Brickflow Guide to Design and Access Statements

Find out more about Design and Access Statements; what they are, what they should contain, when you need them and how to create them.

-1.png) Industry Insights

Industry Insights

Opinions, forecasts and predictions continue to see-saw around the UK economy with the latest figures released last month now showing that annual inflation in April was higher than expected at 8.7%.

A disappointing result, not just for the government, whose Spring Budget pledge to reduce inflation to 2.9% by the year’s end now looks unachievable, but also to the households across the UK whose finances are spread thinner than Marmite.

Dropping from 10.1% in March, it’s the biggest fall since the cost of living crisis began though and the first time inflation has been below double figures since last summer. But progress is being hampered by food prices, said to be at the highest level in 45 years (consumer groups are researching what can be attributed to external factors and how much is profiteering). France has agreed price caps with its major supermarkets and a similar arrangement in the UK could ease pressure on households, with food now exceeding energy bills as the biggest financial burden.

Another rise on the horizon

The higher-than-expected inflation also raises the prospect of a 13th interest rate rise by the Bank of England, something that chancellor Jeremy Hunt will support even if it risks recession. Markets are now predicting that interest rates could climb to 5.5% by the end of the year, up from their current level of 4.5%, putting further pressure on borrowers and the housing market (theguardian.co.uk).

Likewise, Nationwide has just increased mortgage rates on several of its products, further delaying first-time-buyer plans and prompting buyers to stop and take stock. Nationwide states that it is due to SWAP rates increasing after the inflation announcement.

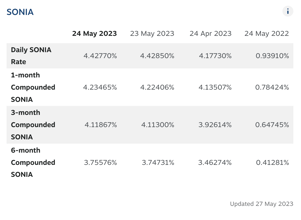

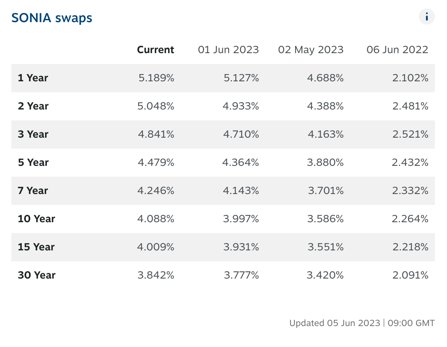

Source: chathamfinancial.com

Rates have since moved down slightly since Nationwide’s price hike, but markets continue to price in the potential 5.5% base rate:

Source: chathamfinancial.com

The value of advice during volatility

So it seems that a less-than-steady economic climate is set to continue for a while yet.

Undoubtedly a volatile market has good property opportunities if you’re willing to accept a degree of uncertainty, but buying at the right price with the right finance is key. With lenders keeping rates apace with the Bank of England there are continual changes in the cost of borrowing, and finding the best deal becomes even harder. Hence why more people seek professional advice in an unstable market.

With higher borrowing costs, squeezed profit margins and equity needing to stretch further, developers feel like their finance options are narrowing, driving them to the same lender.

Recently, we’ve been hearing a lot about people that are regretting cross-collaterisation, where a single lender is used to finance multiple properties/developments. The lender secures one loan against the property portfolio, thereby financially entwining all assets.

Avoiding cross-collateralisation

Whilst cross-collateralisation is a form of credit enhancement, it essentially gives one bank or lender control over all your assets. Often a property investor unknowingly enters into a cross-collateral situation because they didn’t seek professional advice or they assume their current lender is the quickest and surest way to secure CRE finance.

Naturally, lenders benefit from a cross-collateralised structure because it provides greater security. For the investor, however, there are huge drawbacks:

Using the same lender for every transaction eliminates all other products on the market; better rates, better terms and better borrowing can only be accessed by shopping around.

The biggest issue though is when things go wrong. We saw it in 2008, and we're starting to hear about it again now: if all your lending is with one lender, if one asset stops performing, then the lender controls the whole portfolio, and you can lose all of your properties.

Even if nothing goes wrong, the lender's appetite for the sector may change. If you have 10x properties and 1x lender, you have a 100% chance of a problem if the lender decides they no longer like lending in the CRE space. If you have 10x properties and 10x lenders, it's less of a problem.

You wouldn't invest all of your money in a single stock or share. This is no different. Spread your risk.

It's easy to forget this point and go for the lazy option when the market is growing. Now with CRE valuations under pressure, investors are being forced to sell assets at discounted values, because they've overstretched themselves and made bad decisions.

The Brickflow platform makes it easy for developers and brokers to access lenders across the breadth and depth of the market, to stop exactly this situation from arising.

The compound effect of bad finance

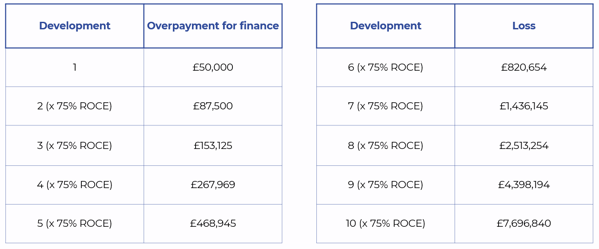

We know how easy it is to ‘lose’ £50,000 on a transaction by using the wrong finance. A 1% difference in fees on a £5m loan over 1 year will do it. With each lender charging arrangement fees and exit fees, as well as interest, it's very hard to compare like with like and with a fragmented marketplace, I would bet that every property developer has lost money on their finance, perhaps without knowing it.

It’s easy to be frivolous when the numbers involved are so big. But when this £ 50k number is compounded over the career of a developer the exponential loss is eye-watering.

We created a chart to show the impact of a developer losing £ 50k on their first development, assuming a 75% ROCE on each development thereafter;

Losing £ 50k on development 1 could mean a loss of over £ 7m by development 10 - probably the strongest argument you’ll see for using a comparison tool like Brickflow for development finance.

Bringing comparison software into the CRE finance market

The CRE market is moving towards more regulation, more qualification and more transparency, meaning less and less borrowers will overpay for commercial property finance and will be able to access as many options as are available to them.

Recent innovations in fin-tech, including the Brickflow platform, are bolstering the move towards a fairer, more open market for all.

Embedded finance for the future

Earlier this month, Fintech Talents held a London conference on Embedded Finance and Super-Apps, looking to unpick the ‘how and why of what it means to offer seamless access to tailored financial products’ (FTT Embedded Finance). As a panel speaker at the event, Brickflow’s Founder & CEO Ian Humphreys was discussing the next wave of embedded finance, with a discussion around opening up previously inaccessible markets to consumers. Things like investment and trading platforms opened up the entire stock market to customers with as little as £1, and innovations like Brickflow Enterprise give borrowers the ability to search and access the breadth of the commercial property finance market through their chosen broker.

As a panel speaker at the event, Brickflow’s Founder & CEO Ian Humphreys was discussing the next wave of embedded finance, with a discussion around opening up previously inaccessible markets to consumers. Things like investment and trading platforms opened up the entire stock market to customers with as little as £1, and innovations like Brickflow Enterprise give borrowers the ability to search and access the breadth of the commercial property finance market through their chosen broker.

Searching real-time borrowing options for every project offers property developers and investors a level of unmatched agency in their own financial choices and brings much-needed transparency to the market. Enterprise, currently the only embedded finance solution for commercial real estate, brings the industry into the future and aligns it with the new direction of travel across the market.

Offering consumers a single digital journey from finding a commercial property to funding it, also encourages faster transactions, better loans and essentially more building.

Read more about the conference in our Embedded Finance blog.

Elsewhere in the industry

Private rental market overhaul

There are new regulations in England’s private rental sector, aiming to overhaul the strained market. In mid-May the government introduced ‘reforms to deliver a fairer private rented sector for tenants and landlords’ (gov.uk).

The Renters Reform Bill, introduced on 17th May has abolished ‘no fault’ evictions, introduced a Tenant Fees Act that limits deposit and fee requirements, whilst also making it easier for landlords to recover their properties in certain circumstances.

The bill has been under discussion since 2019, but Rightmove predicts rents will still rise by a further 5% in 2023 unless there is a major addition of available homes.

Planning pains continue

Planning continues to be the biggest dampener to development. We keep hearing of developers facing substantial delays or project abandonment as a result of the challenges associated with obtaining planning permission.

Applications in England hit a 16-year low according to figures published last month by the Department for Levelling Up, Housing and Communities, compounding the country’s housing crisis. Throughout 2022, local authorities received just 409,459 planning applications, down nearly 14% from the previous year.

Toing and froing around new build targets isn't helping, with developers being deterred by changes to the planning system; in 2019 the government set a mandatory target to build 300,000 new homes per year, subsequently ditched in Sept 2022, briefly reinstated by Michael Gove then dropped in December (theguardian.co.uk/housingtoday.co.uk).

Meanwhile, London Mayor Sadiq Khan has hit landmark council housing targets with London building double the number of council houses than the rest of England combined. Over 23,000 new City Hall-funded council homes have been started since 2018 with more than 10,000 between 2022/23.

Sadiq accredits it to a dramatic acceleration in action and ambition by both City Hall and boroughs, claiming the lack of central government support has directly resulted in the lack of new build council houses outside of London, with figures showing just 4325 were built in the same time frame. (London.gov.uk)

Boost to for-profit affordable housing

In May, Savills Housing Consultancy published a report on 'for-profit’ social housing providers which indicates that the sector has grown from 18 organisations owning 187 homes in 2013, to 69 owning 28,164 today.

Savills predicts that the sector will grow by 9,300 homes by the end of 2023 and reach a total of 113,000 homes by 2028, with 100 providers in the field. The growth has more than doubled since March 2021, primarily due to a 131% increase in the number of general needs rented homes owned.

Shared ownership makes up 59% of total for-profit stock now, projected to be 63% in 5 years. Despite concerns about stock sales, Savills notes that 90% of for-profit providers do not plan to exit the sector for the next 20 years.

There is also increased collaboration between not-for-profit housing associations, who have operational and management expertise but lack investment capital, and for-profits who have significant capital to deploy but lack operational and development capabilities. (insidehousing.co.uk/Savills Housing Consultancy).

At Brickflow, we’re hearing of more developers entering this market, considering it a cheaper alternative for ex-landlords to acquire more stock because it avoids the 3% SDLT surcharge and they can buy the properties at cost. And with rents set to continue to rise, the market is even more attractive right now.

Moving towards a transparent market

Alongside the open market access that comparison tech is delivering, new legislation is driving the CRE finance market towards transparency too, with educational opportunities available to support the transition.

Consumer Duty

Last year the Financial Conduct Authority (FCA) set out guidance for the new Consumer Duty that aims to set higher and clearer standards of consumer protection across financial services and requires firms to deliver good outcomes for consumers. The rules come into force on 31 July 2023 (fca.org.uk).

Banks, lenders and brokers will have to demonstrate that they conducted the best possible due diligence for their clients. For commercial property brokers, it’s not easy to provide evidence of their work in sourcing a loan because there’s no central reference system. However, Brickflow gives brokers an audit trail, allowing them to print evidence of comprehensive loan comparison that demonstrates that they have achieved the best solution for their clients.

Speaking to The National Association of Commercial Finance Brokers (NACFB) they've said that around 92% of their 2200+ member firms are already acting within the parameters of regulated finance even though it isn’t yet necessary.

Where there is some sluggishness in implementing Consumer Duty is from lenders - NACFB’s chief executive Paul Goodman thinks that some lenders ‘are just not there yet’ despite the impending deadline. When the NACFB reached out to lender patrons in March to confirm their readiness for Consumer Duty, they received one response. According to Goodman, if lenders are not complying with the new Consumer Duty, brokers ‘shouldn’t really be using them’ meaning more due diligence will be required by brokers (mortgagesolutions.co.uk).

If a broker presents three options to clients, and one lender provides information in terms of fair value and the other two don’t, then the client ‘can’t make a fully informed decision’ which inadvertently opens brokers up to miss-selling claims (Goodman, mortgagesolutions.co.uk).

The NACFB is calling for more clarity though, both on the new regulations of Consumer Duty but also Basel III, the latest regulatory framework that sets international standards for bank adequacy, stress testing and liquidity. In an open letter to the government, the trade body highlights the ‘unintended consequences’ to SME lending (less competition, more capital requirements), with the current definitions deemed too open for interpretation (Goodman, mortgagesolutions.co.uk).

Nonetheless, the industry is moving in the right direction.

FIBA course

The Certified Practitioner in Specialist Property Finance (CPSP) has recently launched as a joint venture between the Association of Short Term Lenders (ASTL), the Financial Intermediary and Broker Association (FIBA) and the London Institute of Banking and Finance (LIBF).

The online course covers bridging, short-term finance, development finance and specialist buy-to-let and gives brokers an opportunity to learn more about the commercial property finance industry.

Vic Jannels, CEO at ASTL, said that the launch of the CPSP was ‘an excellent example of trade associations working together for the benefit of the industry and our customers’ and considers the course ‘a major steppingstone in continuing to enhance standards, increase professionalism and advance the reputation of the specialist finance sector’ (mortgagesolutions.co.uk).

John Somerville, head of financial services at LIBF, continued: ‘This complements the need to embed the higher standards required from Consumer Duty. Designed with lenders and brokers in mind [the programme will ultimately help them to] improve outcomes for clients in an ever-complex lending world’ (mortgagesolutions.co.uk).

As a FIBA partner, Brickflow is delighted to be one of the CPSP sponsors.

Brickflow is a software company only. Our product is designed to be used by experienced property finance professionals to source and apply for development finance loans.

Property investors can search the finance market by using our software to model and analyse their deals, but they cannot apply for finance through Brickflow without a Broker. Speak to your Broker about Brickflow or ask us to connect you with a Broker.

Property development carries risk, including variables beyond the developer’s control. A property development loan is debt and should be procured with caution.

Brickflow does not provide information on personal mortgages, but your home and other assets are at risk if you provide a personal guarantee for a corporate loan.

Brickflow is a digital marketplace for specialist property finance. We connect brokers with lenders to source the best value development loans, quickly and easily.

Find out more about Design and Access Statements; what they are, what they should contain, when you need them and how to create them.

What is the difference between bridging and development finance, and how are they both used?

Insights into the essential skills needed to be a property developer and how to convince a lender you’ve the right experience to make your project a...