Commercial Mortgages in Edinburgh

Whether you’re acquiring a retail unit on Princes Street, buying office space in Leith, or expanding your investment portfolio across the capital, Brickflow helps you secure the best commercial mortgage for your Edinburgh property, fast.

Why Use Brickflow to Find a Commercial Mortgage in Cardiff?

We’ve made finding commercial mortgages faster, smarter and more transparent. With Brickflow, you can:

- Compare lenders in real time across 20+ mortgage providers

- Get a Decision in Principle (DIP) in minutes

- Filter by rate type, LTV, term, and loan amount

- See full breakdowns of fees and eligibility

- Secure loans from £100,000 up to £100 million+

Finance Solutions for Cardiff’s Commercial Property Market

From historic arcades to new-build developments, Cardiff’s property landscape is diverse. Brickflow helps you find commercial funding for:

- Retail stores and leisure units

- Industrial and warehousing sites

- Mixed-use buildings with residential elements

- Buy-to-let and semi-commercial portfolios

- Owner-occupied commercial buildings

- Complex or high-value projects

Enabling Growth for Cardiff’s Property Sector

Whether you’re investing in Canton, Cathays, or Cardiff Gate, Brickflow connects you to commercial mortgage lenders that understand the nuances of the Welsh market and help you move faster.

Compare loans from 20+ commercial mortgage lenders

See how much you could borrow against a specific project & at what rate

Check detailed eligibility criteria to avoid wasting time & money

Ensure your deal stacks & make smarter investment decisions

Not Sure If a Commercial Mortgage Is Right?

Our expert-written guides help you explore your finance options with clarity:

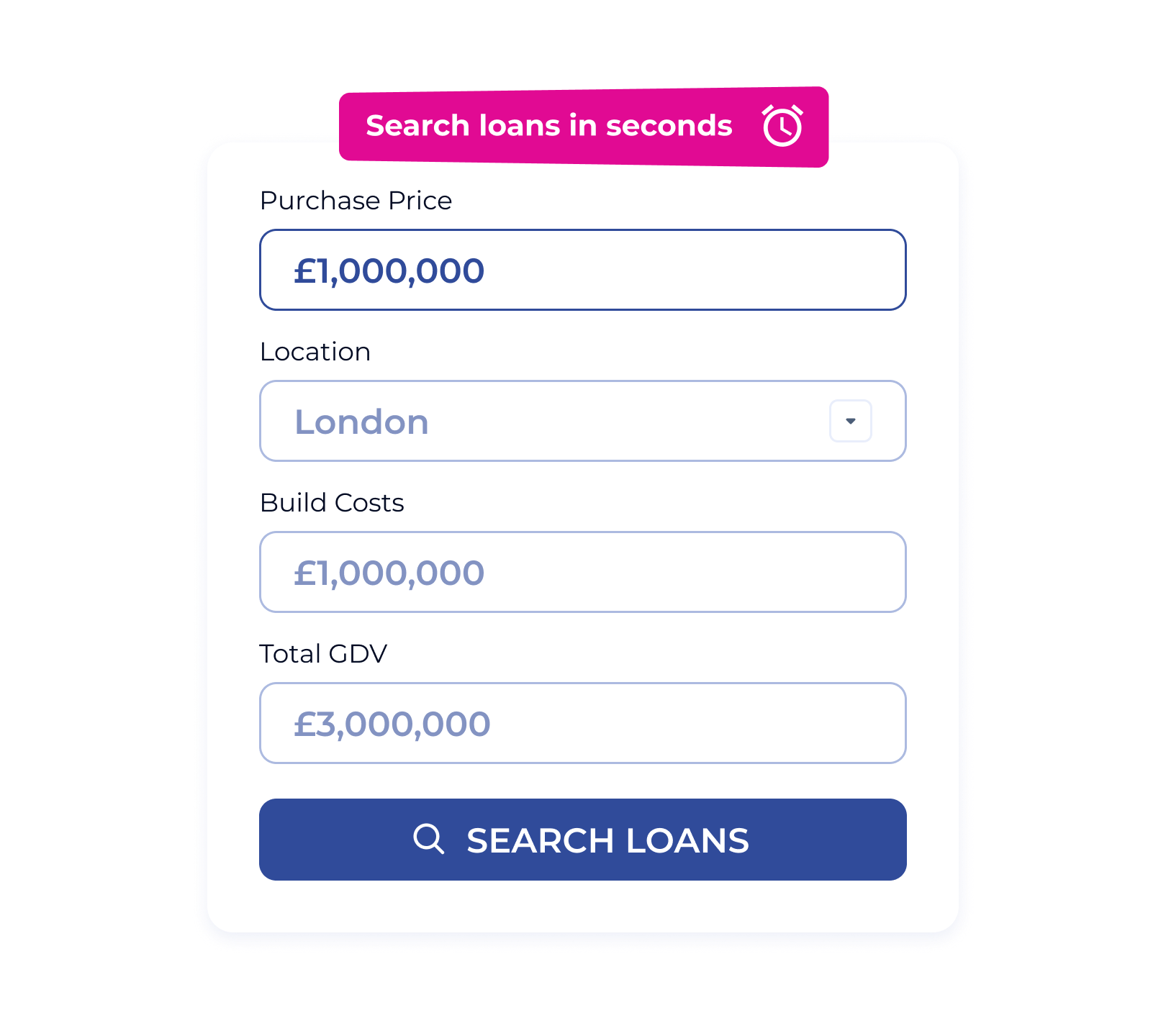

Compare Commercial Mortgages in Minutes

With Brickflow, searching the market takes seconds. Enter your project details, filter by what matters most to you, and get live, lender-backed results, all in one place.

No calls. No paperwork. No wasted time.

.webp)

Ready to Get Started?

Whether you're refinancing, investing or purchasing, Brickflow gives you the tools to take control of your commercial mortgage journey in Cardiff.

What is a commercial mortgage?

A commercial mortgage is a loan secured against property used for business purposes. It typically runs for 3–25 years, with repayment options that suit your financial strategy.

Can I get a commercial mortgage in Cardiff?

Yes. Brickflow connects you with lenders that finance a wide range of commercial property types across Cardiff and the surrounding South Wales region.

What documents will I need?

You’ll usually need company accounts, proof of income or projected rental revenue, property details, and sometimes a business plan.

How quickly can I get funding?

You can receive a DIP within minutes. Full application and drawdown usually take between 2 and 6 weeks.

Need fast access to capital?

If you’re buying at auction or renovating a property, a bridging loan in Cardiff might be a better fit. Compare both options with Brickflow to find the best match.