Commercial Mortgages in Manchester

Navigating Manchester’s fast-moving commercial property market requires the right finance partner. Whether you’re acquiring a new business premises or investing in mixed-use real estate, Brickflow helps you secure the best commercial mortgage offers from over 20 lenders, quickly and easily.

Why Use Brickflow to Find Your Commercial Mortgage?

We’ve streamlined the commercial mortgage application process to help you secure funding with speed and confidence:

- Compare 20+ commercial mortgage lenders

- Decision in Principle secured in minutes

- Customise your search by loan terms, interest type, LTV, and more

- Access detailed breakdowns of borrowing costs and lender fees

- Loans available from £100,000 to £100 million+

Tailored Commercial Finance for Manchester Projects

Manchester’s commercial landscape is thriving, from Salford Quays to the Northern Quarter. Brickflow connects you with lenders who specialise in commercial funding:

- Office buildings and coworking spaces

- Retail units on high streets or in shopping centres

- Industrial warehouses and logistics hubs

- Mixed-use developments

- Residential buy-to-let portfolios

- Semi-commercial and owner-occupied properties

- Complex or high-value commercial transactions

Supporting Manchester's Growth Through Smarter Finance

Whether you’re a first-time commercial buyer or a seasoned investor expanding across Greater Manchester, Brickflow helps you source tailored mortgage deals to suit your vision.

Compare loans from 20+ commercial mortgage lenders

See how much you could borrow against a specific project & at what rate

Check detailed eligibility criteria to avoid wasting time & money

Ensure your deal stacks & make smarter investment decisions

Is a Commercial Mortgage Right for Your Next Move?

Understanding your financing options is key. Our guides help you explore what’s involved in securing a commercial mortgage:

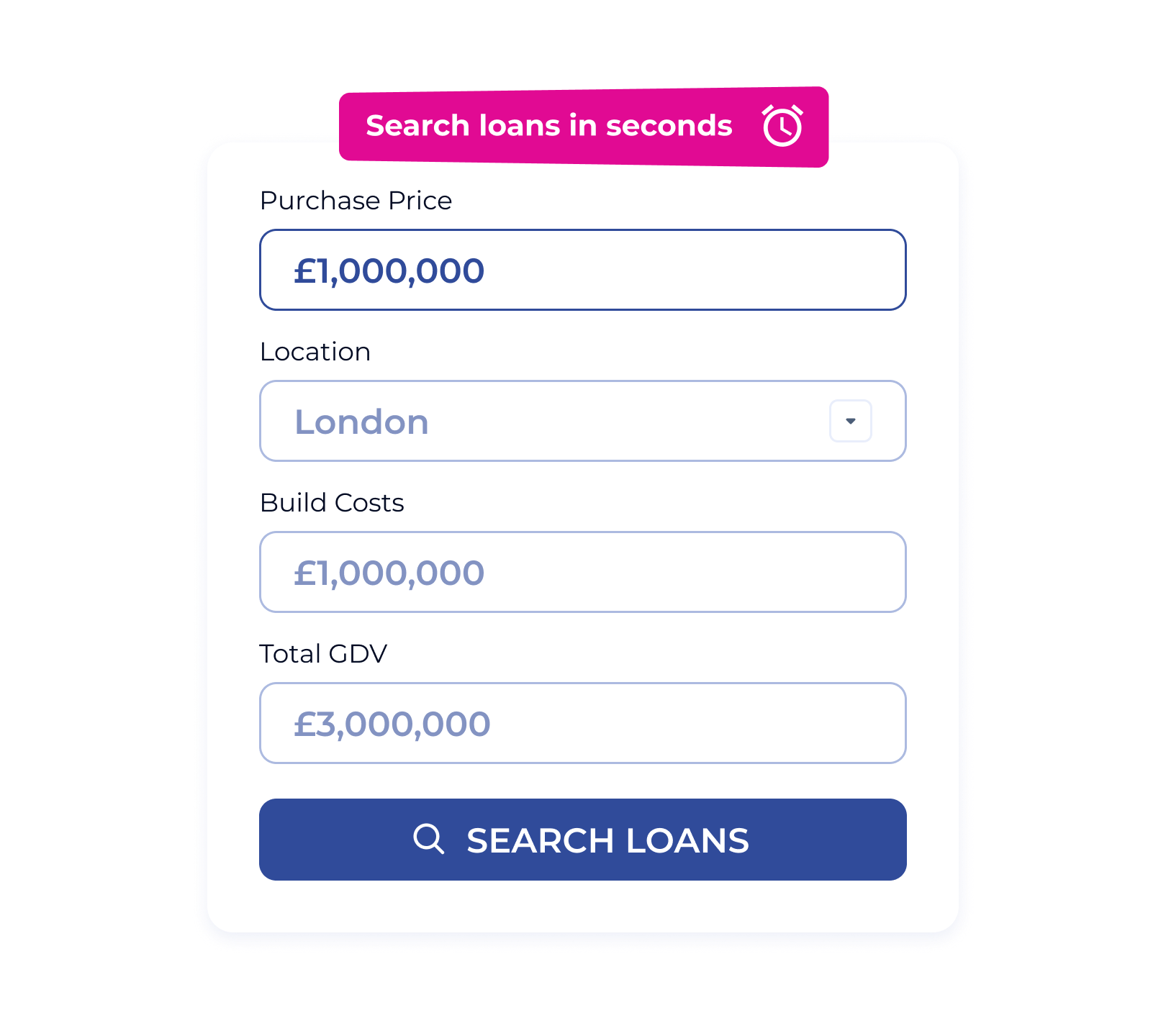

Compare Commercial Mortgage Rates in Seconds

Using Brickflow to search for a commercial mortgage is quick, comprehensive, and cost-effective. Compare like-for-like mortgage offers, see real-time interest rates, and filter results to match your investment goals.

Your next commercial property in Manchester could cost less to finance than you think, with more left over for growth.

.webp)

Ready to Get Started? Brickflow Can Help

From navigating mortgage complexity to securing the best rate, Brickflow gives you access to the widest selection of commercial finance products in the UK, all in one place. Compare lenders now! Compare lenders now!

What is a commercial mortgage and how does it work?

It’s a long-term loan secured against property intended for business or rental use. Terms generally span 3 to 25 years, and interest rates may be fixed or variable depending on your lender.

Can I get a commercial mortgage for a property in Manchester?

Yes, Manchester’s booming economy and diverse property mix make it a key location for lenders. Whether it’s a shop, warehouse, or office block, commercial mortgages are available to match your plans.

What documents are typically required?

Expect to provide company financials, details about the property, a business plan (if relevant), and proof of income or rental projections.

How long does the mortgage process take?

You can receive a Decision in Principle within minutes. Full approval typically takes between 2 to 6 weeks, depending on the lender and how quickly documents are submitted.

Need fast, short-term finance instead?

If your project is short-term or needs to move quickly, such as a renovation or auction purchase, a bridging loan in Manchester could be a better fit. Brickflow lets you compare both options to find what works best.