Commercial Mortgages in Newcastle

Whether you're buying commercial premises for your business or investing in property across the North East, Brickflow connects you with over 20 lenders to find the right commercial mortgage for your Newcastle project.

Why Use Brickflow to Find a Commercial Mortgage in Newcastle?

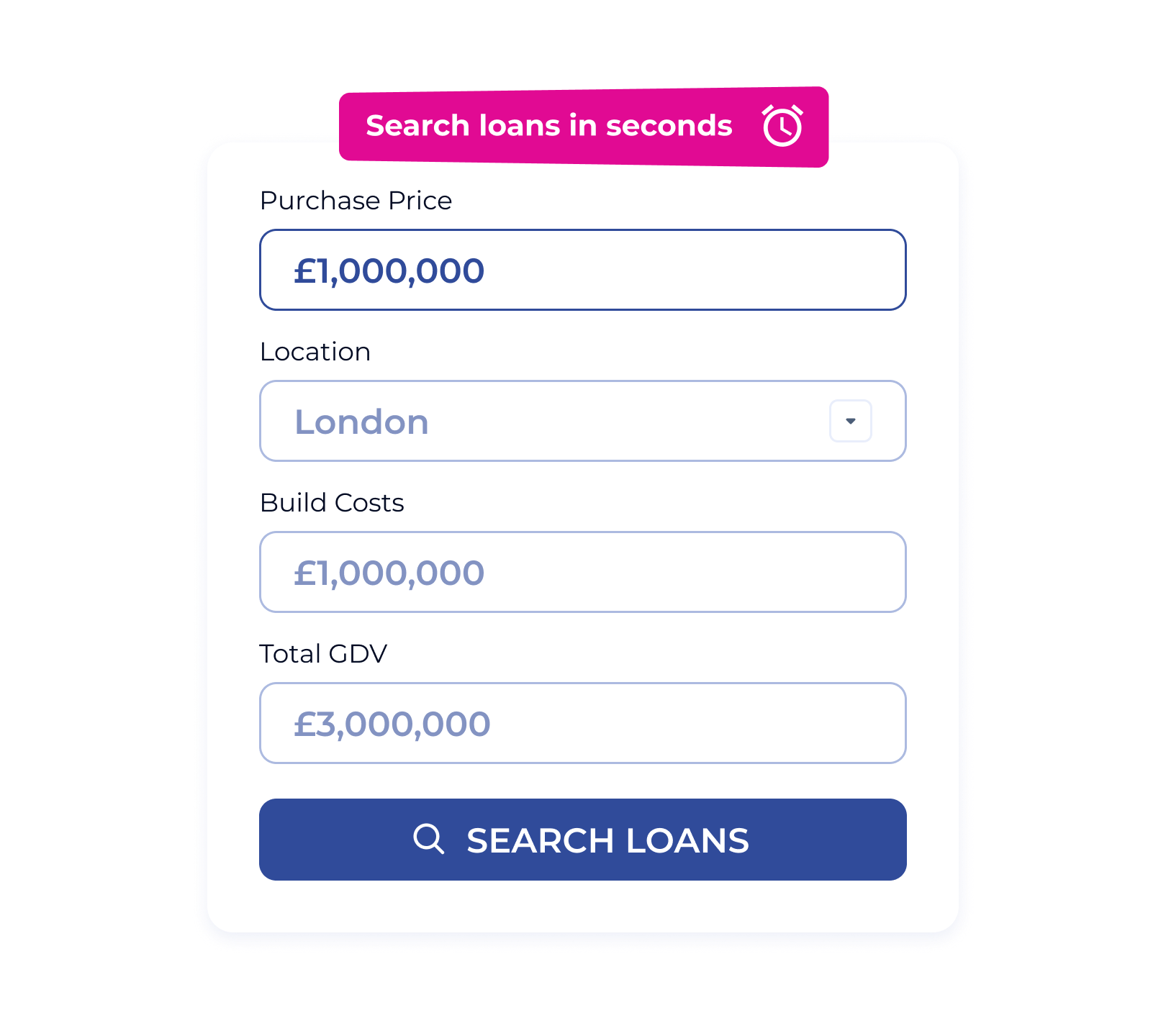

Brickflow simplifies the mortgage process by letting you compare, filter, and apply for commercial finance, all in one place:

- Compare rates from 20+ lenders

- Get a Decision in Principle within minutes

- Filter results by term, rate type, LTV, and loan amount

- View full cost breakdowns and lender eligibility criteria

- Borrow from £100,000 to £100 million+

Commercial Property Finance Across Newcastle

From Quayside developments to tech hubs near the city centre, Newcastle offers strong investment opportunities. Brickflow can help to secure commercial funding for:

- Office buildings and workspaces

- High street and retail park units

- Light industrial and warehouse facilities

- Mixed-use developments

- Semi-commercial and buy-to-let portfolios

- Owner-occupied commercial premises

- Specialist or large-scale projects

Supporting Newcastle’s Commercial Growth

Newcastle’s commercial scene is thriving, whether you're refurbishing a historic building in Ouseburn or buying new-build space in Jesmond. Brickflow empowers developers, investors, and business owners to secure better commercial finance, faster.

Compare loans from 20+ commercial mortgage lenders

See how much you could borrow against a specific project & at what rate

Check detailed eligibility criteria to avoid wasting time & money

Ensure your deal stacks & make smarter investment decisions

Is a Commercial Mortgage Right for You?

If you're considering your financing options, start by reviewing our free educational guides:

Compare Commercial Mortgages in Seconds

No more guesswork. Brickflow makes it easy to search and compare live commercial mortgage rates based on your specific needs, saving time and uncovering better deals from across the market.

.webp)

Ready to Get Started?

Whether you’re refinancing a property or planning a new investment in Newcastle, Brickflow helps you move forward with confidence.

What is a commercial mortgage?

A commercial mortgage is a secured loan used to purchase or refinance commercial or income-generating property. Loan terms range from 3 to 25 years and can have fixed or variable interest.

Can I get a commercial mortgage in Newcastle?

Yes. Brickflow works with lenders across the UK who offer finance for a wide range of commercial properties in and around Newcastle.

What do I need to apply?

Typically, you’ll need financial records, property details, income projections, and in some cases a business plan.

How quickly can I get approved?

You can receive a Decision in Principle within minutes. Final approval and funding typically take 2 to 6 weeks.

Need short-term finance instead?

If your project is time-sensitive, such as a renovation or auction purchase, a bridging loan in Newcastle may offer the speed and flexibility you need.