Why Use Brickflow’s Commercial Mortgage Calculator?

If you’re looking to finance a commercial property, whether as an investment property or for your own business premises, Brickflow’s Commercial Mortgage Calculator will help you find the best deal.

With Brickflow’s commercial mortgage calculator, you can:

- SEARCH live borrowing options from the breadth of the market instantly

- COMPARE interest rates and arrangement fees

- CHECK if your deal stacks against actual monthly repayments

- UNDERSTAND how rental yield affects deposit input and max LTV

At Brickflow, it couldn’t be easier or quicker to search for a commercial mortgage.

Here’s how it works:

1. ENTER your project criteria and model deals

- It takes seconds to enter the details of your property

- Your search will be saved so you can log back in later and modify your numbers if needed

2. COMPARE loans from the breadth of the market

- Our search includes banks, non-banks and specialist lender

- See live loans currently available, with details on LTVs, interest rates, fees and more

- Shortlist your preferred loans and with your intermediary request a same-day DIP from each lender

3. APPLY directly from the platform

- With your intermediary, or Brickflow partner, apply to multiple lenders with 1 x online application; if one lender says no, send the same application to another lender with one click, and avoid repetitive form-filling.

- Our lender-favoured digital application covers everything lenders need to know to make quick, reliable credit decisions.

*If you don’t get any results back, try amending your search. The minimum loan is £25,000 and it can be secured against any commercial or semi-commercial property.

Commercial Mortgage Criteria

Every lender has certain criteria to meet in order to secure a commercial mortgage, including:

- Aged 18 or older and able to provide ID & proof of address

- Can provide a credit file and income details, though the mortgage will be based on the rental yield

- Businesses, property investors, Ltd companies, sole proprietors and partnerships can be eligible for a commercial mortgage.

For owner-occupied commercial mortgages, you’ll usually have to show at least two years of business accounts and trading activity.

Most commercial lenders will need a pre-agreed rental contract for a commercial investment property. The strength of the tenant and the length of the lease can affect a lender’s decision.

The deposit criteria depend on what loan-to-value ratio the lender offers, but it is typically a maximum of 75% LTV.

First-time buyers

First-time commercial property buyers can get a mortgage, but it’s more complex.

Lenders establish whether a business can adequately service the mortgage debt by reviewing its operating performance and looking at earnings before interest, tax, depreciation and amortisation.

A new business with no trading history can’t provide the above; as such, lenders would likely only consider an application where the borrower can provide 50% or more deposit or existing properties as further collateral. Lenders will also focus more on you as a borrower and your creditworthiness.

Some lenders on Brickflow will arrange a two-thirds term to allow a business to build up a trading history before moving on to a full commercial mortgage.

True Cost of a Commercial Mortgage

Commercial mortgages work in much the same way as residential mortgages, with similar costs involved.

Typically, the costs that can be expected throughout the commercial mortgage process include:

- Interest charges: Currently rates from 7% - 12% (Q1 2024)

- Arrangement fees: Around 2% of the loan amount

- Legal fees

- Valuation fees

When you search for a commercial mortgage on Brickflow, you can see accurate total repayment costs over the fixed term, including interest and capital repayments.

.png?width=1600&height=360&name=unnamed%20(24).png)

Similar to a residential mortgage, what you pay back will be considerably more than what you borrow, but this has to be weighed up against rental yield as well as potential capital growth.

Brickflow’s commercial property mortgage calculator can instantly show you whether or not your next investment property is viable.

Commercial Mortgage Example: How a Commercial Mortgage Works?

Commercial mortgages are a long-term finance solution that is repaid monthly with interest. The property that is acquired using the commercial mortgage acts as security for the lender, so if you default on the mortgage (stop paying it), the lender can repossess your property after a certain period of time.

A commercial mortgage is serviced using the income generated from the property, i.e., the monthly rental income. Lenders stress-test affordability by comparing the rental income with the monthly mortgage payment. This is unlike a residential mortgage, which is supported by the borrower’s income.

For owner-occupied commercial mortgages, the loan serviceability is tested against the business strength and trading accounts.

The term of the mortgage can be up to 30 years and will be decided when the loan is arranged. Monthly repayments will be determined by how much you borrow, how much deposit you put down, and the interest rate of the loan.

Commercial mortgages can be repaid as interest only or capital & interest. Interest can be fixed, typically for 2, 3, or 5 years. Alternatively, they can be secured on a variable rate meaning that they might rise and fall over the mortgage term.

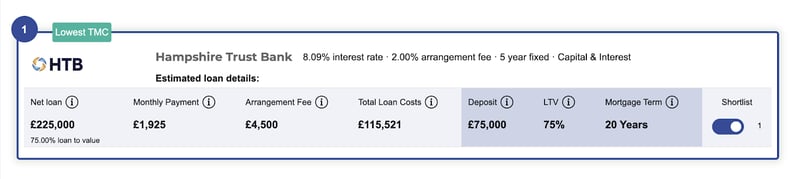

Looking at the below example helps to demonstrate how a commercial mortgage works:

- Purchase price of the property: £300,000

- Purchase costs: £15,000

- Mortgage term: 20 years

- Product type: Fixed for 5 years

- Repayment type: Capital and Interest

- Rental lease: 3+ years

- Gross monthly rental: £4000

Using the above numbers with Brickflow’s commercial mortgage calculator gives us an example loan of 75% LTV, with a 2% arrangement fee and an 8.09% interest rate. In this case, the monthly repayments would be £1925.

"The benefit of Brickflow is instant information in a snapshot. You can see what various lenders are going to offer you, meaning you can move more quickly on deals and put an offer in."

"This is incredibly useful technology. Twelve months ago, we knew what lenders' pricing and appetite was - but today, in an ever changing market place, it's incredibly difficult to keep up."

What deposit is needed for a commercial mortgage?

Deposit requirements depend on how much you are borrowing, but commercial mortgages are typically limited to 75% LTV. So on a £500,000 purchase with a 75% LTV, you would need £125,000 in deposit (additional capital would be needed to cover purchase costs).

Lenders determine their lending limits based on a variety of factors, including:

- The length of the lease and strength of the tenant (for investment properties)

- Your business accounts and trading activity for owner-occupied mortgages

- Credit history (good credit history is not essential to secure a commercial mortgage because it is based on rental income, but it can help to secure better terms)

- The lender's own criteria

A lender calculates maximum LTV and maximum affordability separately, and one cannot exceed the other. So, if, for example, you can borrow a large amount based on the rental calculation, but this exceeds the lender’s max LTV, then only the max LTV will apply.

On the other hand, if the rental income provides maximum affordability far below the maximum LTV, then the affordability calculation will determine the maximum loan.

your assets used to secure the loan

What is a commercial mortgage used for?

Commercial mortgages are used to fund the purchase or refinance of a commercial property or mixed-use property. This can be as an owner occupier, or as a rental investment / commercial buy-to-let mortgage.

Property examples include:

Care home

Education

Heavy Industrial

Hotel

Leisure

Licenced HMO

Light Industrial

Medical

Mixed Use (part residential part commercial)

Mixed Use (All commercial)

Multi Unit freehold block

Office

Retail

Retirement

Student

What are the criteria for a commercial mortgage?

The key criterion for a commercial mortgage for an investment property is that the monthly rental income exceeds the monthly loan repayments. For owner-occupied mortgages, lenders will typically require a minimum of two years’ worth of trading accounts and business activity to assess affordability.

On top of that, the usual criteria for any long-term financial commitment apply, such as UK residents, aged 18 or over with proof of address, and a credit file.

There are commercial mortgage products for UK nationals living outside of the UK and for foreign nationals, but options are more limited.

When searching for a commercial mortgage on Brickflow, you can filter your results based on the criteria relevant to your circumstances.

How long does it take to get a commercial mortgage approved?

The time it takes to secure an approved commercial mortgage varies depending on the lender and the complexity of the loan. Generally, it will take several weeks, and typically takes longer than a residential mortgage. Residential mortgages are often automated, whilst commercial mortgages are processed and underwritten manually, which slows things down.

To speed up the process, prepare your documentation and application as soon as possible and with as much detail as possible to avoid lenders having to come back and ask for additional information. Responding quickly to any lender requests will help.

Also, be upfront about any potential problems, like issues with your credit file, such as CCJs. for A lender that discovers this a few weeks into the process will not just potentially slow things down but can lead to a lender losing confidence in you as a borrower.

Can you get a 100 percent commercial mortgage?

Yes, it is possible to secure a commercial mortgage without putting down a cash deposit, but you will instead have to use another property or assets as additional security. Rather than 100% finance, it is really a ‘cashless’ deal.

If you default on the loan, the lender may repossess any other assets used to secure the loan.

Brickflow’s preferred brokers are experts in commercial mortgages and can help you secure the best loan for your circumstances.

What is the advantage of a commercial mortgage?

There are several advantages of a commercial mortgage.

Firstly, the advantages for your business include:

- Investment: Repayments could be less than or similar to monthly rental payments, but your money is being invested into a property

- Stability: Owning your own premises gives you more control over your outgoings and means you’re not subject to a landlord’s decisions, such as rent increases or selling

- Potential rental income: If your circumstances change, you could rent your property out to generate an income

Better rental yields: Commercial properties will typically produce higher rental yields than residential - Capital growth: The property could increase in value over the course of your mortgage, generating profit or equity

- Tax benefits and deductions: Interest paid on commercial mortgages is tax-deductible

The advantages of a commercial mortgage:

- Long-term financing: Repaying a loan over a longer-term (up to 30 years) is comparatively cheaper than short-term borrowing, such as bridging loans

- Fixed interest rates: Up to 10 year fixed-rate are available, so you know exactly how much you’re spending per month over a long period

- Capital repayment holidays: A temporary break in capital repayments could be agreed with some lenders (subject to approval, conditions apply, and interest still has to be paid)

- Flexible borrowing: With the rise of challenger banks and non-bank lenders, this type of lending has become much more flexible. Interest only and higher leverage as standard are two examples of the evolution in this space

- Lower interest rates: Usually more competitive than other secured business loans – this is because the lender uses the property as security

- No early repayment charges: Some commercial mortgage products don’t carry early repayment charges

- Borrow with adverse credit: Assessed on a case-by-case basis, but as it is the income that the property earns, rather than you personally, personal credit is less important

Are commercial mortgages more expensive than residential mortgages?

Commercial mortgages are typically more expensive than residential in terms of rates and fees, but cheaper than, for example, bridging loans or other secured business finance.

The cost has to be weighed against the rental yield of a commercial property compared with a residential property or the rent you will pay for your business premises compared to monthly mortgage repayments. In addition, the potential for capital growth should be considered alongside the expense of a commercial mortgage.

For part commercial, part residential properties, a semi-commercial mortgage offers a middle-ground solution.