What are the different types of development finance?

What are the different types of development finance? A short guide looking at the options for funding property development and how to get finance.

Brickflow News

Brickflow News

As Brickflow Enterprise, our embedded finance solution, makes waves across the CRE finance market, Brickflow’s CEO and founder Ian Humphreys headed to Fintech Talent’s Embedded Finance and Super-Apps conference to discuss the latest developments and the future of embedded finance.

Transformation in the finance industry

As technology continues to evolve, the finance industry has been undergoing a significant transformation. The key trend that’s driving this transformation is embedded finance; the integration of financial services into non-financial products or services.

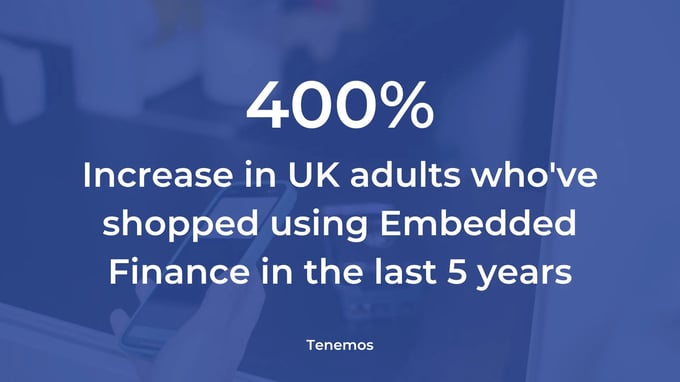

In the last 5 years, there's been a 400% increase in UK adults who've shopped using embedded finance and according to OpenPayed, the global market is predicted to be worth $7.2 trillion by 2030.

The aim of embedded finance is to make paying for goods and services more seamless for customers at the point of sale, and we’re pretty used to seeing it around; the first wave was standard payment solutions like PayPal and Stripe. The second wave was buy-now-pay-later solutions (Klarna, AfterPay).

The new wave of embedded finance

So what’s the third wave?

That was the topic of the day at the recent FTT Embedded Finance and Super-Apps conference. Brickflow’s CEO and Founder Ian Humphreys went along to the London-based event to give his view and join other industry experts as a speaker on one of the discussion panels.

FTT Embedded Finance and Super-Apps conference

Fintech Talents (FTT) is a community of over 200,000 worldwide digital transformation leaders from across the fintech ecosystem, bringing together a community of retailers, manufacturers, insurers, telcos, financial institutions, fintechs and tech innovators to discuss the latest trends, best practices and innovations in the embedded finance space.

In the session titled "Kickstarting the next wave of embedded finance innovation", Ian joined other panellists from across the sector including;

Here's what we learnt...

The third wave is coming

The future direction is naturally any innovation or application that can help people make better, more informed financial decisions and democratise previously inaccessible markets. Think investment and trading platforms like eToro, Trading 212 or Hargreaves Lansdown where people can buy and sell shares with as little as £10 buy-in.

Another example is in the residential mortgage space, where property listings include finance calculators and possible borrowing options.

Now joining the movement is the financing market for commercial real estate - which is exactly the space that Brickflow Enterprise is in.

Brickflow is at the forefront of change

Whilst other industries are adapting and future-proofing, when it comes to commercial real estate transactions, the process is still stunted and segregated, leaving it seriously lagging behind.

Property investors and developers are so used to handing over the financing of their projects to a single lender or relying on figures supplied by brokers. The majority of the market seems to be behind a wall of lender criteria and eligibility and it’s only advertising from big banks that ever reaches a borrower's radar.

This is exactly why we created Brickflow Enterprise, allowing borrowers to see actual real-time finance options for every property investment and compare rates, terms and equity requirements before beginning sales negotiations.

It opens up the entire breadth of the lending market for CRE transactions and means consumers can transition from property search to property financing in a single digital journey. It also connects every entity involved in CRE transactions from agent to buyer to broker to lender.

Bringing CRE into the future

One of the first industries to fully embrace embedded finance was car sales. A person finds a car they want to buy but walks out of the showroom to find finance elsewhere; the purchase fall-out rate was huge. By making finance available at the point of sale, it’s much easier for the customer to transact.

Not only did car sales improve, but retailers also increased revenue through lending commissions.

We know from speaking with commercial property agents that between 25% and 40% of transactions they work on each year don’t complete due to finance issues. Adding an embedded finance solution eliminates those losses and offers a seamless experience on every property purchase, in the same way as the car industry.

Enterprise brings our industry into the future, in line with the rest of the fintech community, and being involved in FTT gave Brickflow an opportunity to learn further from other innovators and share our direction for CRE financiers.

Key takeaways

Overall, the FTT Embedded Finance & Super-Apps event highlights that people want to ‘self-serve’ their finance, have more control over it, more transparency and access to the financial sphere.

Even in the wealth management space, advisers now embed products into their client CRMs and platforms, so clients can self-serve at a time that suits them, with an adviser still there to support them.

From a business perspective, if you can make paying for your goods or services frictionless then undoubtedly you will do more business. The buyer gets a better user experience and the agent gets a better-qualified customer - it’s win, win.

This is the approach we are now taking with Real Estate - showing the potential buyer their financial options whilst they are browsing allows them to know whether the purchase is viable.

Fintech is changing how we finance everything from clothes to cars and now, with the arrival of Brickflow Enterprise, commercial property.

If you’re a commercial property broker, estate agent or auction house and would like to learn more about Brickflow Enterprise, please reach out to Frazer Campbell our Head of Partnerships - frazer@brickflow.com.

Brickflow is a software company only. Our product is designed to be used by experienced property finance professionals to source and apply for development finance loans.

Property investors can search the finance market by using our software to model and analyse their deals, but they cannot apply for finance through Brickflow without a Broker. Speak to your Broker about Brickflow or ask us to connect you with a Broker.

Property development carries risk, including variables beyond the developer’s control. A property development loan is debt and should be procured with caution.

Brickflow does not provide information on personal mortgages, but your home and other assets are at risk if you provide a personal guarantee for a corporate loan.

What are the different types of development finance? A short guide looking at the options for funding property development and how to get finance.

Wondering how to finance your property development? Read our short guide on development finance options, the documentation needed and how to get...

Why is development finance important? A look at the benefits of using development finance, what paperwork is required and if it’s the right choice...