Commercial Mortgages in Birmingham

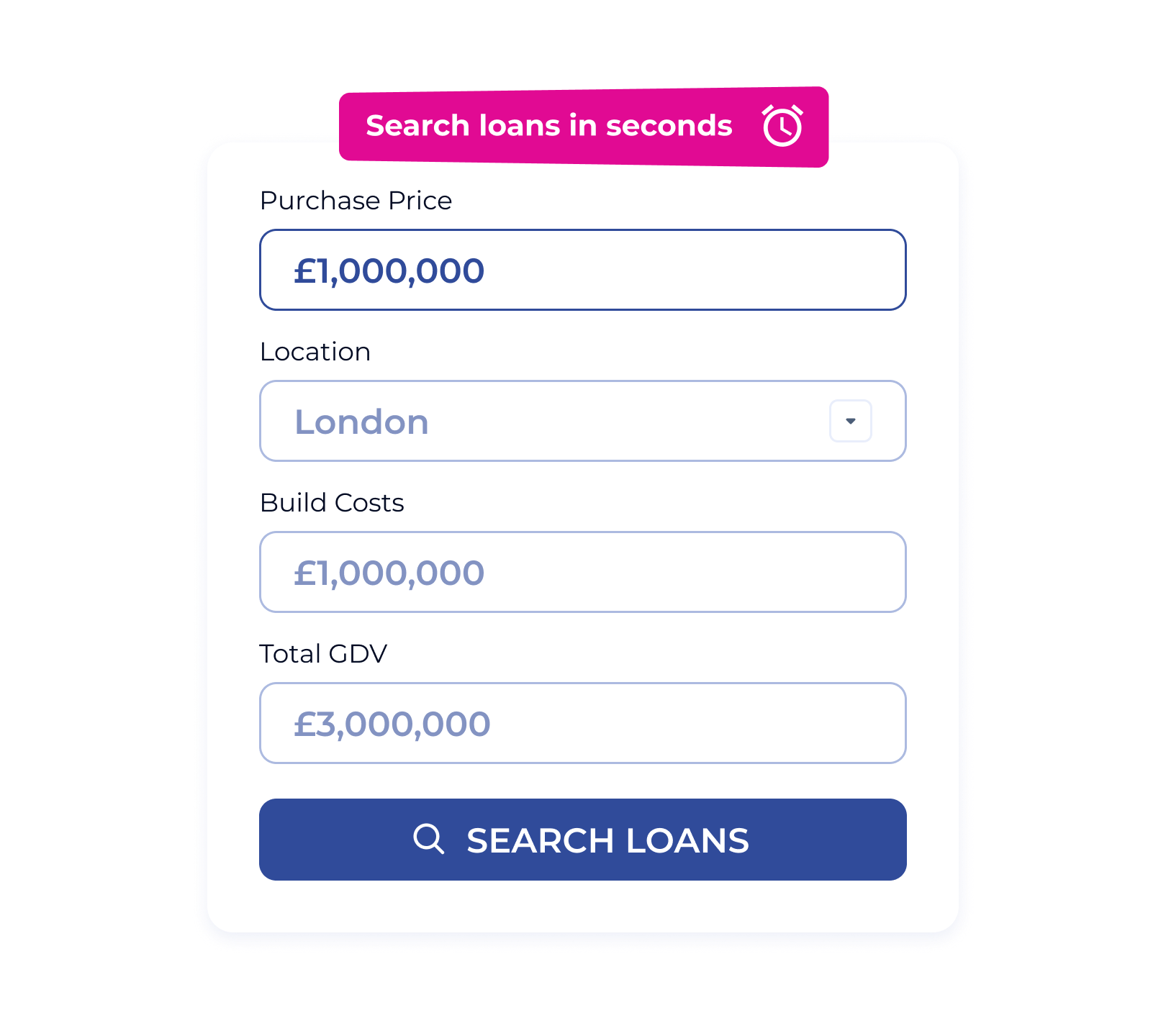

Whether you’re purchasing a new HQ, investing in commercial property, or growing your portfolio across the West Midlands, Brickflow gives you access to the UK’s top commercial mortgage lenders, all in one platform.

Why Brickflow is the Smarter Way to Finance Commercial Property?

Brickflow simplifies the commercial mortgage process, helping you save time and money while securing the most suitable deal for your needs:

- Compare rates from over 20 commercial mortgage providers

- Apply filters by term, LTV, interest type, and more

- Instant Decision in Principle from selected lenders

- Transparent view of fees, eligibility and loan terms

- Finance available from £100,000 to £100 million+

Tailored Commercial Finance for Birmingham Projects

Birmingham is one of the UK’s most dynamic commercial hubs, perfect for long-term property investment. Brickflow helps you find commercial funding for:

- Offices and business parks

- High street and shopping centre retail units

- Light industrial and manufacturing premises

- Mixed-use buildings with residential components

- Professional buy-to-let portfolios

- Semi-commercial properties

- Owner-occupied buildings and specialist assets

Enabling Birmingham’s Property Professionals to Grow

Whether you’re expanding into Digbeth, acquiring property near Snow Hill, or refinancing existing assets in Edgbaston, Brickflow’s commercial mortgage comparison tool helps you unlock better deals, faster.

Compare loans from 20+ commercial mortgage lenders

See how much you could borrow against a specific project & at what rate

Check detailed eligibility criteria to avoid wasting time & money

Ensure your deal stacks & make smarter investment decisions

Is a Commercial Mortgage the Right Fit?

Choosing the right type of finance can be challenging. Our expert content makes it easier:

Compare Commercial Mortgages with Confidence

Looking for a better deal on your next Birmingham property purchase? Brickflow allows you to run tailored searches across commercial mortgage lenders in seconds, compare borrowing costs side-by-side, and access live offers from major UK lenders.

Get full visibility, complete control, and the confidence to move quickly.

.webp)

Start Your Search With Brickflow Today

Brickflow is the modern way to finance commercial property. Get clear on your options, lock in a competitive rate, and keep your Birmingham project moving forward. Compare the best rates now!

What is a commercial mortgage?

A commercial mortgage is a loan secured against a property used for business or income-generating purposes. It’s typically repaid over 3 to 25 years and can come with fixed or variable interest terms.

Can I get commercial mortgage finance for property in Birmingham?

Yes. Whether you’re buying in the Jewellery Quarter, city centre, or surrounding suburbs, Brickflow connects you with lenders offering commercial finance tailored to the Birmingham market.

What documents do I need to provide?

You’ll usually need recent business accounts, details of the property, a business plan (if applicable), and proof of income or rental projections.

How quickly can I get approved?

Initial approval (DIP) can be secured in minutes via our platform. Full application and completion generally take between 2 to 6 weeks.

Is short-term finance available too?

Yes—if you’re purchasing at auction or planning a renovation, you may want to explore a bridging loan in Birmingham as a quicker, short-term solution.