Commercial Mortgages in Liverpool

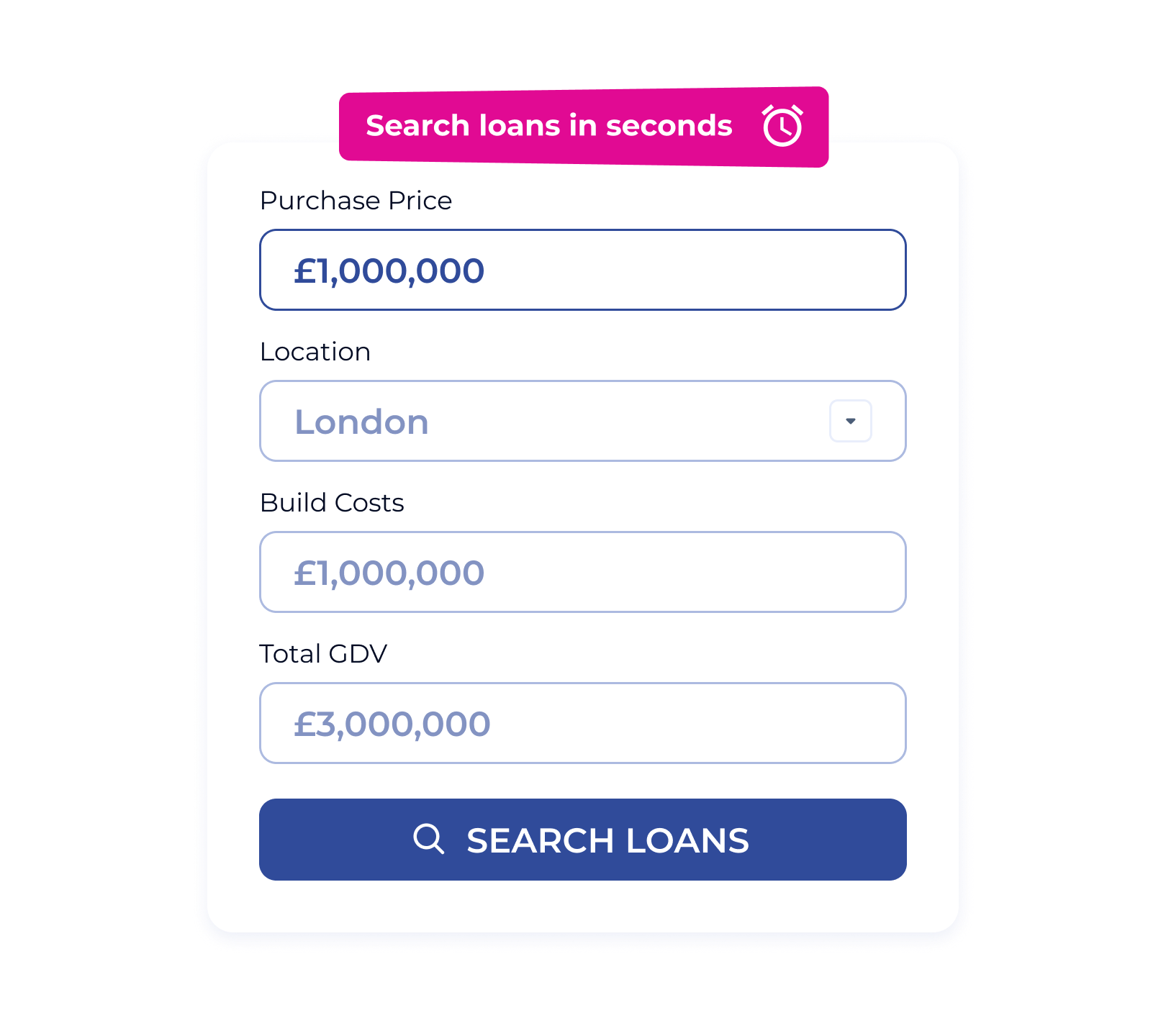

Liverpool is a city full of opportunity, whether you're investing in commercial real estate or buying property for your business. With Brickflow, you can search and compare commercial mortgage deals from over 20 lenders in just minutes.

Why Use Brickflow for Your Commercial Mortgage?

Our platform makes finding and securing a commercial mortgage faster, easier, and more transparent:

- Access 20+ commercial mortgage providers

- Instantly secure a Decision in Principle

Filter by loan amount, term, interest rate type, LTV and more - Compare detailed lender rates, fees, and terms side-by-side

- Finance options from £100,000 to over £100 million

Flexible Commercial Mortgage Solutions Across Liverpool

From city centre developments to dockside investments, Brickflow helps you find commercial funding for a range of property types:

- Offices and coworking spaces

- Shops, cafes and retail units

- Industrial and logistics buildings

- Mixed-use developments

- Buy-to-let portfolios

- Semi-commercial buildings

- Owner-occupied premises and specialist projects

Supporting Liverpool’s Commercial Growth

From the Baltic Triangle to the Knowledge Quarter, Liverpool’s commercial sector is thriving. Brickflow connects investors, developers and business owners with commercial lenders who understand the local market.

Compare loans from 20+ commercial mortgage lenders

See how much you could borrow against a specific project & at what rate

Check detailed eligibility criteria to avoid wasting time & money

Ensure your deal stacks & make smarter investment decisions

New to Commercial Mortgages? Start Here

We’ve created helpful resources to walk you through everything you need to know about commercial property finance:

Compare Commercial Mortgages Instantly

Brickflow is the UK’s leading commercial mortgage comparison platform. In just a few clicks, you can view live rates, explore lending criteria, and find the most cost-effective loan for your Liverpool-based project.

A smarter way to borrow. A faster way to grow.

.webp)

Start Your Search With Brickflow Today

Whether you're buying, refinancing, or expanding your portfolio, Brickflow helps you secure the best commercial mortgage in Liverpool, quickly and confidently.

What is a commercial mortgage?

It’s a long-term loan secured against a commercial or income-generating property. Terms typically range from 3 to 25 years, and loans may come with fixed or variable interest rates.

Can I get a commercial mortgage for a Liverpool property?

Yes, Brickflow works with lenders who fund a wide range of commercial property types in Liverpool, from retail units to office space and mixed-use developments.

What paperwork do I need to apply?

Generally, you'll need recent business financials, property details, and evidence of income or rental projections. A business plan may also be required for some applications.

How fast is the process?

You can get a Decision in Principle within minutes. Full funding typically completes in 2 to 6 weeks, depending on the complexity of the deal.

Need short-term funding instead?

For quicker turnarounds, such as auction purchases or property refurbishments, a bridging loan in Liverpool may be a better fit. Brickflow compares both commercial and bridging finance, so you can choose what’s best.