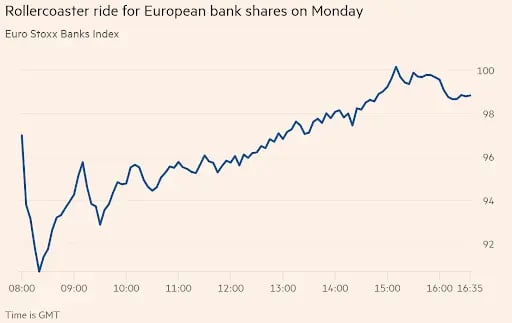

Fuelling the fire, Switzerland’s second-biggest lender, Credit Suisse’s share price sank by 30% after news that their biggest shareholder (Saudi National Bank) ruled out providing fresh funding. The price plunge dragged other European banks down, deepening concerns about the global financial system.

The Swiss National Bank stepped in and offered 50 billion francs, stating it had supported Credit Suisse because it meets all higher financial regulations imposed (post-2008) on banks deemed systemically important.

It pointed out that the US banking problems were different and didn’t ‘pose a risk of contagion’ to Switzerland. Credit Suisse chair, Axel Lehmann, also attempted to calm fears, stating ‘we have strong capital ratios, a strong balance sheet’ (APNews.com).

Credit Suisse’s problems are not new, with a string of major financial losses (ballooning at 7.3bn Swiss francs (£6.6bn) in 2022) and scandals involving alleged misconduct, money laundering and tax evasion that worried investors and fuelled a recent client exodus (The Guardian).

However individualised these banking failures, worldwide governments are keen to reassure depositors that their money is safe and avoid the situation where someone ‘sits in a darkened room and shouts fire, causing a rush for the exits’ (Russ Mould, AJ Bell, APNews.com). In other words, hysteria and panic withdrawals are more detrimental to the banking system than interim loss of capital funding - if SVB customers hadn’t panicked and made withdrawals en masse, SVB would have held its bonds until maturity, and received its capital back.

SONIA, swap rates and interest rates

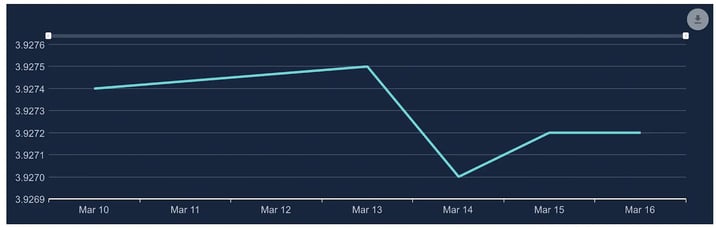

After the banking tremors, there was a brief spike in SONIA on 13th March but they have since dropped and were lower than last month.

SONIA almost indicated that the UK’s interest rates might have peaked, but the 0.25% hike has changed the course again and economists speculate a possible peak of 4.5%.

It’s likely that rates may need to fall faster than previously predicted.

SONIA

Bank of England

Chatham Financial

The US has also raised rates by 0.25% after February’s ‘deflationary’ measures didn’t impact their higher-than-expected inflation (reuters.com).

Likewise, despite the banking troubles, the European Central Bank (ECB) still considers inflation as the bigger risk to tackle, and followed through with increasing its benchmark rate of 2.5% to 3%. Christine Lagarde, ECB president, indicated that the ‘vast majority’ of the Council kept to the planned rise to show confidence in the Eurozone banking system (Financial Times).

The ECB’s steadfast decision can be seen as a good sign that indicates Credit Suisse and Silicon Valley Bank are isolated incidents with their own set of circumstances (Forbes.com). But despite glimmers that stability is afoot, the current market is still volatile.

Brickflow’s View

Lenders are still open for business, but as banking share prices see-sawed on the w/c 20th March and economic instability continues, lenders and their investors could soon become cautious and tighten their credit.

Financial Times, 13/03/2023

Any market reset would normally be gradual. With a few of the biggest market participants reducing their leverage and/or increasing their rates to make themselves look less attractive, which results in smaller lenders picking up the slack. However, eventually, they are forced to make their own products less attractive as well, otherwise, they get overwhelmed. This merry-go-round can have a few rotations over a few months until the whole market has reduced leverage and/or upped pricing.

For developers with a project lined up, it would be a good idea to get started sooner rather than later, whilst credit is still readily available.

The Chancellor’s Investment Zones

For developers who aren’t fixed in one area, Hunt’s ‘spreading opportunity everywhere’ initiative could inspire looking further afield.

It’s well known that opportunity is spread unequally across the UK and the government wants the benefits of economic development to be felt everywhere; towns, cities, rural and coastal.

Combined with initiatives from February’s 2022 Levelling Up White Paper, focused on improving infrastructure such as internet service and transport, the Spring Budget Investment Zones programme aims to catalyse 12 growth clusters across the UK, including four in Scotland, Wales and Northern Ireland.

12 Canary Wharfs

The 12 Investment Zones could be, as Hunt suggested, the next Canary Wharfs, Britain’s most successful regeneration site.

Once the dock for fresh produce coming from the Canary Islands (hence the name), London Docklands went from a thriving industrial site to derelict between 1978 and 1983. A government-led regeneration project prompted Toronto based developers, Olympia & York, to begin construction in the late 80s, building the iconic One Canada Square tower.

By the early 90’s heavyweight banks moved in, the skyscrapers kept growing, and by 2018, a daily working population of 120,000 was occupying more than 16.4 million sqft of office space, serviced by over 300 shops, bars, restaurants and 20 acres of green space.

Each English Investment Zone will have access to a single 5-year tax offer worth £80 million, including enhanced rates of Capital Allowance, Structures and Buildings Allowance and Stamp Duty Land Tax relief.

The locations, shortlisted through assessment of their productivity potential, innovation, levelling up need and local governance, include:

• Greater Manchester Mayoral Combined Authority (MCA)

• The proposed East Combined County Authority

• Liverpool City Region MCA

• The proposed North East MCA

• South Yorkshire MCA

• Tees Valley MCA

• West Midlands MCA

• West Yorkshire MCA.

Areas covered by these authorities can present their tailored bids for hosting an Investment Zone, with a view to agreeing on the proposals by the end of 2023. Local government can choose the number and size of tax sites, up to a maximum of 3 sites totalling 600 hectares, Devolved governments will determine their own locations.

Brickflow’s View

This initiative undoubtedly provides great opportunities for developers.

Once these areas are decided upon, then the surrounding areas will almost certainly see a knock-on uplift in value. Think of areas close to CrossRail stations, Vauxhall & Nine Elms after the Battersea Power Station planning was approved and the US Embassy decided to relocate there, as well as towns and cities that benefited from better connectivity thanks to HS1 and HS2.

For any developers who are keen to get involved in these aspirational regeneration zones, now is the time to start making some connections.

Plugging the Labour shortage

As mentioned in February’s Industry Insights, the UK’s stagnating economy is being driven by its workforce shortage, which was another key focus of the Spring Budget.

The UK is an international outlier amongst advanced countries, who have all returned employment back to pre-pandemic levels. The reason for the high number of economically inactive workers is multifaceted, and puzzling economists.

As well as post Brexit desertion, the UK has intrinsic problems; analysis suggests a major contributor to the labour shortages is Britain’s shattered public services. Lengthy NHS waiting lists, inadequate support for those with health conditions and disabilities, and long-Covid mean there are currently around 2.5 million working-age adults on long-term sick. For the first time since the Industrial Revolution, health gains helping to grow the size of the workforce have gone into reverse, according to economist Andy Haldane. (The Guardian)

Then there’s the lack of affordable childcare, no support for elderly relatives, and employers not offering flexible work. Meanwhile, the over 50’s, with mortgages paid off after years of house price growth, seem too financially comfortable to return to work.

Increasing the construction labour force

The Chancellor has announced several schemes to combat the problems; free childcare, ‘returnships’ offering apprentice-like training for over 50s, and, in a win for the property development industry, a relaxation of immigration rules for skilled construction workers.

After commissioning the Migration Advisory Committee (MAC) to assess the Shortage Occupation List for the construction and hospitality sectors, the government added five construction occupations – plasterers, roofers, bricklayers, plumbers and carpenters. The changes will take effect before summer recess.

Whilst the hospitality sector received no such boost, it seems that the consortium of trade and professional bodies that lobbied the MAC on the industry skills gaps and shortages were heard (constructionenquirer.com).

Brickflow’s View

Increasing the construction labour force will further decrease build cost inflation, which has been falling officially since June 2022, as the disruption in global supply chains dissipated.

Whilst the increased cost of materials was well reported, a big contributor to inflation across the sector was labour costs. Stories of sub-contractors being lured to a site on the opposite side of the road for more money were commonplace.

A change in policy to actively lure skilled construction workers will further reduce the cost of building your next project, so again, another reason to be positive as a developer.

The challenges remaining

Whatever is happening in policy, banking, or global economics, developers continue to face problems obtaining planning permission.

The case-by-case planning process based on the 1947 Town and Country Planning Act gives local authorities such a high level of discretion that developers often have applications that meet every planning rule rejected. The outdated policy is not just exacerbating the housing crisis but also holding the economy back.

Planning delays

The delays are attributed to a few factors, from clearing the backlog of lockdown renovation applications, to concurrent budget cuts causing staff shortages. Some councils are openly admitting they can’t meet the statutory requirement to review applications within 8 weeks.

Also, to further frustrate development teams, councils limited communication channels to manage the strain on planning departments, meaning architects can no longer phone to discuss issues or small changes.

There’s also the ever-present problem of NIMBY culture, and further hampering the development of much-needed housing is Nutrient Neutrality.

Nutrient Neutrality

In a bid to reduce the level of harmful phosphates and nitrates in our rivers, estuaries and wetlands, Natural England issued regulations on 74 councils and planning authorities. The impact of contaminants is being assessed at the planning stage and permission is only granted where developments can demonstrate nutrient neutrality.

It’s currently estimated that over 120,000 homes are stuck in planning due to the issue.

Whether a developer overcomes nutrient neutrality through offset schemes, purchasing biodiversity credits or having on-site treatments, the end ethos is aligned with the environmental policy behind the Investment Zones.

Going forward, any developer who shows in-depth consideration has been given to the environmental impacts of their scheme are likely to be favoured at the planning stage. And for developers keen to be involved in the development of the ‘12 new Canary Wharfs’, nutrient neutrality is just one of the environmental issues that is worth getting to grips with.

Brickflow’s View

It’s never a good time to be a developer as there is always so much risk to balance, however, it does seem like there are plenty of positives;

Brickflow is a software company only. Our product is designed to be used by experienced property finance professionals to source and apply for development finance loans.

Property investors can search the finance market by using our software to model and analyse their deals, but they cannot apply for finance through Brickflow without a Broker. Speak to your Broker about Brickflow or ask us to connect you with a Broker.

Property development carries risk, including variables beyond the developer’s control. A property development loan is debt and should be procured with caution.

Brickflow does not provide information on personal mortgages, but your home and other assets are at risk if you provide a personal guarantee for a corporate loan.

Brickflow is a digital marketplace for property development finance and bridging loans. We connect brokers with lenders to source the best value development loans, quickly and easily.

The inside track on property development in February 2023.

The inside track on property development in September 2023.

The inside track on property development in April 2023.