Industry Insights (February 2023)

The inside track on property development in February 2023.

Industry Insights

Industry Insights

On April 19th the ONS published its most recent report on property market activity. Despite four consecutive months of house price falls, the data reveals a stoic resilience within the UK property market.

The latest figures from ONS, including data up to Feb 2023, show property prices have fallen for four consecutive months, but remain higher than a year ago. From the 12 months to February 2023, the average UK house price increased by 5.5% to £ 288K, £ 16K higher than February 2022, but £5,000 below November 2022’s peak.

Overall, the -3.1% drop in prices in the year to March 2023 marks the biggest annual fall since 2009 (Nationwide).

Regional Differences

The regional differences in average house price increases over the past 12 months have been vast;

The West Midlands saw the highest annual percentage change of all English regions in the 12 months to February 2023 (8.6%), while London saw the lowest (2.9%). (Ons.gov.uk)

Sales volumes are down

Data also shows that the volume of both residential and non-residential property transactions have dropped significantly since last year, with the impact of higher mortgage and interest rates now evident within the statistics.

However, towards the end of Q1, sales volumes are stronger.

The approximate number of UK residential transactions in February 2023 is from 76,920 (non-seasonally adjusted) – 90,340 (seasonally adjusted), 18% lower than February 2022 and 2% - 4% higher than January 2023

The estimated number of UK non-residential transactions in February 2023 is 8,710 (non-seasonally adjusted) – 9,870 (seasonally adjusted), 7% lower than February 2022 and 8 - 5% higher than January 2023

Source: National statistics UK monthly property transactions commentary (March 2023)

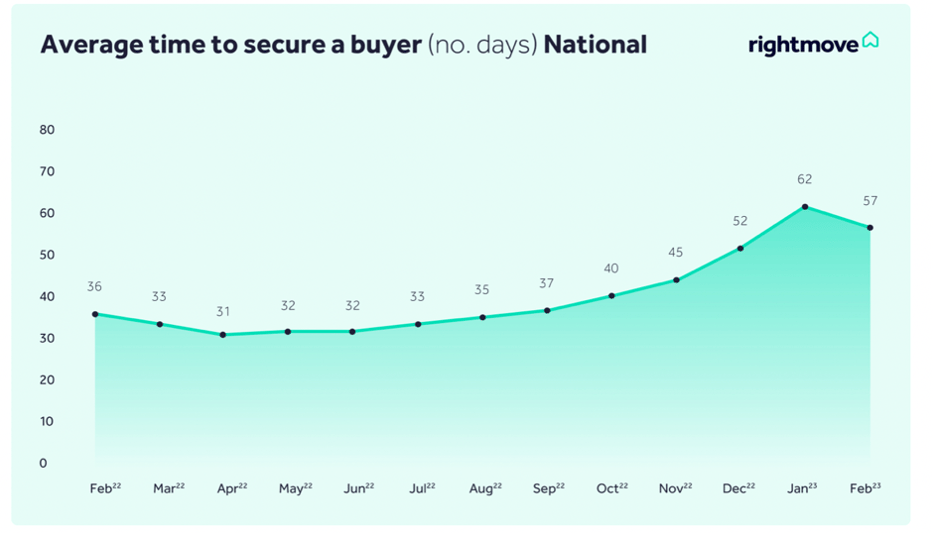

Sales completion times are up

Scotland continues to be the quickest place to complete a sale at just 40 days, with London being the slowest at 70 days, increased from 57 days in Feb 2022.

Nonetheless, Rightmove’s data reflects a cautious recovery throughout Q1 of 2023.

How is this reflected in the property development market:

Deeper discounts on land and sites

The slowing of the housing market has of course trickled down to the slowing of developments, creating less activity within the residential land market and a lessening of land values.

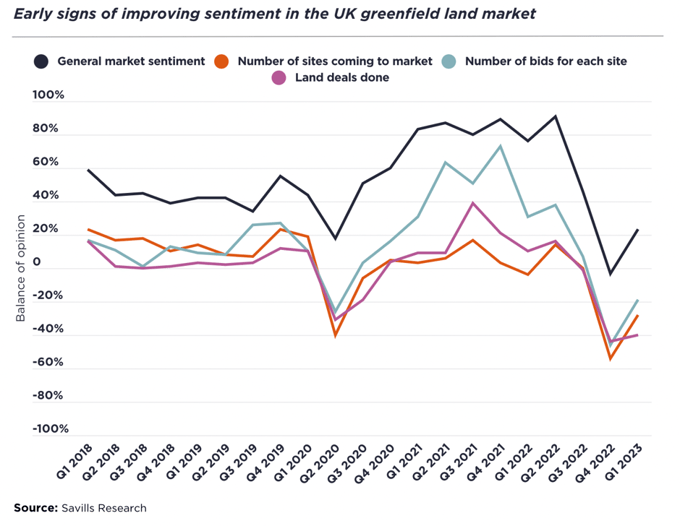

According to Savills, the market slowdown, including the loss of the government Help to Buy scheme in October 2023, has contributed to -9% fewer Savills land deals in Q1 2023 compared to the same quarter last year. They also report that the number of new sites launching onto the market fell to its lowest levels seen in over ten years, at -54%.

Falling house prices, slower sales rates in the new build market and inflated build costs (despite recent easing on the supply chain, and a potentially bolstered labour force by summer 2023, build costs rose by 8.6% over the last year and BCIS forecast an 17% increase over the next five years) will continue to put downward pressure on land values.

The Savills Development Land Index shows ‘UK greenfield and urban values fell by -1.7% and -1.8% in Q1 2023, marking -3.8% and -3.4% falls respectively since September 2022’ but sentiment is improving (savills.co.uk).

Prime sites

The ongoing shortage of supply of sites is sustaining demand and land value in some locations. Whilst some sites have seen continual price drops over the past 3 months, others where there is a distinct lack of supply have seen little to no price drop. As a result, there hasn’t been the price adjustment to reflect the wider residential market slowdown.

Where there’s greater buyer affordability, such as parts of the North and Wales, sales of new build sites are significantly stronger (Wales’ extension of the Help to Buy scheme until March 2025 is helping to support the new build market), creating an appetite for land from a range of parties.

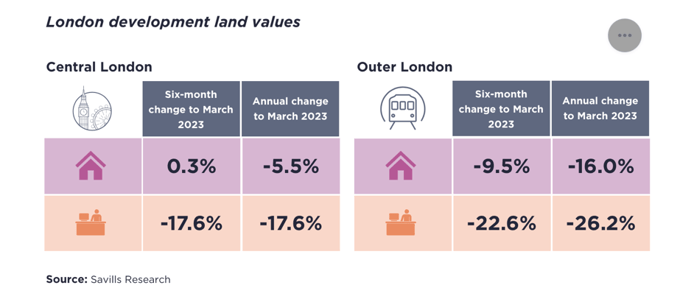

London

Whilst land transactions in London have slowed significantly, Central London residential land values have remained stable, partly due to cash buyers and overseas buyers with less reliance on borrowing.

Residential land values in Outer London have seen more significant price falls in the six months to March 2023.

In the London office market, land values have also faced a noticeable correction, with significant drops in both Central and Outer London office land values, mostly driven by higher borrowing costs, decreased investor demand and weak market sentiment.

New Builds

Naturally, the decline in market activity has impacted the number of new house-build starts. According to statistics from the National House Building Council (NHBC), construction on new plots in January 2023 was -30% below the same time in 2022.

However, with recently reduced mortgage costs and increased availability, the major housebuilders have reported an increase, albeit small, in sales from 0.3 per outlet per week in Dec 2022 to 0.6 by Feb 2023 (NHBC).

Recovery in new build sales is key to demand returning to the land market because it drives developer confidence to start on a new site. If the recent uptick in new build sales continues at the same rate, it’s likely that activity in the land market will return by summer (savills.co.uk).

House sales versus mortgages

Whilst Q1 of 2023 shows improving conditions, recovery will continue to be hampered by mortgage rates. BOE transaction data indicates that 353,000 fixed rate mortgages were due to be renewed in Q1, with the number of fixed rate mortgage deals coming to an end in 2023 peaking in Q2 at 371,000. The actual figures are likely to be much higher though because the data doesn’t include remortgages with the same lender and second-charge lending. (Ons.gov.uk)

The Bank of England’s Monetary Policy Report suggest that around 4 in 10 (45%) adults with mortgages have concerns over the impending change to their mortgage payments.

Auction activity rising

The natural consequence of mortgages being unaffordable is more repossessions and therefore more auction activity, which is supported by recent figures on auctionhouse.co.uk. UK wide, the number of lots offered has mostly increased month on month, with few exceptions. There’s no discernible patterns in the percentage of lots sold per auction, which typically fluctuate between 60 and 100%.

Like in the wider market, prices are showing resilience though and, where info is available, particularly greater London, all lots have sold for well above the guide price.

So whilst auction opportunities will increase, scooping up a rock-bottom bargain isn’t likely.

Brickflow’s View

The weaker housing market has undoubtedly triggered more caution amongst buyers and reduced competition for sites over the last quarter. With the major housebuilders currently being less active in the land market, private SME housebuilders should take advantage of the lack of competition. At Brickflow, we’re hearing more deals being renegotiated with deeper discounts as developers factor in higher borrowing costs, higher build costs and reduced selling prices.

To avoid deals falling through, or rather than getting stuck in a buyer-seller stand-off, consider making conditional deals like deferred land payments.

Alternative developing

Built-to-rent: As private landlords continue to make an exodus from the market under ever-reducing profit margins, the rental market can’t meet supply and demand. As such, the Build to Rent sector has an oversubscribed audience and avoids grappling with the sales market.

Though BTR is a less sure market in Scotland, where new rent regulations are stymieing investment, with a study by the Scottish Property Federation claiming that the legislation had spooked institutional investors from Scotland’s fledgling build-to-rent market, with some viewing the country as “uninvestable” under current conditions. (insidehousing.co.uk)

PBSA: Also affected by the shrinking private rental sector is student accommodation and as China opens up after prolonged lock-downs, demand is returning to the market. Data recently released by UCAS shows that the number of international applicants to UK undergraduate courses increased by 3% compared to last year. (britishcouncil.org)

Sites within proximity to major universities across the UK are in demand by Purpose Built Student Accommodation (PBSA) providers, with particular demand being strongest in ‘cities like Newcastle, Leeds and Nottingham, where private rental supply has dropped by over 30% compared to the 2017–19 average’ (savills.co.uk).

Affordable Homes: Demand for affordable homes is now more pertinent than ever. An Inside Housing Survey of the 50 largest housing associations show ambitions to deliver just over 233,000 new homes by 2027 (insidehousing.co.uk). Developers keen to deliver on the Affordable Homes Programme 2021 – 2026 can continue to access government grants to support land purchases, and recent updates to the guidance means grant funding can now be allocated retrospectively in certain cases (gov.uk).

Where the HNWIs are investing

Meanwhile, with inflation predicted to be at its peak and lower debt costs anticipated in the near future, investment in the property market from HNWI’s is set to grow. According to Knight Frank’s recently published Wealth Report (an annual assessment of private capital and its impact on property markets), real estate is a ‘critical and a growing part of private investor strategies [and] … the global share of all property investment taken by private capital has risen to a historic high.’ (knightfrank.com)

Beyond the ‘permacrisis’, as dubbed by Collins English Dictionary after the Ukraine crisis led to an energy crunch, supercharging inflation and driving one of history’s steepest ever global interest rate rises, change is afoot and real estate opportunities are emerging (knightfrank.com).

Global mobility & international buyers

‘London took the biggest share of cross-border investment’

An ‘ironic legacy of covid’ (Knight Frank) is the spurring of digital nomads and a new generation of HNWIs that are opting to be bi-primary based. Hence more people want to work and invest internationally, creating a dramatic impact on luxury residential and office market demand.

According to the Wealth Report, ‘the 13% of UHNWIs who are planning to acquire a second passport or citizenship is the tip of the iceberg. The boom in so-called digital nomads is only just starting – promising disruption to outbound countries, destination markets, tax systems, residential rental demand and office requirements’ (knightfrank.co.uk).

According to the Wealth Report, ‘the 13% of UHNWIs who are planning to acquire a second passport or citizenship is the tip of the iceberg. The boom in so-called digital nomads is only just starting – promising disruption to outbound countries, destination markets, tax systems, residential rental demand and office requirements’ (knightfrank.co.uk).

‘While institutions reduced real estate investment by 28% in 2022, private capital was less defensive, falling only 8% and accounting for a record 41% of the US$1.1 trillion committed by all investors. Private investment was dominated by allocations to residential (43%), offices (18%) and logistics (15%). While US cities led in terms of volumes, London took the biggest share (15%) of cross-border investment.’ (knightfrank.co.uk)

International buyers

With the Pound plunging in value in Q4 2022, compounded with Brexit, and continuing economic headwinds, it makes for a good currency swing for international buyers. Hence London continues to be one of the top investment cities for international buyers spending US$10 million+, pipped only by New York and LA. Sales volumes were considerably lower than 2021 (though still 49% higher than 2019). A total of 296 luxury non-landed homes were sold in 2022, substantially lower than the 487 transactions recorded the previous year, largely due to dwindling supply. London also dominated the US$25 million + market, with New York in second place. (knightfrank.co.uk)

According to Knight Frank’s predictions, ‘2023 will see 19% of UHNWI’s investing in income producing property, with the sectors most in demand being healthcare leads, followed by logistics, offices and residential. London will be the top target for office space.’

Brickflow’s View

With the trend in digital nomads set to continue, developers can adapt to target the specific audience and their requirements: think green, sustainable, and innovative, with adaptable office spaces suited to a co-working environment.

Brickflow is a software company only. Our product is designed to be used by experienced property finance professionals to source and apply for development finance and bridging loans.

Property investors can search the finance market by using our software to model and analyse their deals, but they cannot apply for finance through Brickflow without a Broker. Speak to your Broker about Brickflow or ask us to connect you with a Broker.

Property development carries risk, including variables beyond the developer’s control. A property development loan is debt and should be procured with caution.

Brickflow does not provide information on personal mortgages, but your home and other assets are at risk if you provide a personal guarantee for a corporate loan.

Brickflow is a digital marketplace for property development finance and bridging loans. We connect brokers with lenders to source the best value development loans, quickly and easily.

The inside track on property development in February 2023.

The inside track on property development in March 2023.

The inside track on property development in September 2023.