Commercial Mortgages in Edinburgh

Whether you’re acquiring a retail unit on Princes Street, buying office space in Leith, or expanding your investment portfolio across the capital, Brickflow helps you secure the best commercial mortgage for your Edinburgh property, fast.

Why Use Brickflow to Find a Commercial Mortgage in Edinburgh?

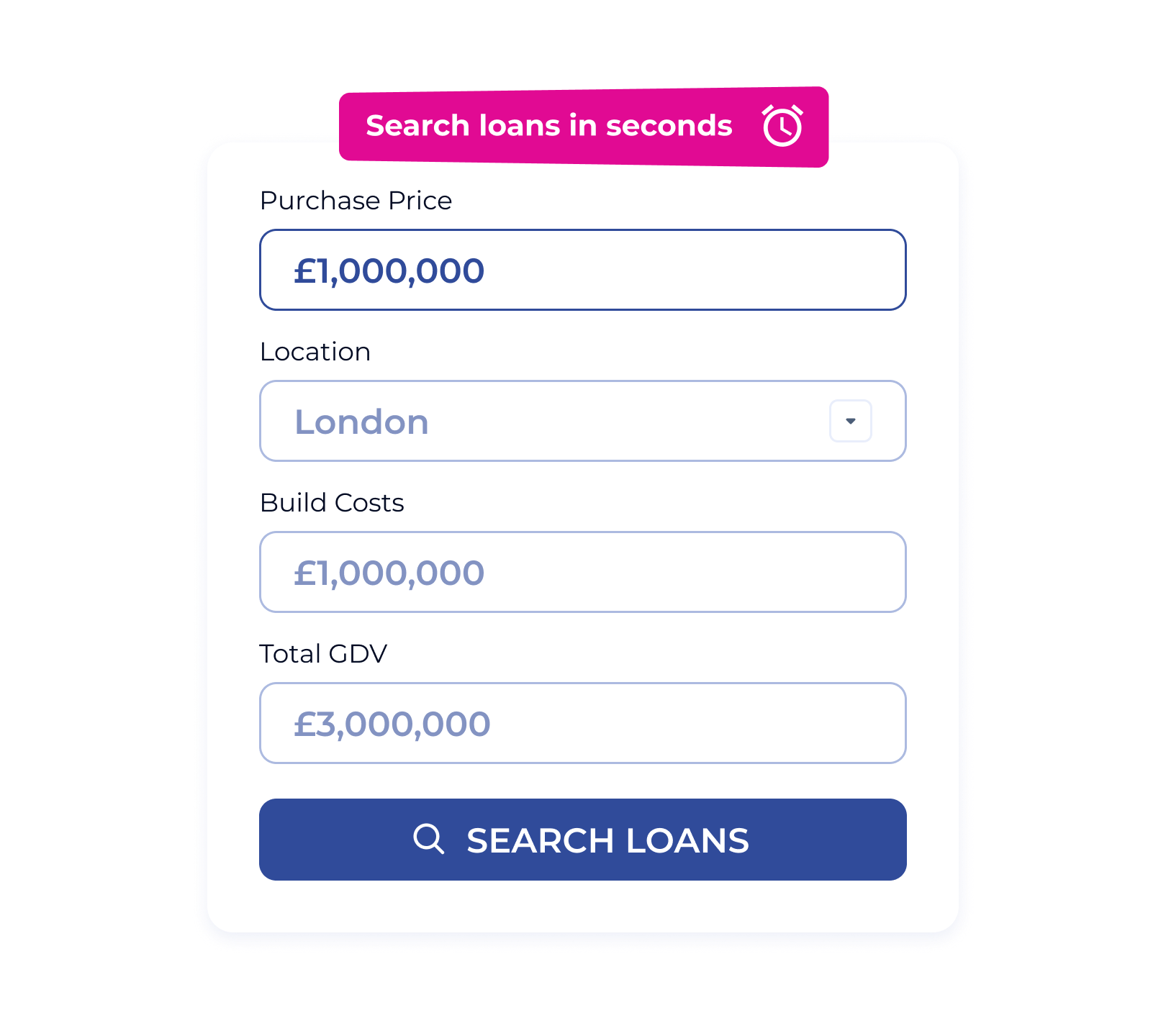

We’ve simplified the commercial mortgage process to help you move faster and make smarter financial decisions:

- Compare over 20 commercial mortgage lenders in real-time

- Get a Decision in Principle (DIP) in just minutes

- Filter results by rate type, LTV, term length, and more

- View transparent breakdowns of interest rates, fees, and lender criteria

- Loans available from £100,000 to £100 million+

Commercial Property Types We Finance in Edinburgh

From Georgian townhouses to modern mixed-use developments, Edinburgh offers a rich variety of commercial property opportunities. Brickflow helps identify commercial mortgage finance:

- Offices and serviced workspaces

- High street and boutique retail units

- Industrial buildings and logistics hubs

- Residential and commercial mixed-use schemes

- Semi-commercial investments and BTL portfolios

- Owner-occupied business premises

- Unique or high-value funding cases

Fueling Commercial Property Investment Across Edinburgh

Whether you're redeveloping space in Haymarket or launching a business in the New Town, Brickflow connects you to the right commercial mortgage lenders to bring your vision to life.

Compare loans from 20+ commercial mortgage lenders

See how much you could borrow against a specific project & at what rate

Check detailed eligibility criteria to avoid wasting time & money

Ensure your deal stacks & make smarter investment decisions

Exploring Your Finance Options? Start With These Guides:

If you're new to commercial property or just looking for clarity, our guides can help:

Compare Commercial Mortgage Offers in Seconds

Our platform lets you compare like-for-like commercial mortgage products, filter by your specific requirements, and see real-time commercial mortgage offers from UK lenders.

Make better decisions. Save time. Save money.

.webp)

Let Brickflow Help You Finance Your Next Edinburgh Project?

Whether you’re buying, refinancing, or developing property in Edinburgh, Brickflow gives you access to better commercial mortgage finance, faster.

What is a commercial mortgage?

A commercial mortgage is a loan secured against a property that’s used for business or investment purposes. Repayment terms typically range from 3 to 25 years.

Can I get commercial property finance in Edinburgh?

Yes. Brickflow works with lenders across the UK who actively finance a wide range of commercial properties throughout Edinburgh and the Lothians.

What documents will I need?

Most lenders require recent company accounts, proof of income or rental forecasts, and detailed property information. A business plan may also be needed for some loans.

How long does it take to get approved?

You can receive a DIP in minutes. Full approval and drawdown usually takes 2–6 weeks, depending on complexity and documentation.

Need shorter-term funding?

If you’re buying at auction or carrying out a refurb, a bridging loan may be more suitable. Compare both commercial and bridging options with Brickflow.