Commercial Mortgages in Bath

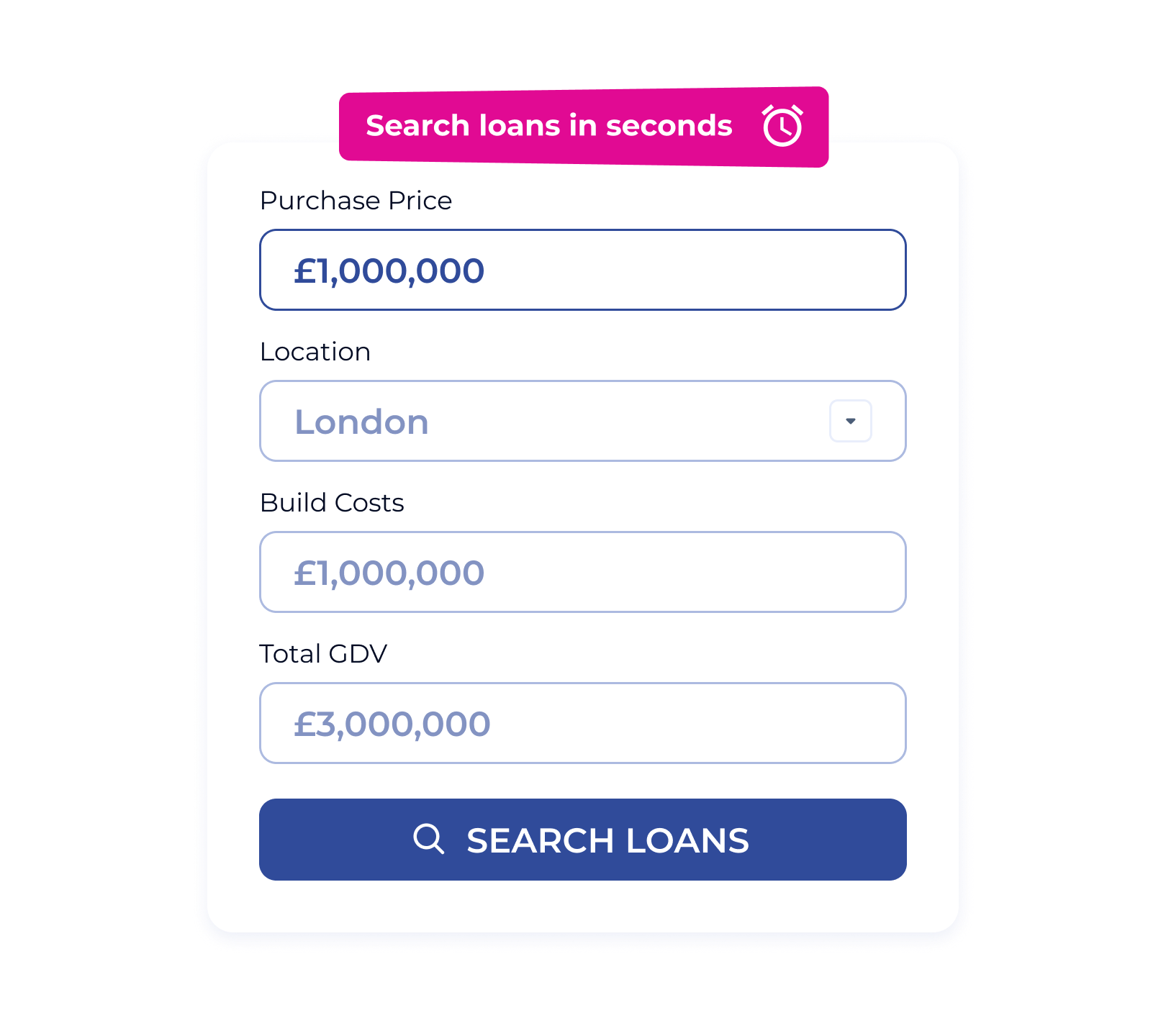

Whether you’re buying a shop in the city centre, converting a Georgian building, or expanding your property portfolio, Brickflow helps you find the most competitive commercial mortgage deals in Bath—fast. Search 20+ lenders in minutes.

Why Use Brickflow to Find a Commercial Mortgage in Bath?

We bring speed, transparency, and lender choice to the commercial mortgage process, so you can focus on growing your investment by finding the best deal available:

- Compare deals from over 20 commercial mortgage providers

- Instant Decision in Principle options

- Filter by LTV, loan size, term, and interest rate type

- See transparent breakdowns of costs and fees

- Loans from £100,000 to £100 million+

Commercial Mortgage Solutions Across Bath

With a mix of period architecture and modern developments, Bath’s commercial property market is unique. Brickflow helps secure commercial funding for:

- Serviced offices and co-working spaces

- Restaurants, cafés and leisure venues

- Mixed-use residential and commercial buildings

- Semi-commercial and BTL portfolios

- Owner-occupied commercial properties

- Larger or bespoke funding projects

Empowering Property Investors and Business Owners in Bath

From historic conversions in Lansdown to retail units in SouthGate, Brickflow makes it easy to find the right commercial finance for your Bath-based commercial venture.

Compare loans from 20+ commercial mortgage lenders

See how much you could borrow against a specific project & at what rate

Check detailed eligibility criteria to avoid wasting time & money

Ensure your deal stacks & make smarter investment decisions

Learn More About Commercial Mortgages

If you're unsure where to begin, our guides explain the commercial mortgage process step by step:

Compare Commercial Mortgages in Seconds

Brickflow is the UK’s leading commercial mortgage comparison tool. Enter a few project details and view tailored results from 100+ lenders—saving you time, stress, and potentially thousands in costs.

The smarter way to finance your Bath property.

.webp)

Ready to Get Started?

Whether you’re refinancing a business premises or buying your first commercial asset, Brickflow helps you compare your commercial finance options and take the next step with confidence.

What is a commercial mortgage?

It’s a secured loan used to purchase or refinance commercial property. Loans typically run from 3 to 25 years, with both fixed and variable rate options.

Can I get a commercial mortgage for a property in Bath?

Yes. Brickflow works with lenders across the UK, offering finance for commercial properties in Bath—including retail, office, leisure and mixed-use buildings.

What documents are required to apply?

Most lenders require business accounts, property details, proof of income or rental projections, and sometimes a business plan.

How quickly can I secure funding?

You can get a Decision in Principle within minutes. Final approval and drawdown generally take between 2 to 6 weeks, depending on your case.

What if I need short-term finance instead?

If you're buying at auction or need funding for a refurbishment project, a bridging loan in Bath might be more appropriate. Brickflow lets you compare both types of finance.