How do changing interest rates affect my development finance?

Insights into changing interest rates, development finance and property loans. Find out which lenders link to the BofE base rate, pricing methods and...

Industry Insights

Industry Insights

This month we’re trying to make sense of the headlines on the economy for property developers as well as answer the questions that all developers are asking (no prizes for guessing that ‘fixed rates’ is the number 1 topic!).

Making sense of the headlines

August has been a very busy month. Whilst the wider economy is weighed down by more and more negative data, there are positives from the construction sector.

Build cost inflation seems to have peaked. House price growth is slowing or in reverse, but is still up by more than 10% over the last 12 months. Rents are growing faster as well.

So is this a good-time to be a property developer?

Property development is counter-cyclical. Land purchased now for new-build could be 2 or 3 years away (or longer with planning) from hitting the market as a finished product. Therefore, a property developer shouldn’t be overly worried by the current doomsaying. The question should be, where will market sentiment & house prices be when I come to market?

“Be fearful when others are greedy. Be greedy when others are fearful.” - Warren Buffet on Real Estate

Build cost inflation has peaked

This is good news. Developers and builders have had a torrid time since Covid. Material and labour costs have gone through the roof, making sites unviable. As demand falls, costs fall, but contractors are also forced to revisit their pricing to guarantee pipeline.

According to BCIS build cost inflation peaked in June 2022, and is now falling on a year on year basis.

We’re regularly hearing from developers that contractors are dropping their prices when compared to quotes a few months ago, so keep revisiting your costs or have another conversation with your contractor.

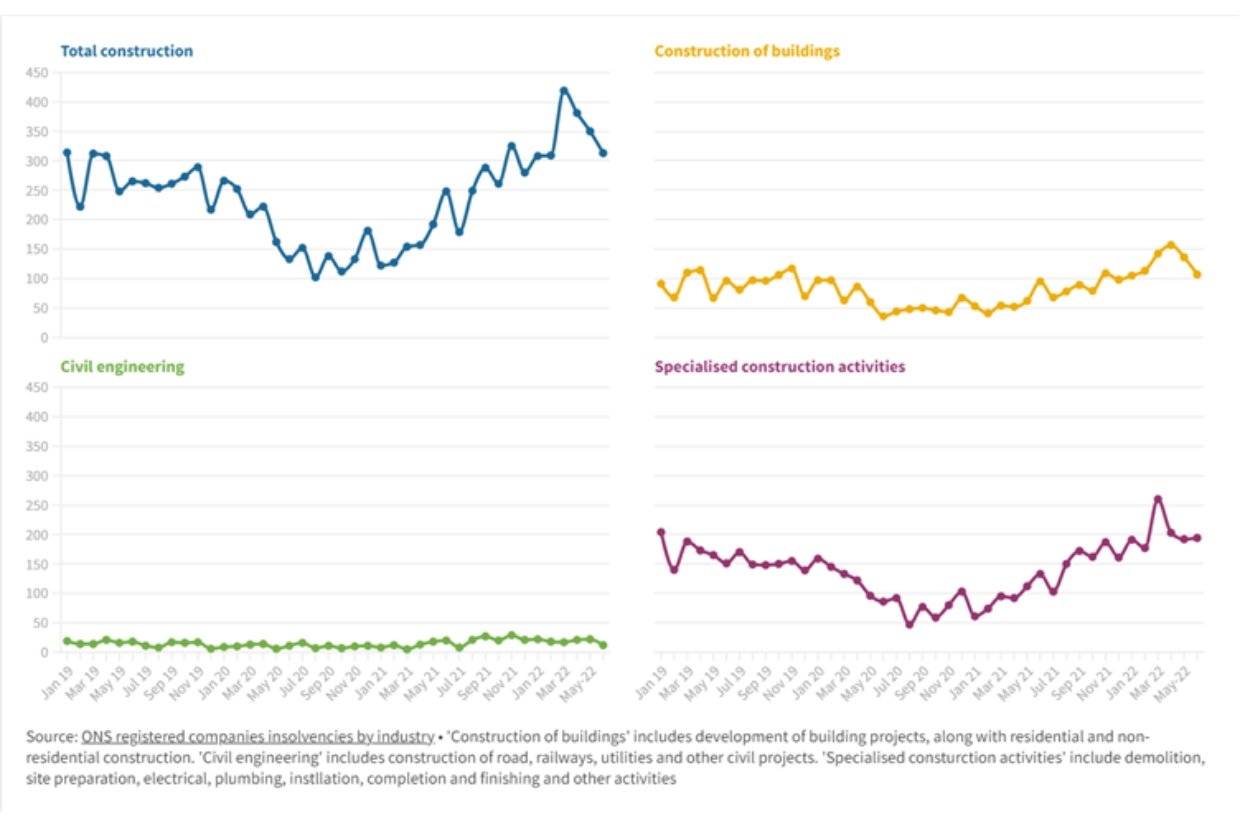

Construction Insolvencies are falling

Again, good news. In Q4 of 2021 and Q1 of 2022, around a fifth of all UK insolvencies were in the construction sector. As the graph below shows, insolvencies are falling as contract prices now reflect the new reality and weaker firms have gone. Nothing makes a lender more nervous (or a developer) as when contractors are going under, so this news will breed sector confidence.

Mortgage rates increasing

This is bad news. Ultimately, if mortgage payments are going up, then affordability reduces and buyers can borrow less. How high will rates go? Well it depends on who you read. Swap rates are now predicting interest rates as high as 4% in May 2023, but economists are suggesting 3% in 2023 is more likely. To more than double interest rates from where they are today by May next year, seems unrealistic. This would almost certainly cause a crash in house prices, and presumably our own government would struggle to meet their debt obligations.

There’s a good article about this in the FT.

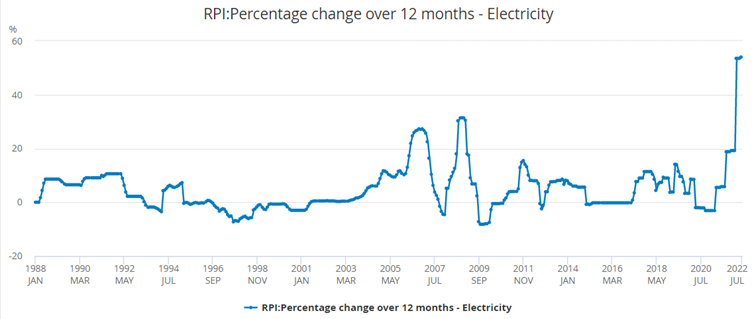

Remember rates are primarily rising to deal with inflation. The biggest item within our current inflation rate is energy. Electricity is up 54% year on year. These are extraordinary circumstances. If energy prices come back in line, then inflation will drop significantly, and it will be irrespective of where our base rate is.

Source = ONS

In 2 or 3 years time when your project comes up for sale will inflation rates be as high?

Will interest rates be rising or falling?

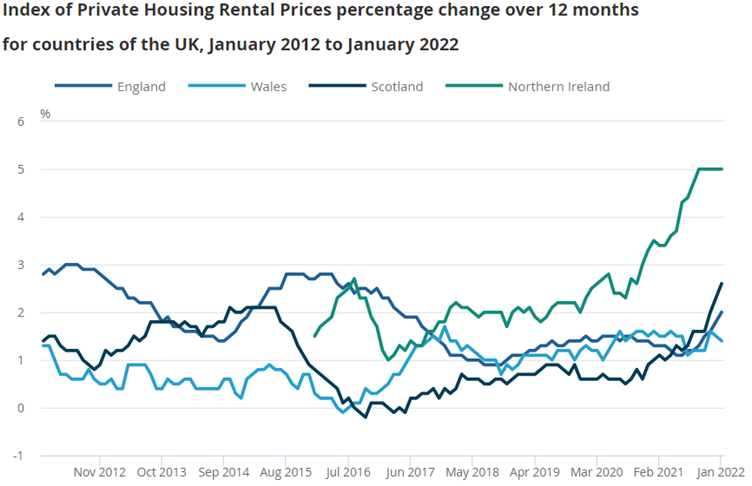

Private rental prices are increasing

Rentals were up 2% in January in the previous 12 months (without London this increases to 3%). This is good news for property developers. Especially those that are more inclined to retain their stock.

It partly offsets the increased mortgage costs and other associated landlord costs, but also hints to a shortage of rental stock.

We’re now really starting to see the impact of government changes to treatment of the BTL sector under Cameron & Osborne in the early 2010’s.

One of the forecasted outcomes was to stop the so-called accidental landlord retaining housing stock, and therefore increasing supply for purchase, instead, it seems we still have a shortage of housing stock to buy, and now to rent as well.

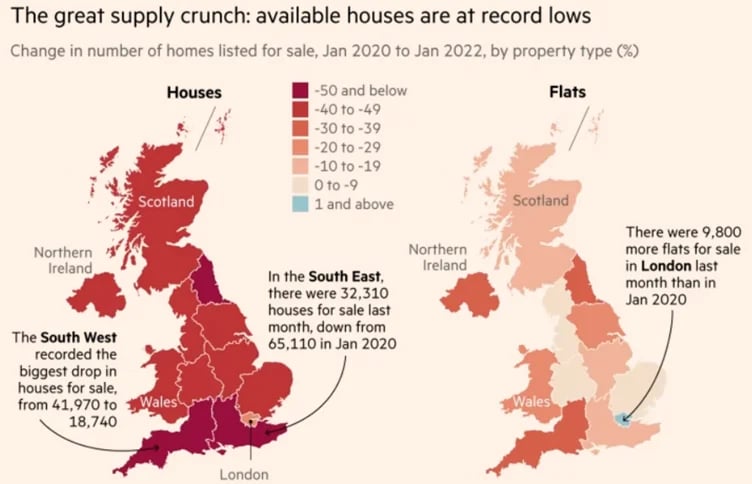

House prices are stagnating (possibly falling?)

Not good or bad news. Yet. Prices dropped marginally, down by 0.1% in July according to Halifax, although Nationwide had prices up by the same margin. Rightmove had the decrease down further at 1.3% in August. However, prices are still up by over 10% year on year according to most indices.

Development lenders are definitely looking more closely at the projects they fund. Quality is key.

Previous downturns have shown that the less favoured property types can be more difficult to fund in times when prices are stabilising / falling; flats above commercial, trophy properties and unusual builds. Outliers that might not have the same end user demand if there is less demand.

However, it’s still a question of demand and supply. The UK has a chronic shortage of housing stock (both rental and purchase), so regardless of how optimistic or pessimistic the economic outlook is, there will always be a level at which we can’t fall below.

If build costs are falling, and you can control your borrowing costs (more on that below - as of today there are still 11 lenders out of 40 on Brickflow that are offering fixed rates), then over the next 12 to 18 months is the time when property developers can be greedy.

Source: Financial Times

Questions we’re being asked by property developers this month

Can I get a fixed rate for my development debt?

The answer is yes, but it’s an ever decreasing pool.

Prior to the recent interest rate hikes around half of the 40 lenders on Brickflow offered the option to fix. That number is currently at 11 (out of 40) and the position changes weekly.

If you have a development starting this side of Christmas or early in Q1 2023, and you want a fixed rate, then there is merit in starting an application now with a fixed rate lender.

Whilst there are no guarantees that the lender’s model will not change before completion, history tells us that if you are credit-approved prior to a change in lending policy, they are more likely to honour it.

We have a £ 5.2m loan completing next week, that was agreed on a fixed rate and the lender is now only offering debt on tracker rates. Because the loan was agreed on a fixed rate some weeks ago, the lender has decided to honour that agreement (even though their contract allows them to change). Lenders aren’t all bad!

Click the "CHECK ELIGIBILITY" button next to the lender’s name on the results screen on Brickflow to see which lender’s offer fixed rates.

When would I use mezzanine finance?

Pure mezzanine finance is becoming more difficult to justify with today’s array of stretched senior lending products. Historically, senior lenders would cap at 65% LTGDV and mezzanine would go as high as 70%-75%.

Now, with senior lenders going as high as 70% to 75% on their own, there is little to no room left for mezzanine finance.

However if you’re using a mainstream development lender, they will normally lend at lower leverage and lower rates, therefore mezzanine could be available and better priced. But, remember as a borrower you must consider the blended cost of your finance.

Add together the forecasted interest rates and fees for the mezz loan and senior loan and then divide by the loan amount, and then divide by the number of months. This is the monthly cost of the interest. If you multiply this number by 12 that is your annual interest cost (or what we call on Brickflow the True Monthly Cost). If this is lower than the same loan amount on a stretched senior rate, then you could be better off.

Although the mezz lender will want a separate lawyer, and there will be additional valuation and QS reports, so this needs to be considered, as well as the additional administration of dealing with two lenders.

Step 1

([Mezz interest + Arrangement & Exit Fee] + [Senior Interest + Arrangement & Exit Fees]) / Number of months of loan term (to get monthly interest cost)

Step 2

Multiply the monthly cost by 12 = annual True Monthly Cost (TMC)

Step 3

(Senior Interest + Arrangement & Exit Fees) x 12 = TMC

Number of months of loan term

Step 4

Compare the two TMC’s - the lowest is the best (but also consider the additional legal / valuation / legal costs of mezz)

Some mezz lenders have got wise to the above, and now offer equity alongside the mezz, to provide a different offering and reduce deposit requirements for developers.

Again the same calculations need to be made, to ensure you have the right mix of debt and equity to have the optional capital stack.

Brickflow is designed to be used by experienced finance & property professionals and property developers using Limited Companies or Incorporated Partnerships, to source and apply for development finance and bridging loans.

Brickflow is not an advisory business and does not give advice. It can deal with purely factual inquiries and provide information but it will not give an opinion or recommendation in any circumstances.

Property development carries risk, including variables beyond the developer’s control. A property development loan is debt and should be procured with caution.

Brickflow does not provide personal mortgages, but your home and other assets are at risk if you provide a personal guarantee for a corporate loan.

Insights into changing interest rates, development finance and property loans. Find out which lenders link to the BofE base rate, pricing methods and...

The inside track on property development in September 2022. Covers interest rate rises, lender reactions, build costs and land price predictions.

Brickflow wins Technical Innovation of the Year at the NACFB Commercial Lender Awards 2023