Brickflow wins 'Technological Innovation of the Year'

Brickflow wins Technical Innovation of the Year at the NACFB Commercial Lender Awards 2023

Industry Insights

Industry Insights

A new year ahead and an altered property market emerging. Read January's Industry Insights for our views on the back drop to the economic downturn, why interest rates are rising, why we’re facing a liquidity crunch and the outlook for 2023.

What a difference a year makes. This time last year we were just coming out of our final lockdown and the market was very optimistic.

We emerged from our cocoons into 2022, like butterflies into a year that was destined to be full of promise (albeit with some headwinds gathering). Build costs were still increasing exponentially, but it was ok as house prices were also still increasing. However, things didn’t quite go according to plan.

Coming into 2023, instead of optimism for most, there is a lot of doom and gloom. Especially in the media, by talking us into a deeper depression than I believe will actually play out in some parts of the property sector.

Markets are cyclical and a downturn was well overdue, however, everyone’s interests are different. Not all cycles are aligned.

In fact, if you are a property developer or investor, 2023 should fill you with a lot more optimism than 2022 (providing you’re a buyer and not a seller).

The backdrop to this new downturn

Last year, and probably the previous 2 years to that, were extremely difficult for property developers and investors. It’s been almost impossible to make a deal stack.

We went into Covid with an already inflated market. Land prices were high, and a correction was due.

Instead of the market crashing during the pandemic, as it should have done, prices actually rose thanks to aggressive quantitative easing and government pressure for banks to stay patient with their borrowers, via payment holidays and the like.

Build costs went up significantly during and have continued to rise since the pandemic, but this was masked by the relentless rise of property prices.

Stamp duty holidays and the ability of banks to borrow from the Bank of England at next to nothing made for a sellers market, and land and property prices rose rather than fell.

And underpinning all of this was of course extremely low interest rates.

Now a sharp rise has caught a lot of people out.

Why are rates going up?

We all know why rates are going up. Inflation.

We are now at a near record high inflation rate, but why?

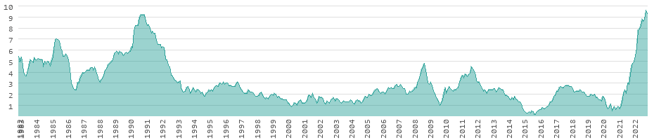

Inflation rates for consumer goods in the United Kingdom. Source = World Data

Continuous lockdowns in China, Russia’s invasion of Ukraine and a clearer understanding of the true impact of Brexit have all seen inflation not only rise, but also become more stubborn.

Prior to the war, Ukraine was a huge net contributor to the global food supply chain responsible for; 10% of all global wheat, 13% of barley, 15% of corn and 50% of sunflower oil (source: origins.osu.edu).

So now, not only do we have supply-side issues in manufacturing and infrastructure as a hangover from Covid, the global economy has also had a supply shock to food staples and energy.

To counter inflation, economies raise interest rates, and that has happened across the board, in the US, UK, Europe and beyond.

Whilst the UK putting up interest rates is not going to make a dent in any of the global issues we face, our central bank is forced to follow the rest of the world, as global capital is attracted to where it can achieve the best returns.

If the US and Europe put up rates and the UK doesn’t, it becomes more difficult for the UK to attract investment. Therefore, the Bank of England’s hand is somewhat forced.

How high will rates go?

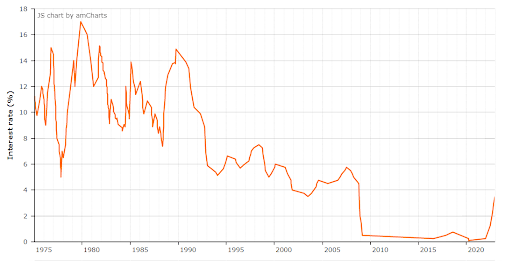

Source: https://www.propertyinvestmentproject.co.uk/property-statistics/uk-interest-rate-history-graph/

Interest rates first increased from their historic lows of 0.1% in December, and interest rate forecasts became increasingly gloomy through Q2 and Q3 of 2023, spiking just after September's infamous mini-budget, with some commentators predicting a whopping 5.75% or 6% by Q2 of 2023.

Fortunately, the rate-setting body of the Bank of England, the Monetary Policy Committee, has since said that is unlikely to pass, and that interest rates may now peak at 4%-4.25% instead, before starting to fall again.

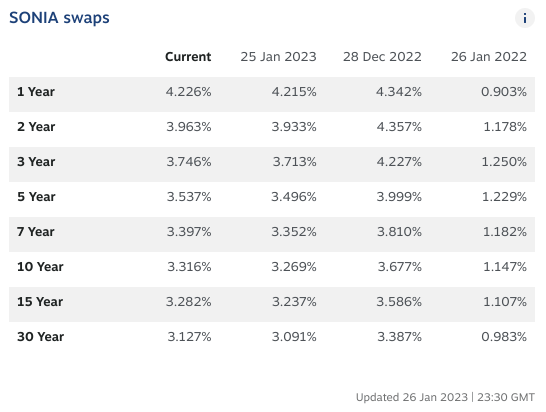

SWAP rates, effectively interest rate futures, have now settled to a 5 year average of 3.59%, but had been as high as nearly 5% after the mini-budget, which caused mortgage rates to spike. As SWAPS have fallen, mortgage rates have fallen as well, but we have to accept the times of super low interest rates are over.

Source = https://www.chathamfinancial.com/technology/european-market-rates

For more than 10 years the UK’s base rate has been lower than 1%, and the fact is we’ve simply become complacent.

By historical standards, our current base rate of 3.5%, is still very low. We just need to adapt the new normal quickly.

There will be a time of adjustment, as we wean ourselves off of cheap credit and get used to higher living costs. But it’s in this period of volatility, or adjustment, that opportunities will undoubtedly arise for most investors and developers.

How will all of this affect the market?

For those that overstretched themselves during the good times, there may be some pain to come.

As we’ve written about before, there will be plenty of people that bought land and property with development potential at the top of the market. Now, perhaps due to planning delays, they are approaching the end of their loan term, the land is not worth what they paid for it, and the lender will be pushing them to sell. Therefore, expect to see motivated sellers and reductions in land prices across the board the further we get into 2023.

However, on the flip side, and again as we’ve said before, this is not 2008.

We do not have a credit crunch on our hands. There is still an abundance of credit available, so prices can only fall a certain distance. This time we have what I would call a ‘liquidity crunch’.

What is a liquidity crunch?

Credit is the part you borrow in an asset purchase. The debt. The deposit is the part the buyer contributes, or the equity.

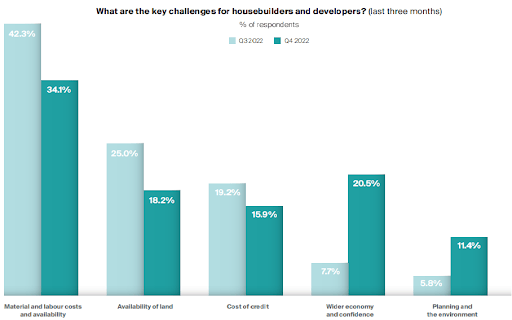

Two things are happening in the market right now; loans are getting smaller, and buyers' liquidity, which is their ability to fund deposits, is decreasing.

Loans are getting smaller as interest rates go up. In development finance and bridging, where loans are forward funded, lenders set aside a bigger percentage of the loan to cover their interest costs. This means a smaller amount of the loan is available to fund the acquisition and therefore the borrower has to find a larger deposit.

For income assessed loans, higher rates means the tenancy income for commercial mortgages, or the borrowers earned income for residential mortgages, covers less debt. Again, meaning a smaller debt is available relative to the asset value.

So, we have a situation across the board, where debt availability is shrinking as a percentage of the property value, thus increasing the deposit needed, and all at a time where rampant inflation is eroding liquidity for buyers'. Hence a liquidity crunch.

The net effect of this is that buyers start finding bigger deposits, or prices fall. The reality is, it will be a bit of both. Sellers will take time to accept the new reality, but again the abundance of credit will mean the majority will not have to take huge writedowns. You’ll also see innovation in the lending market to plug the gap.

Expect to see distressed debt funds back into the market. These funds will plug the gap between the senior debt and the buyer’s deposit, taking the form of mezzanine debt or preferred equity.

These type of funds will be needed by existing owners, not just buyers, and have a big part to play in reducing repossessions.

As an example, if you are the owner of a commercial property that is coming to the end of a loan term, rates have risen, and your bank can no longer support the 65% mortgage you have. You can either default, reduce the debt from your own pocket, or borrow to plug the gap. For most, borrowing more will be the only option.

As a property entrepreneur it’s important to get to know this market and a good broker will be able to help you with that.

If you don’t know a good broker, speak to Brickflow and we can put you in touch with our network of brokers.

What is the market outlook for 2023?

Positives:

Source = Knight Frank UK Res Dev Land Index

Negatives:

Well that’s it for January’s Industry Insights. I hope it was useful.

We will be back in February with more updates on what we’re seeing and hearing through our conversations with brokers, property entrepreneurs, estate agents and lenders every day.

Brickflow is designed to be used by experienced finance & property professionals and property developers using Limited Companies or Incorporated Partnerships, to source and apply for development finance loans.

Brickflow is not an advisory business and does not give advice. It can deal with purely factual inquiries and provide information but it will not give an opinion or recommendation in any circumstances.

Property development carries risk, including variables beyond the developer’s control. A property development loan is debt and should be procured with caution.

Brickflow does not provide personal mortgages, but your home and other assets are at risk if you provide a personal guarantee for a corporate loan.

Brickflow is a digital marketplace for property development finance and bridging loans. We connect brokers with lenders to source the best value loans, quickly and easily.

Brickflow wins Technical Innovation of the Year at the NACFB Commercial Lender Awards 2023

The inside track on property development in August 2022. Covers interest rate rises, lender reactions, build costs and land price predictions.

The inside track on property development in September 2022. Covers interest rate rises, lender reactions, build costs and land price predictions.