Commercial Mortgages in Glasgow

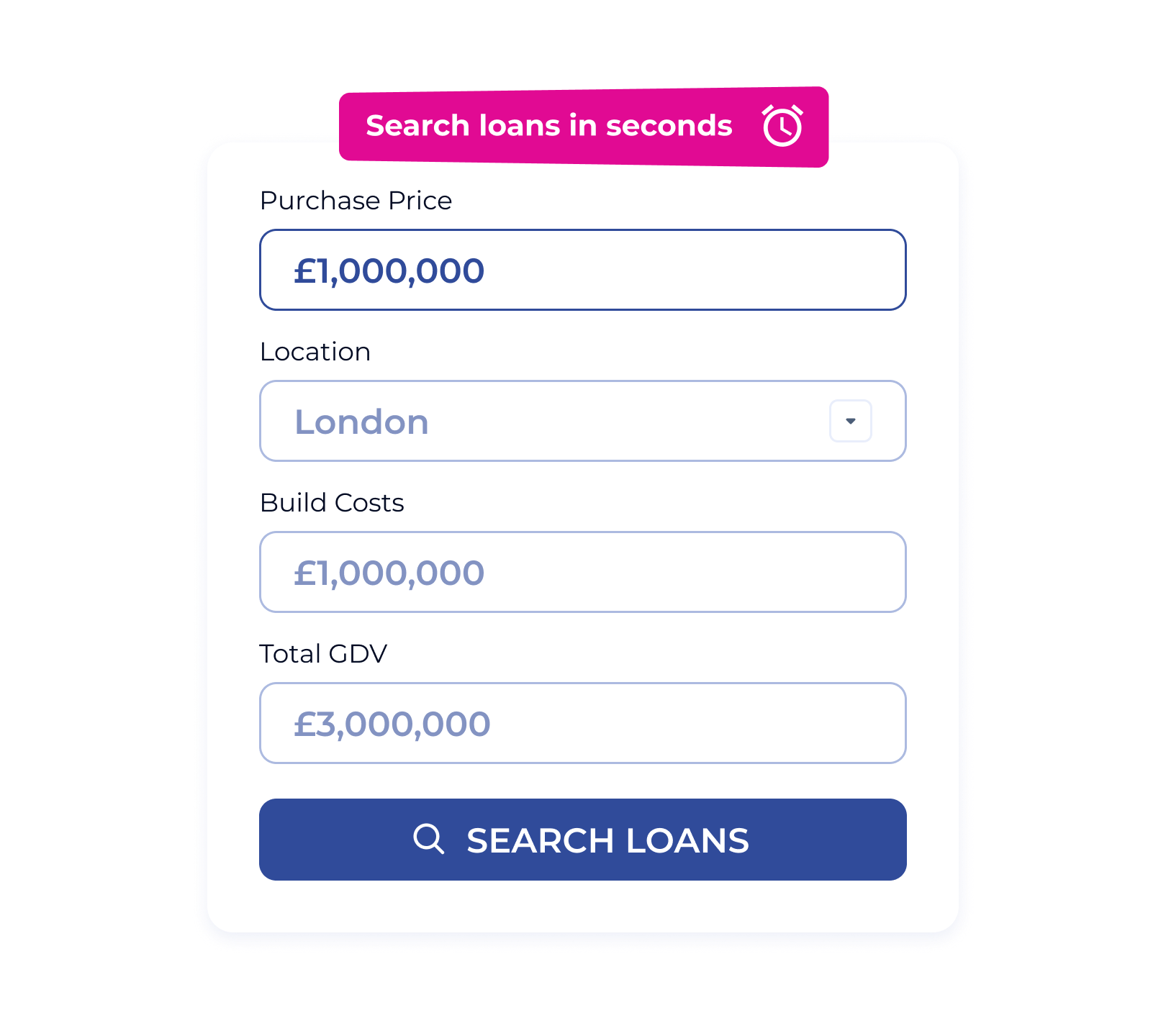

Whether you're buying your first commercial premises in Glasgow or expanding your property portfolio across Scotland, Brickflow helps you secure the right mortgage, fast. Compare loans from 20+ UK lenders in minutes, all in one platform.

Why Use Brickflow for Your Next Commercial Mortgage?

Our platform puts you in control of the commercial mortgage process, saving time and helping you secure the best deal available:

- Instantly compare offers from 20+ commercial mortgage lenders

- Receive a Decision in Principle within minutes

- Filter by interest type, term length, LTV, and loan amount

- See full breakdowns of rates, eligibility, and fees

- Borrow between £100,000 and £100 million+

Commercial Property Finance That Matches Glasgow’s Growth

From the Merchant City to Finnieston, Glasgow’s commercial landscape is diverse and expanding. Brickflow connects you to commercial finance for:

- Retail units in high-traffic zones

- Industrial and distribution premises

- Mixed-use developments

- Semi-commercial and buy-to-let portfolios

- Owner-occupied business buildings

- Complex or large-scale commercial projects

Supporting Developers and Investors Across Glasgow

Whether you’re renovating an old industrial unit in the East End or purchasing a flagship store in the city centre, Brickflow provides the tools to find fast, affordable finance tailored to your strategy.

Compare loans from 20+ commercial mortgage lenders

See how much you could borrow against a specific project & at what rate

Check detailed eligibility criteria to avoid wasting time & money

Ensure your deal stacks & make smarter investment decisions

Is a Commercial Mortgage Right for You?

Before you make a decision, explore our expert-written guides to better understand your finance options:

Compare Glasgow Commercial Mortgage Rates in Minutes

With Brickflow, you can instantly compare like-for-like commercial mortgages. Run a search in seconds, filter results by what matters to you, and view borrowing costs upfront.

It’s the fastest way to find a mortgage that fits your project and your budget.

.webp)

How Brickflow Can Help You Move Forward

From sourcing the best lender to helping you understand loan structures, Brickflow is your digital finance partner for commercial property in Glasgow.

What is a commercial mortgage?

A commercial mortgage is a long-term loan secured against a property used for business or investment purposes. These loans typically range from 3 to 25 years, with fixed or variable interest rates.

Can I get a commercial mortgage for a property in Glasgow?

Absolutely. Whether you're buying in the city centre, Southside, or West End, there are lenders offering tailored commercial finance for a wide range of Glasgow properties.

What documents are usually required?

Lenders typically request recent business accounts, property details, rental income projections, and potentially a business plan depending on the loan type.

How long does it take to get approved?

You can get a Decision in Principle within minutes. Full approval and funding are generally completed within 2 to 6 weeks.

Need something more flexible or short-term?

If you're renovating or purchasing at auction, a bridging loan in Glasgow may offer a quicker and more flexible solution. Brickflow compares both types of funding to help you find the right fit.