Industry Insights (February 2023)

The inside track on property development in February 2023.

Industry Insights

Industry Insights

A halt to interest rate rises, a decrease in inflation and a resilience amongst mortgaged homeowners to stave off the bank’s bailiffs. Are things looking up? Read this month’s Industry Insights to find out why we believe now is the time for the savviest investors to grab opportunities.

"Be greedy when others are fearful"

Steady interest rates and reduced inflation aside, rhetoric about the economic climate continues to be gloomy, which is naturally creating fear amongst non-professional property investors, leaving many sitting on the fence for their next project.

But, in the words of Warren Buffet, ‘be greedy when others are fearful.’ As others are too afraid to dip into the market, the savvy, professional investors know now is the time to seize the opportunities. It’s no surprise that the Brickflow platform is busier than ever right now.

We’re taking a look at mortgage arrears, repossession rates and land values to get some perspective on the market and why it’s not as bad as you might think.

But first…

Interest rates and inflation forecasts

For the first time since December 2021, the Bank of England put a halt on interest rate rises, with the Monetary Policy Committee (MPC) voting by a narrow margin of 5-4 to maintain the bank rate at 5.25%

The decision comes after inflation fell unexpectedly to 6.7% in August 2023, down from 6.8% in July. This is the lowest level of inflation since February 2022, when Russia's invasion of Ukraine began driving up oil and food prices.

The fall in inflation was due to a slowdown in food price hikes. However, recent increases in oil prices, to around US$90 a barrel, dampen hopes of a steady decline and made the central bank’s balancing act more precarious. The MPC has cut forecasts for economic growth for Q3 from 0.4% to just 0.1% and noted ‘clear signs of weakness in the housing market’ (Reuters.com).

Core inflation (excluding energy and food) remains at 6.2%, the highest level since 1989. Recent findings from Bank Underground’s analysts have pointed to a rebound in corporate profit margins preventing inflation from falling as quickly as expected. According to the research, 45% of companies surveyed say they plan to increase their profit margins in the coming 12 months, with the top 10% of the most successful businesses driving profit margins towards 30%. Most companies do not intend to pass on falling costs, particularly from energy, to consumers – meanwhile BOE governor, Andrew Bailey, has suggested workers should turn down pay rises to curb inflation.

Overall though, the base rate holding steady will be a relief to the mortgage market.

Looking at the numbers

Arrears

Arrears remain lower than pre-pandemic levels

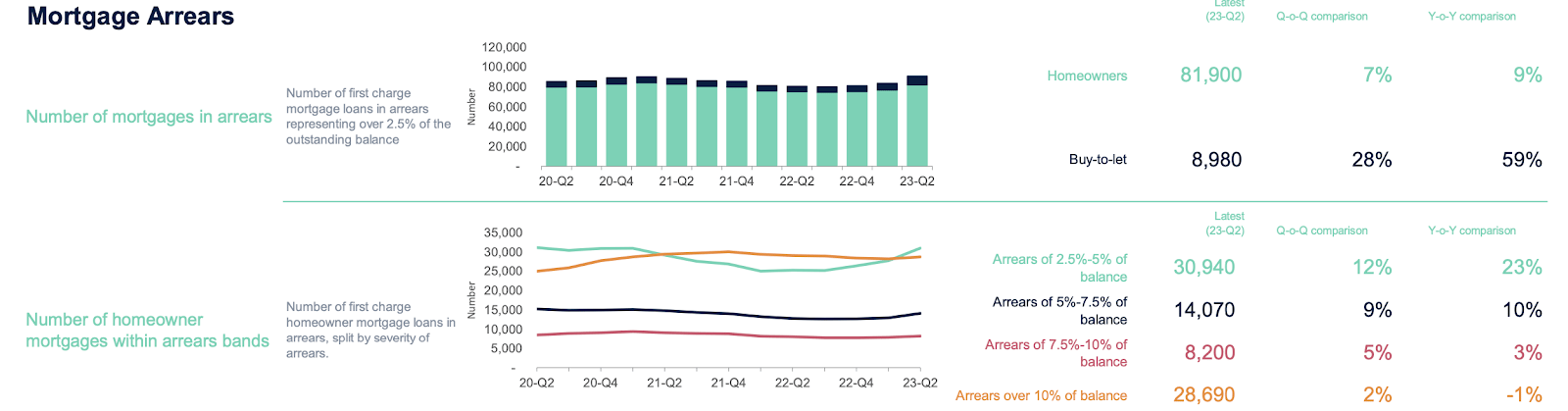

According to UK Finance, in Q2 of 2023 there were 81,900 first-charge homeowner mortgages in arrears of 2.5% or more of the outstanding balance.

This represents a 7% increase on the previous quarter. However, the number of homeowner mortgages in the lightest arrears (2.5-5% of the outstanding balance) is 12% greater than the same period last year at 30,940.

UK Finance

Whilst 2023 has seen the expected increase in homeowners struggling to keep up with mortgage payments, in all bands, except those over 10%, the number of mortgages in arrears is lower than pre-pandemic levels. For arrears over 10% of the balance, the numbers have fluctuated in no discernible pattern.

.webp?width=1600&height=591&name=Mortgages%20in%20arrears%20(number).webp)

UK Finance

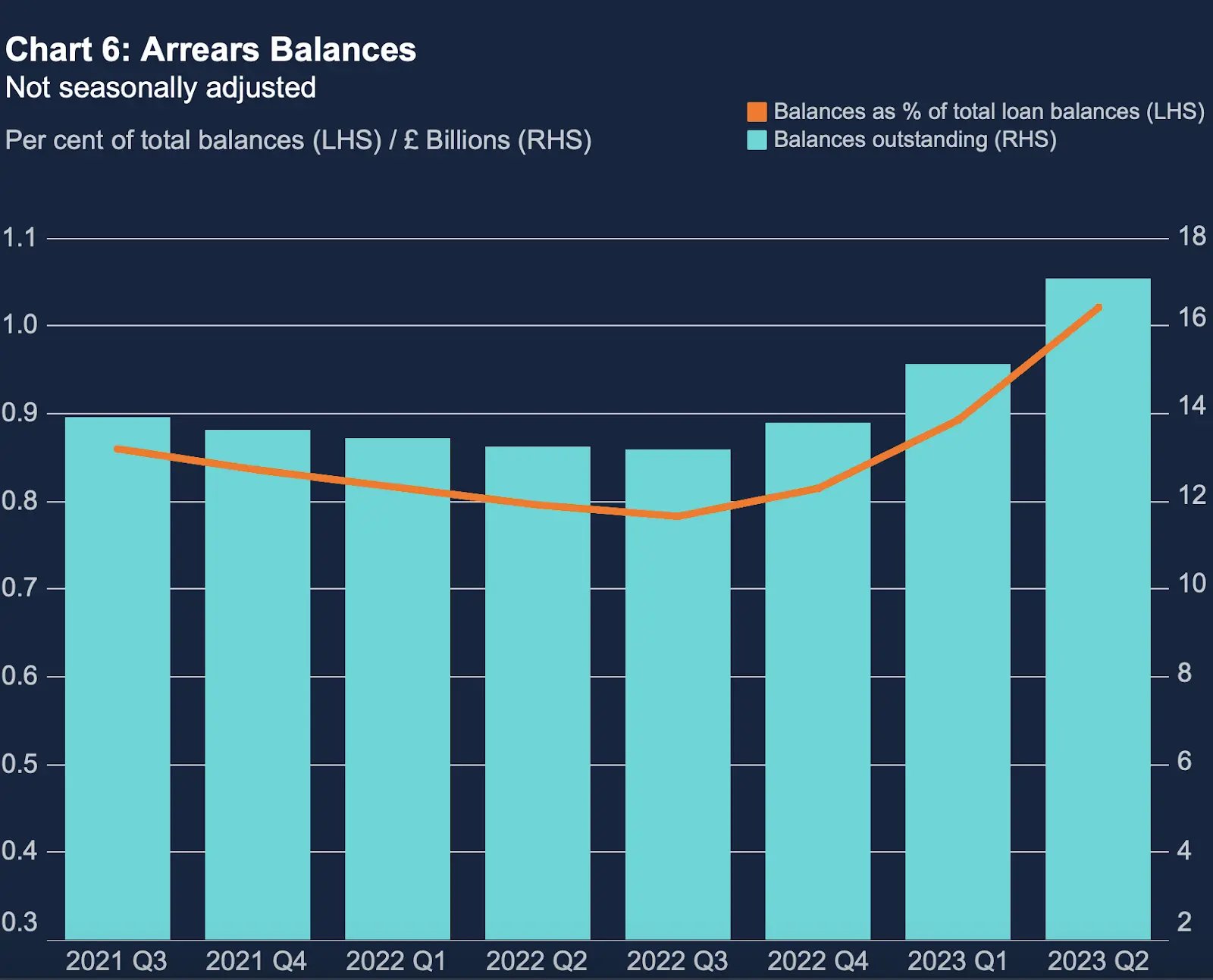

According to Bank of England data (published 12th September), the number of mortgages in arrears is higher.

The data includes arrears equivalent to at least 1.5% of the outstanding mortgage balance (UK Finance is 2.5%) and states the value of outstanding balances with arrears increased by 13.0% on the quarter and 28.8% on a year earlier, to £16.9 billion.

Bank of England

The report spurred a flurry of headlines declaring a mortgage arrears crisis. However, £16.9 billion is the total value of the mortgages that have arrears. The value of the arrears themselves is £1.9bn, an increase of 5.5% on the previous quarter.

The number of total loan balances with arrears increased on the quarter from 0.89% to 1.02%, the highest since 2018 Q1.

Nonetheless, both UK Finance and BOE figures are significantly lower than the 3.32% of total residential mortgages in arrears in 2009.

Buy-to-let arrears

A 126% Y-oY increase of BTL mortgages in arrears

Where UK Finance’s data shows significant challenges is within the buy-to-let sector (BTL); there were 8,980 BTL mortgages in arrears of 2.5% or more of the outstanding balance in Q2 2023, 28% greater than the previous quarter.

Within the total, 4,810 BTL mortgages were in the lightest arrears band – an increase of 41% from the previous quarter.

Landlords can often be scape-goats for our housing problems and whilst the private rental sector (PRS) undoubtedly has some abysmal properties, higher mortgage costs combined with recent legislations are having a detrimental effect on the market. Regulation to protect tenants is welcomed, but rather than weeding out only rogue landlords, the entire sector is affected and the dramatic increase in arrears on BTL mortgages will likely make the rental scene more stark for renters.

According to UK Finance there are 2,033,512 BTL mortgages and as of Q3 23, 0.44% of those are in arrears. Whether landlords resolve their arrears by selling or defaulting, it signifies a potential loss of approximately 8950 privately rented properties.

BTL mortgage arrears

UK Finance

Rental caps have to be realistic (for example, in Scotland there has been a 3% annual cap on rent increases at a time when mortgages have more than doubled in some cases), otherwise income does not cover costs, clearly demonstrated in the year-on-year comparison figure of 126% increase in the number of landlords in arrears.

Brickflow's view

It might look as if the PRS is unviable right now but anyone entering the market today is aware of mortgage costs and rental income – unlike current landlords who need to make their investment work retrospectively after significant mortgage and tenancy changes.

Additionally, the record-high levels of tenant demands have continued into H2 of the year, with Zoopla data showing that letting demand has consistently tracked above the five-year average over the past 12 months.

Though buy-to-let investors in, for example, southern England might now need to have equity of 40-50% of the property’s value to get the numbers to stack up, being savvy with funding means you can avoid emptying your equity pot and maximise the opportunities of an under-supplied, oversubscribed market.

For example, using bridging finance to purchase and renovate a below market value property, then refinancing with an improved LTV ratio. There are already signs of loans for landlords shifting in the right direction, with one of the UK’s biggest BTL mortgage providers reducing rates on selected products by up to 20 basis points from the 19th this month. (mortgagestrategy.co.uk)

How are the banks behaving to arrears?

During the pandemic, The UK Financial Conduct Authority (FCA) issued ‘Tailored Support Guidance’ outlining how they expect firms to support customers in financial difficulty. The same guidance is applicable to borrowers impacted by the rising cost of living, and the FCA’s Dear CEO letter, sent to more than 3,500 lenders this summer, reiterates these guidelines.

Around 85% of the mortgage market have now signed up to the new mortgage charter. Under this charter, borrowers can seek guidance from their lender without affecting their credit file, and lenders agreed to a range of options to help borrowers including switching to interest-only payments, extending mortgage terms, and temporary payment deferrals.

Banks seem to be playing their part in improving outcomes for borrowers struggling with their repayments. Many banking institutions are actively contacting people who have moved onto a standard variable rate (SVR), or those who they believe will be stretched on roll-off, as well as keeping regular customer checkpoints for those already on forbearance support.

A key element of the mortgage charter is that borrowers will not be forced to leave their home within 12 months of their first missed payment. This combined with more stringent stress-testing, has kept repossessions below pre-pandemic levels.

Repossessions

Prior to the measures put in place with the mortgage charter, the Centre for Economics and Business Research (CEBR) forecast that with an interest rate of 6% there could be 10,000 UK home repossessions over the next three years.

Whilst we haven’t reached 6% yet, it seems banks are successfully keeping repossessions at bay for now. According to UK Finance;

610 homeowner mortgaged properties were taken into possession in Q2 of 2023, 19% fewer than in the previous quarter.

440 buy-to-let mortgaged properties were taken into possession in Q2 of 2023, 7% greater than in the previous quarter.

UK Finance

Auction activity

So, there hasn’t been swathes of repossessed homes going to auction, but there has been notable growth in auction transactions.

IAM Property Index shows the number of auction sales in Q2 2023 increased by 32% compared to the same period last year, with 2,354 properties sold under the hammer. This is the highest number of auction sales in a single quarter since the IAM Property index was launched in 2019. Auction sales have grown amongst all price ranges, with properties selling between £50,000 and £10 million; £200,000 - £300,000 is the most popular price range.

There are two attributable factors to this growth;

Land price data

Knight Frank’s Residential development land index report shows that Q2 23, has seen a slowdown in activity and a market wide decline in prices.

According to the report, central London land values fell by 5% and UK Greenfield and urban Brownfield values also fell on average by 6.1% and 5.9%, taking the annual change to -14.6% and -17.9% respectively.

Residential land prices are volatile and sensitive to house price changes, which means there’s likely to be a sharp rebound in land values when the economic situation invariably improves.

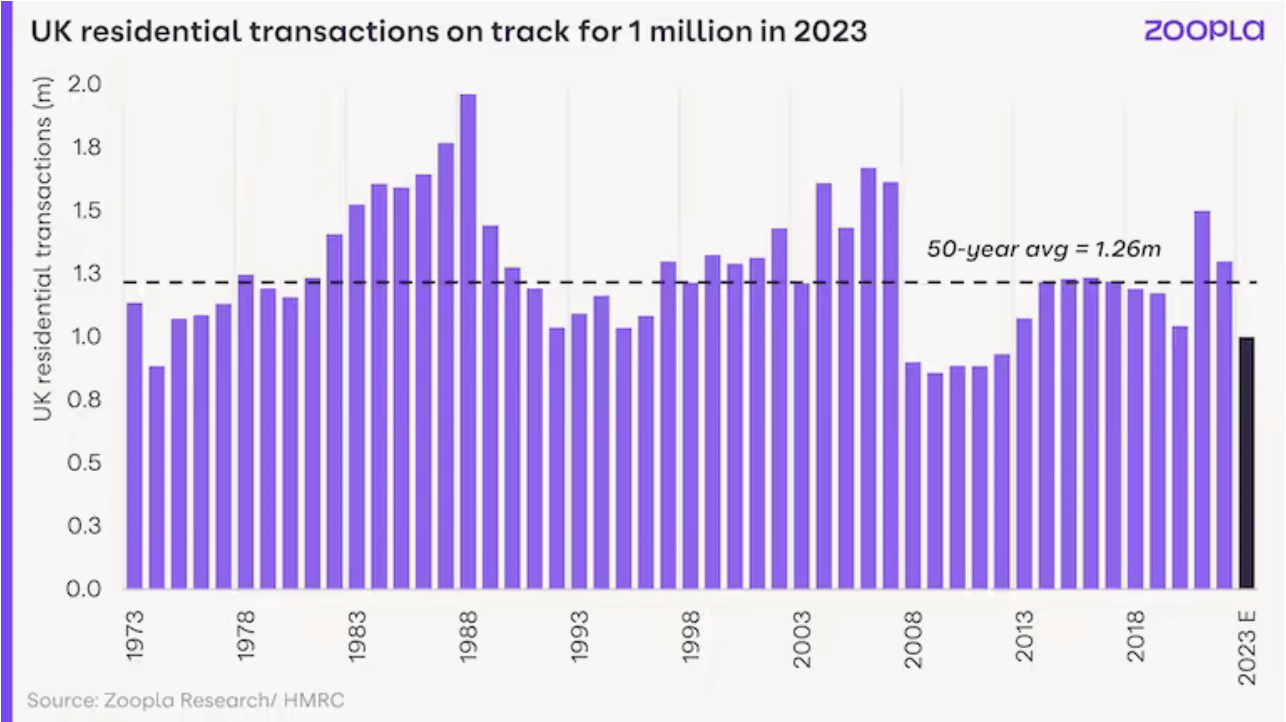

Nonetheless, against the challenging economic backdrop, residential transactions are set to reach 1 million in 2023.

zoopla.co.uk

Wage rises of around 7% over the last year combined with lower house prices are improving housing affordability despite higher mortgage rates. Going into 2024, if mortgage rates fall as expected, buyer affordability will continue to improve and market activity will surge.

Liquidity crunch

Despite the lower land prices, developers still need to stump up more cash and borrowing is less readily available because of what, at Brickflow, we’re calling a ‘liquidity crunch.’

With every 1% increase to the base rate, a developer needs £10,000 more in equity per £1m borrowed. This means that, based on the UK’s £8 billion development finance market, £400 million more is needed in equity. With less equity available, the amount developers can borrow with the same amount of equity is now 25% lower than last year, creating a liquidity crunch rather than a credit crunch.

The market developers have been waiting for

Developers selling finished products in the current market have of course come up against some difficulties, but for those who are looking to get started, this is the market they’ve been waiting for. Land prices are lower and competition is less steep – as already mentioned, the volatility is causing many property investors to back out, leaving the path clear for those who know what they’re doing.

'Be greedy only when others are fearful'

As lender rates and criteria shift continuously, people can’t rely on the previous lenders they’ve used and what knowledge they had of specialist property finance before the volatility started. This is why the Brickflow platform is busier than ever and an essential tool for developers.

Brickflow users are savvy and understand that getting the finance right is core to the success of any project, even with discounted land prices. With equity being stretched and borrowing costs up, finding smart ways to make deals work will let you scoop up the opportunities that others are too fearful to take on.

Smart ways to make deals work

Start at the beginning – there’s plenty of money to be made in the initial stages by obtaining planning permission, but if you overpay for land, it’s pretty hard to recoup that later. The biggest mistake we see investors make, time and time again is underestimating their finance costs. If you underestimate your finance costs, you will overpay for your land. It is that simple.

Speak to your Broker or head to Brickflow - it takes less than 2 minutes - and get a read on where the market is pricing. Once you have factored in your finance costs, you can accurately predict your profit, and then work backwards to determine the price you want to pay for the land.

Negotiate your price - again, this is the ideal market for making those negotiations. An overage agreement, where the seller will benefit from any increase in land value upon sale, can be a useful negotiation tool. Using bridging finance to cover purchase and planning costs can significantly reduce your equity input and increase your return on capital, as well as freeing up capital to invest elsewhere simultaneously.

You can compare bridging loans at Brickflow and see how it can improve your ROCE.

Then, as ever, it comes down to securing the best development finance loan – lender deposit requirements vary from 10% to 35% of total costs (including land, build, finance and professional fees). This can mean a difference of hundreds of thousands of pounds.

Mezzanine debt, a smaller secondary loan that is second-charge to the development finance loan and provided by a different lender, is another way to reduce equity contribution.

Speak to your Broker or head to Brickflow to find out the smartest ways to make your next deal work and compare bridging loans and development finance from the breadth of the market, instantly. We continually update lender criteria and rates so you can access real-time borrowing options.

Now is the time to ‘be greedy’ and secure your next projects.

Brickflow is a digital marketplace for commercial property finance. We connect brokers with lenders to source the best value loans, quickly and easily.

The inside track on property development in February 2023.

The inside track on property development in March 2023.

The inside track on property development in April 2023.